Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2023

Global business activity contracts for fifth successive month as demand downturn accelerates

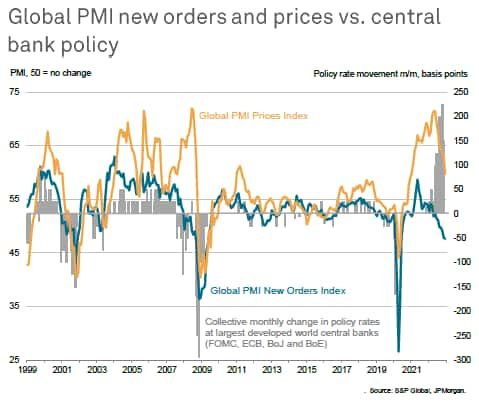

Global business activity fell for a fifth consecutive month in December, with the rate of decline moderating slightly amid improved supply conditions but still rounding off the worst quarter since 2009 barring lockdown months. What's more, with new orders falling at an increased rate, the underlying demand environment appears to have deteriorated further.

Price pressures meanwhile continued to moderate, pointing to a marked cooling of global inflationary pressures.

The steepest downturn - and commensurate calming of inflation - has been seen in the US. In Europe, the pace of decline moderated, fueled in part to fewer energy market worries. China's decline also slowed, thanks to fewer COVID-19 restrictions.

Looking ahead, business confidence has lifted slightly thanks to the changing situation in China and improving global supply-side conditions, but the mood generally remains subdued due to worries over higher interest rates and the possibility of further demand in the months ahead.

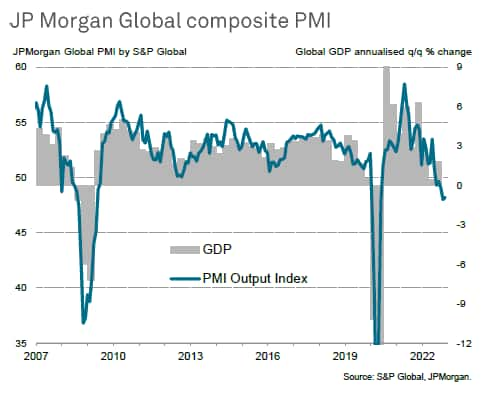

December drop in business activity rounds off disappointing fourth quarter

At 48.2 in December, the Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - indicated a fifth successive month of falling business activity. Despite rising slightly from 48.0 in November, the December reading rounds off the worst calendar quarter since the second quarter of 2009, during the global financial crisis, if the initial pandemic lockdown months of early 2020 are excluded. The PMI is consistent with global GDP falling at an annualised rate of approximately 1% in the fourth quarter.

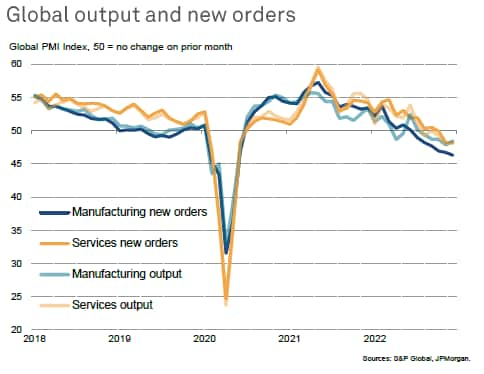

Similar rates of decline were recorded across the manufacturing and service sectors, pointing to a broad-based economic contraction at the end of the year. Neither sector has registered any output growth since last July. Although an unchanged rate of output decline in the service sector in December contrasted with brighter news of a slight moderation in the pace of manufacturing decline, the latter reported an increased loss of new orders to hint that the factory production decline could reaccelerate in January.

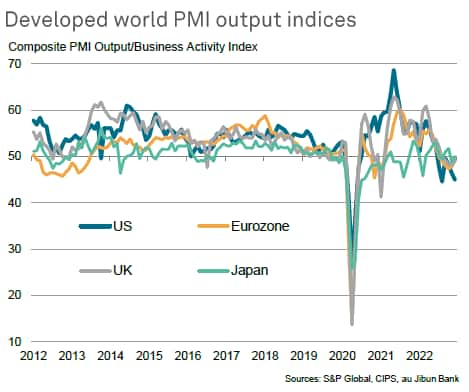

European downturns moderate, US sinks deeper into decline

Looking at the major developed economies, trends varied markedly. Downturns moderated in Europe, with all four of the largest eurozone member states and the UK reporting weaker rates of contraction at the end of the year to consequently indicate only very modest GDP declines in all cases. The European data therefore suggest that the region's decline peaked back in October, though one notable exception is UK manufacturing, where the rate of decline accelerated further in December as Brexit contributed to a worsening of trade performance.

In contrast, the US downturn gathered momentum, with output falling for a sixth successive month in December and contracting at one of the fastest rates since 2009 if pandemic lockdown months are excluded. Both manufacturing and services saw increased rates of output decline. Australia likewise reported a deepening downturn, though Japan saw business activity broadly stabilise after slipping into contraction in November, buoyed by a modest resurgence in service sector activity.

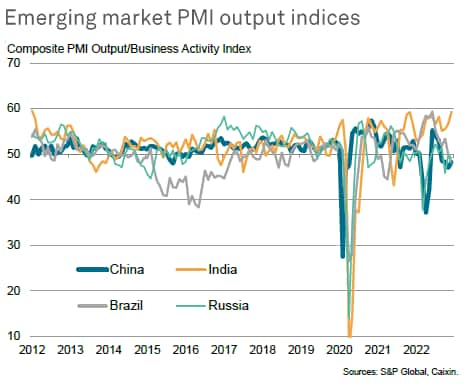

Resurgent India leads emerging markets, China's downturn moderates

Divergent trends were also evident in the major emerging markets. While India notched up the strongest expansion for a decade, fueled by surging growth in both manufacturing and services, Russia, Brazil and mainland China all reported falling levels of business activity.

Encouragingly, China's downturn moderated as activity across both manufacturing and services was buoyed by looser COVID-19 restrictions, but Russia struggled amid ongoing war sanctions, despite a boost to domestic manufacturing as firms benefited from import substitution. Political upheaval and slumping foreign trade meanwhile hit Brazil, leading to a second month of falling output.

Higher prices dampen demand

The most commonly cited cause of the downturn around the world was a weakening of demand due to higher prices. The number of companies reporting order books to have deteriorated as a result of higher prices spiked in December to the highest recorded since data were first available in 2005, running at over six-times the long run average.

But supply conditions start to improve

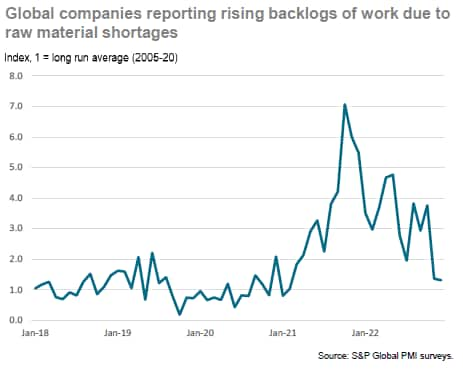

However, a factor helping to moderate the downturn - especially in manufacturing - was an improvement in supplier delivery times, reflecting fewer shortages of raw materials. December saw the incidence of supply delays fall to the lowest since January 2020, just prior to the pandemic, to represent a major improvement in the global supply situation compared to the unprecedented supply scarcities reported at the start of the year and throughout 2021.

To illustrate, the number of companies worldwide reporting that backlogs of work are accumulating due to an insufficient supply of raw materials (i.e. both components and energy) has fallen back close to its long-run average in December, having spiked at over seven-times the long-run average back in October 2021.

At the same time, European manufacturers in particular cited fewer constraints on production due to waning energy market concerns, and in particular lower gas prices. State subsidies in Europe have also been widely cited as a key factor supporting spending, both by businesses and households.

Price pressures abate

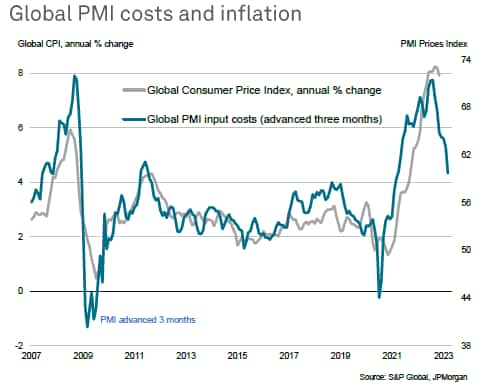

A consequence of the improving supply situation - and the recent slump in demand - was a further softening of price pressures around the world in December. The global PMI input price index, covering both goods and services, registered the weakest rate of inflation for two years, signalling a further marked cooling in the rate of increase from the peak seen in April of last year. As this index acts as a reliable advance indicator of consumer price inflation, the PMI data point to a marked moderation of global inflation in the months ahead.

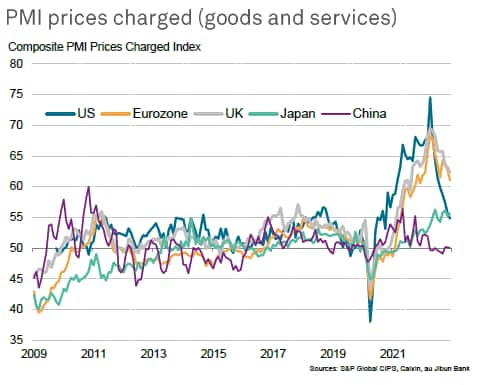

Lower costs generally fed though to lower selling price inflation for goods and services, especially in the US and to lesser - but still notable - extents in Europe. Price pressures proved stickier in Japan, where the PMI is now registering a slightly steeper rate of increase than seen in the US.

Outlook remains subdued

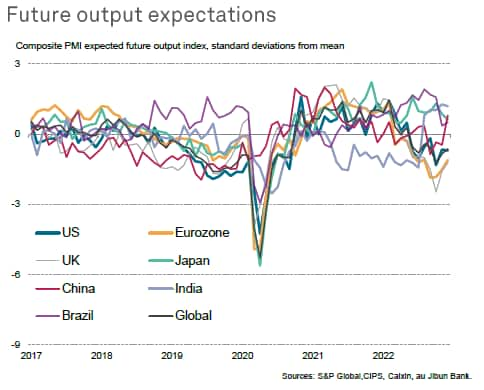

While the improving supply situation and cooling of price pressures helped lift business sentiment in December, with news of loosened COVID-19 restrictions in mainland China also bolstering sentiment in some cases, the overall level of optimism regarding output in the year ahead remained firmly below its long run average in December, reflecting broad-based concerns about demand in the coming months and a heightened risk of recession.

Compared to long run averages, sentiment was the weakest in Europe, with UK-based firms especially gloomy, while sentiment lifted especially sharply in China.

Sentiment also notably remained well below its long-run average in the US, which has seen the most aggressive monetary policy tightening.

While higher interest rates in the US and Europe are having an increasingly evident effect in cooling inflationary pressures, the cost of this fight against inflation has been a demand downturn on a scale not seen since 2009, if the initial pandemic lockdown period is excluded.

Going forward, it is therefore likely that the central bank policy path will be the key determinant of the trajectory of global output in the coming months, with the opening up of China's economy from COVID-19 restrictions also set to have a potential major influence. However, at the moment, it is unclear as to the degree to which policymakers will be swayed by signs of slumping activity and falling inflationary pressures. Equally, it is unclear how China's economy will cope with the relaxation of pandemic restrictions. Flash PMI data, due out on 24th January, will provide the first major insights into how the global economy has fared at the start of 2023.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-business-activity-contracts-for-fifth-successive-month-as-demand-downturn-accelerates-jan23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-business-activity-contracts-for-fifth-successive-month-as-demand-downturn-accelerates-jan23.html&text=Global+business+activity+contracts+for+fifth+successive+month+as+demand+downturn+accelerates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-business-activity-contracts-for-fifth-successive-month-as-demand-downturn-accelerates-jan23.html","enabled":true},{"name":"email","url":"?subject=Global business activity contracts for fifth successive month as demand downturn accelerates | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-business-activity-contracts-for-fifth-successive-month-as-demand-downturn-accelerates-jan23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+business+activity+contracts+for+fifth+successive+month+as+demand+downturn+accelerates+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-business-activity-contracts-for-fifth-successive-month-as-demand-downturn-accelerates-jan23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}