Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2024

Top five economic takeaways from August's PMI as the global manufacturing decline continues

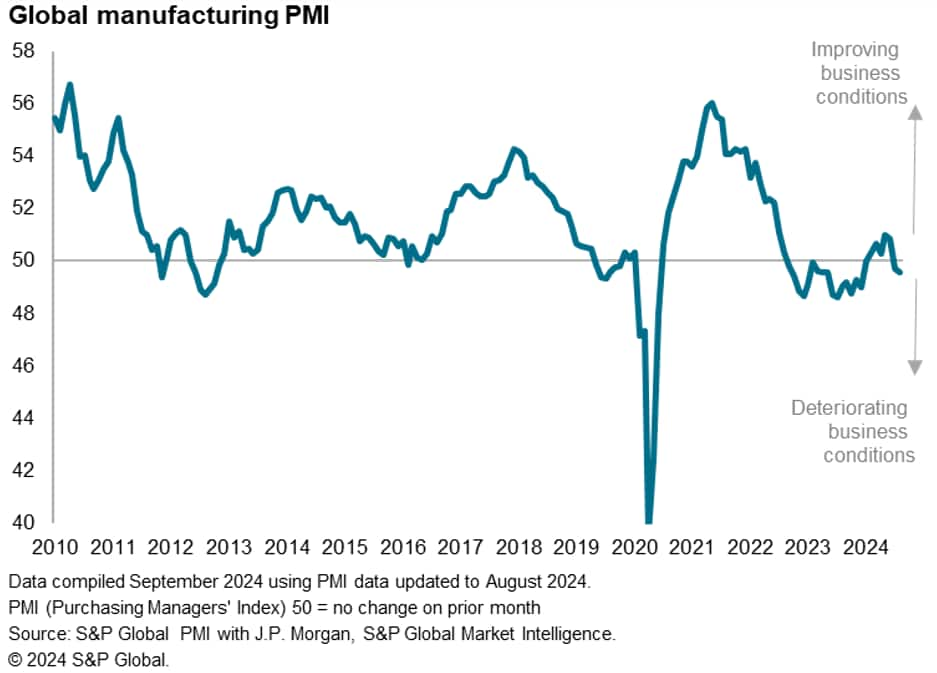

At 49.5, down from 49.7 in July, the Global Manufacturing PMI, sponsored by J.P.Morgan and compiled by S&P Global Market Intelligence, signalled a deterioration of operating conditions for a second successive month in August. The rate of decline, while only very modest, was the steepest since last December.

The deterioration points to a halting of the manufacturing recovery seen in the first half of the year, which had seen the sector's best performance for two years.

To assess what's driving the change, we analyse the headline PMI's survey 'sub-indices'. Here are our top five takeaways from some of these sub-indices, which provides a deeper insight into the current manufacturing trends relating to output, demand, inventories, supply chains, employment and prices.

1: Global output slips into decline

The PMI survey's sub-index of production, which tracks actual month-on-month factory output changes, signaled a marginal drop in production in August, representing the first decline since last December. Although only slight, the decline marks a contrast to the robust gains seen during the second quarter, which had been among the strongest performances recorded over the past three years.

The survey data exhibit a correlation of 75% with the official annual rate of change in global production, with the survey data acting with a three-month lead. Using a simple regression-based model, the latest PMI data indicate that worldwide manufacturing output has broadly stalled so far in the third quarter having been growing worldwide at a relatively robust annual rate of approximately 2% during the second quarter.

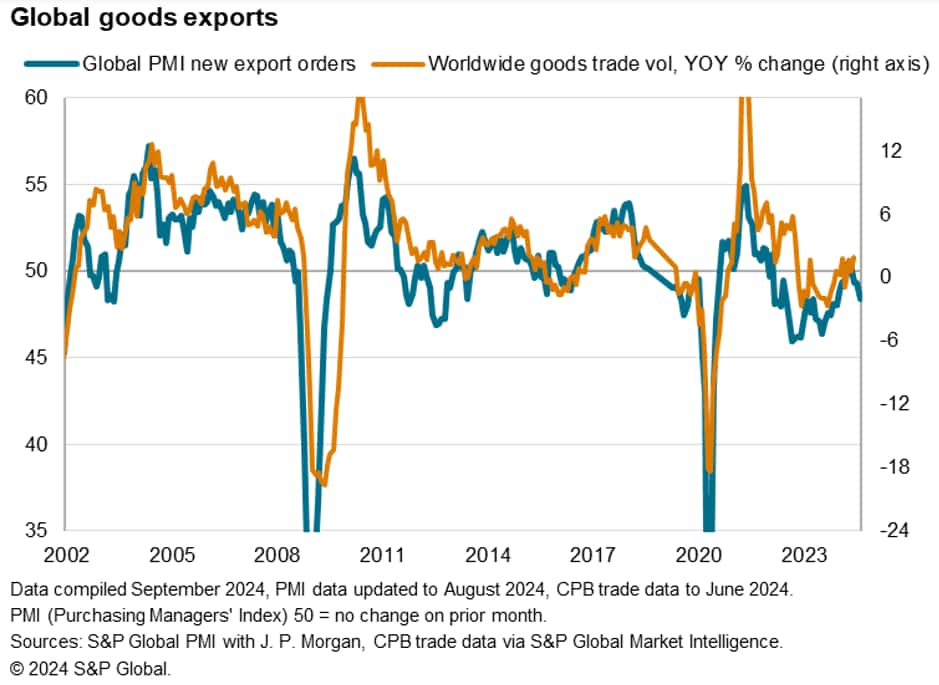

2: Global exports fall for a third successive month

Decline in global output growth was weighed down by new orders for goods falling in August for a second month in a row, in turn a symptom of falling global trade flows. New export orders fell globally in August for a third successive month, dropping at the fastest rate since December.

3. Demand hit by renewed destocking and low confidence

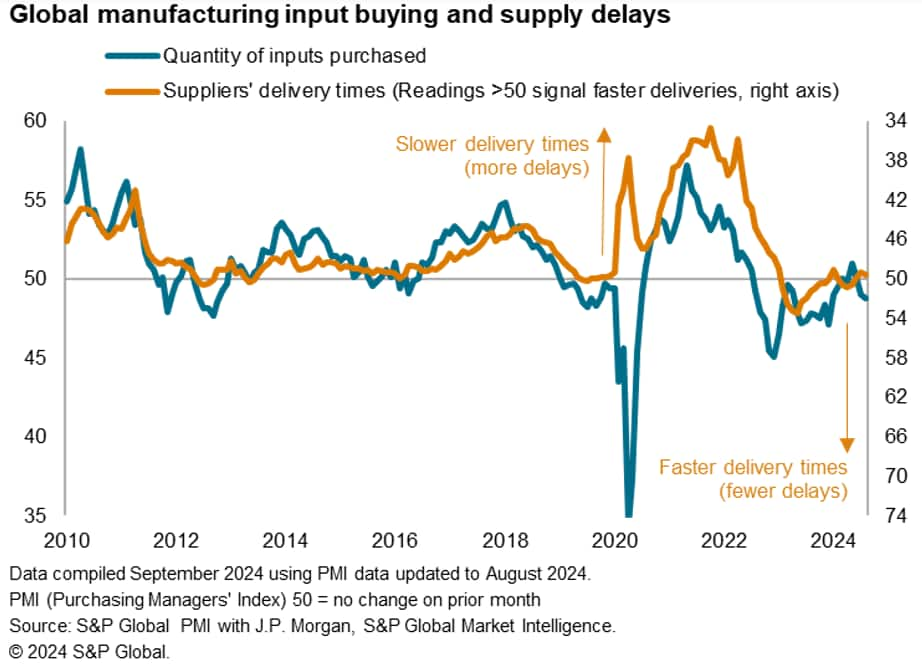

The recent deterioration of demand in part reflects renewed destocking by manufacturers. The amount of inputs bought by factories worldwide fell in August for a second consecutive month, dropping at a rate not seen since last December.

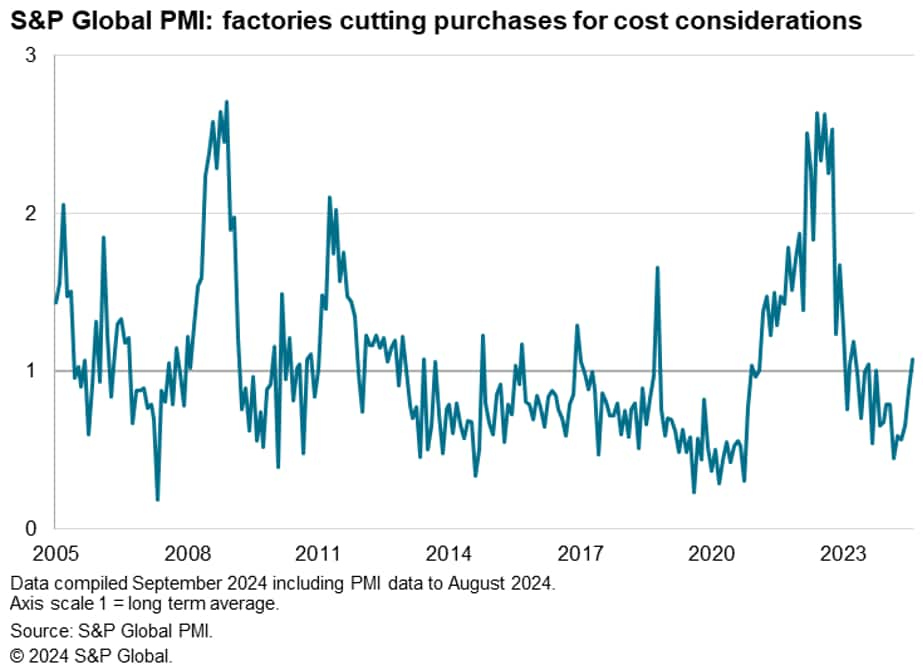

The August survey also saw a rise in the number of companies reporting that their purchasing of inputs was being reduced in order to cut costs. The incidence of such cost-driven destocking was the highest recorded since April 2023.

The shift to destocking in part also reflects few concerns over supply availability. After a brief period of supply concerns at the start of the year, centered around attacks on ships in the Red Sea, supply chains have shown few delays in recent months - as signaled by the PMI's suppliers' delivery times index. Hence the incidence of safety-stock-related purchasing has fallen in recent months.

4. Confidence remains in the doldrums

A factor underlying the weakness of demand, and shift to inventory reduction, was a sustained low level of business confidence. Year-ahead output expectations dipped slightly in August and remain well below their long-run average, with producers around the world concerned in particular about geopolitical uncertainty, rising protectionism and falling trade, as well as broader economic growth risks.

5: Manufacturing prices rise at slower rate despite high shipping prices

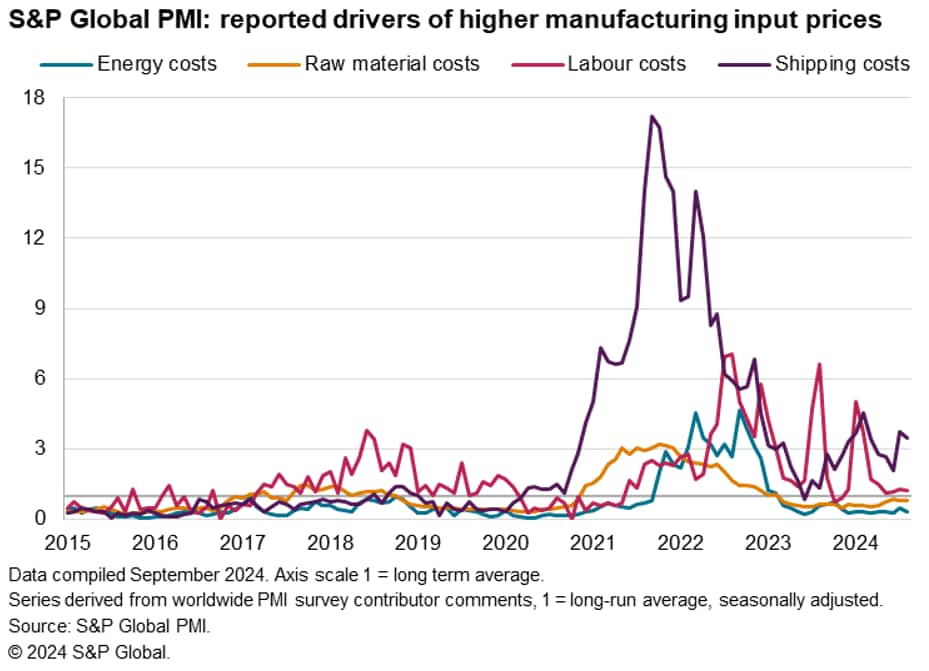

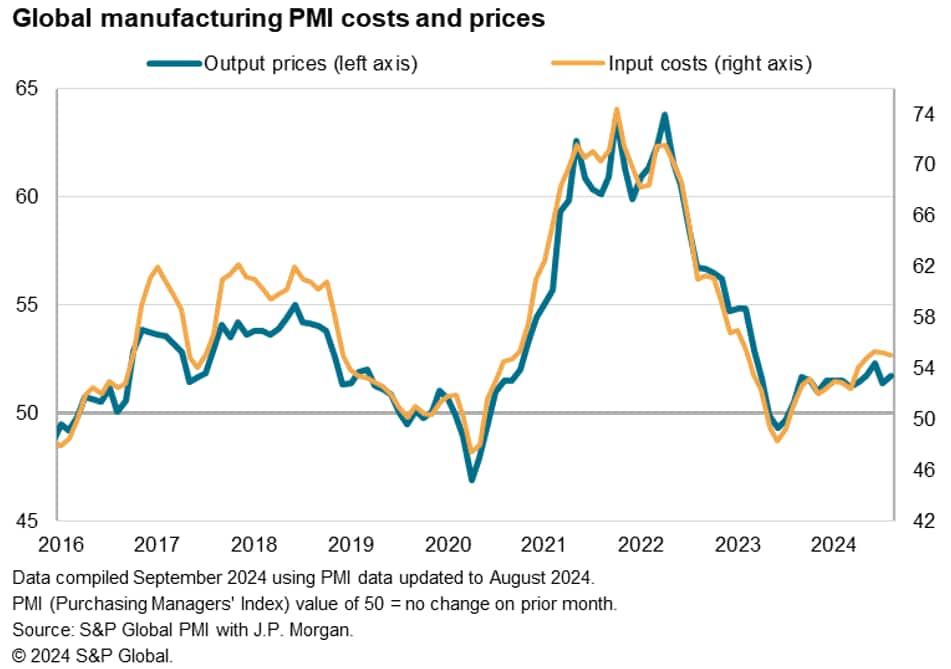

One area of supply chains that was a concern among PMI survey respondents was the recent spike in shipping rates. Although well below the levels seen during the pandemic, higher shipping costs were seen as the main driving force of higher factory costs again in August. However, labour cost pressures have fallen close to normal levels globally - as depicted by the long run average - and raw material cost pressures and energy costs pressures are both below their long run averages.

Hence overall input cost inflation eased slightly in August, dipping further below the average seen in the decade preceding the pandemic, leading to only modest upward pressure on output (selling prices).

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-augusts-pmi-as-the-global-manufacturing-decline-continues-Jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-augusts-pmi-as-the-global-manufacturing-decline-continues-Jul24.html&text=Top+five+economic+takeaways+from+August%27s+PMI+as+the+global+manufacturing+decline+continues+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-augusts-pmi-as-the-global-manufacturing-decline-continues-Jul24.html","enabled":true},{"name":"email","url":"?subject=Top five economic takeaways from August's PMI as the global manufacturing decline continues | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-augusts-pmi-as-the-global-manufacturing-decline-continues-Jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+five+economic+takeaways+from+August%27s+PMI+as+the+global+manufacturing+decline+continues+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-augusts-pmi-as-the-global-manufacturing-decline-continues-Jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}