Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2024

Global PMI selling price inflation close to four-year low in August

Prices charged for goods and services rose globally at the slowest rate for nearly four years in August, according to the worldwide PMI surveys produced by J.P.Morgan and S&P Global in association with ISM and IFPSM.

Inflationary pressures moderated, notably in the service sector, and manufacturing cost pressures remained constrained by falling demand for inputs and few supply scarcities.

Global PMI selling price inflation close to four-year low in August

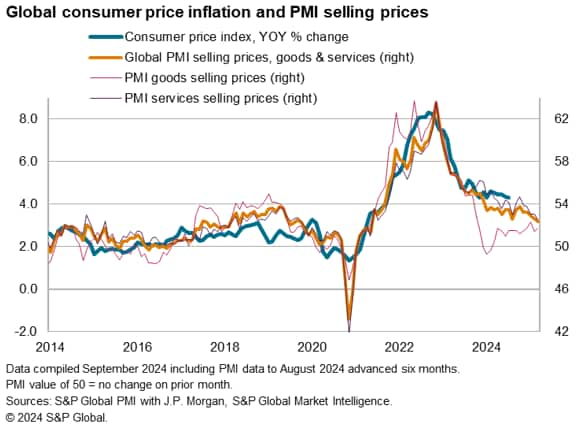

The worldwide PMI surveys showed average prices charged for goods and services rose globally in August at the slowest rate since October 2020 (a 46-month low). The latest index reading, at 52.3, remains above the ten-year pre-pandemic average of 51.2, but hints at inflation dropping in the coming months.

Global inflation was 4.3% in June according to S&P Global Market Intelligence estimates. While down sharply from the peak of 8.3% recorded in September 2022, the rate of inflation cooling has been stubbornly slow so far in 2024. However, the recent PMI data - which tend to lead official inflation data by around six months - hint at the rate of increase moderating to close to 3% in the coming months.

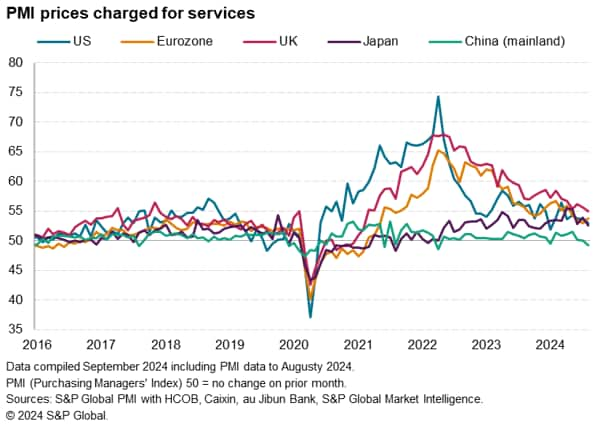

Service sector inflation - which has been the main cause of elevated inflation in recent months - fell in August the lowest since December 2020. While manufacturing selling price inflation ticked higher, it remained only slightly above the pre-pandemic average.

Selling price inflation cools in the US and UK but rises in the eurozone. Prices fall in mainland China

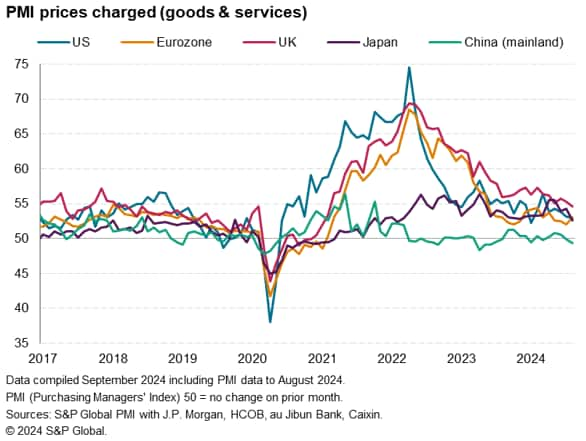

The PMI selling price data showed the rate of inflation across goods and services slowed in the US during August to the second-lowest since June 2020. The equivalent rate in the UK hit the lowest since February 2021. In both cases the cooling was linked to reduced rates of increase in the service sectors. The rate of increase in Japan meanwhile slipped to the lowest since February 2022. While eurozone inflation accelerated, it remained just below the average seen over the past year.

Comparing price trends across the major economies tracked by the PMI surveys, selling price inflation rose most sharply in Brazil during August followed by the UK, Russia, Spain and Ireland. In all cases bar mainland China, where prices fell in August, the latest increases were above pre-pandemic decade averages, with the most elevated rate by historical standards was seen in Spain followed by Brazil, France and Italy.

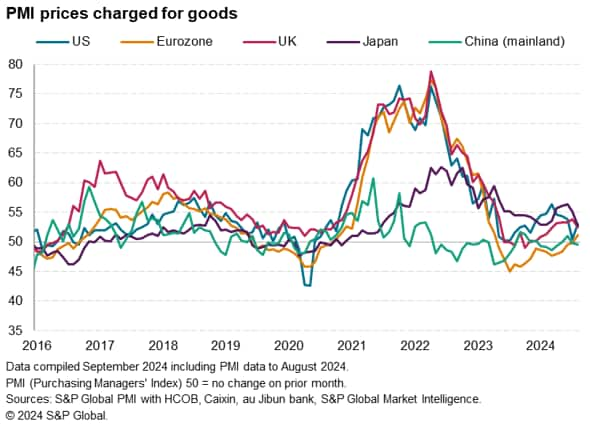

Factory input cost inflation restrained by weak demand and low incidence of supply delays

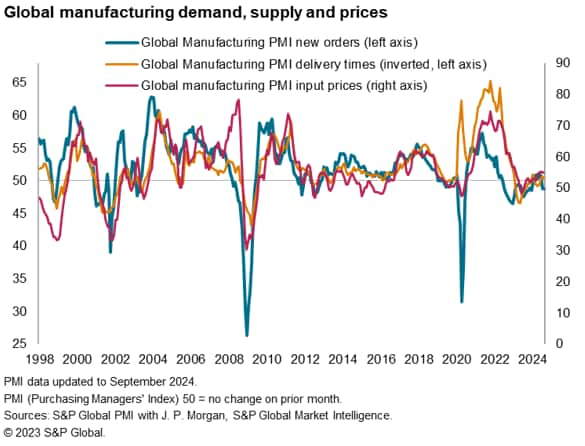

One area of concern this year has been a revival of manufacturing cost pressures, driven in part by higher shipping rates. However, while factories have reported higher logistics prices, linked partly to the diversion of ships to avoid the Red Sea, pressure is being taken off suppliers by falling demand for goods. New orders for goods fell globally for a second successive month in August, led by lower global goods exports and reduced purchasing of inputs by manufacturers. The latter fell in August at the sharpest rate so far this year as producers increasingly focused on inventory management to cut costs.

Global supplier delivery times consequently lengthened only very marginally for a third month running in August, pointing to few supply chain pressures on average, which in turn has helped to limit suppliers' pricing power.

Average factory input prices consequently rose at a slower rate globally in August amid this combination of falling demand and low incidence of supply chain constraints.

Access the Global Composite PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-close-to-fouryear-low-in-august-Sep24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-close-to-fouryear-low-in-august-Sep24.html&text=Global+PMI+selling+price+inflation+close+to+four-year+low+in+August+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-close-to-fouryear-low-in-august-Sep24.html","enabled":true},{"name":"email","url":"?subject=Global PMI selling price inflation close to four-year low in August | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-close-to-fouryear-low-in-august-Sep24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+selling+price+inflation+close+to+four-year+low+in+August+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-close-to-fouryear-low-in-august-Sep24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}