Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2024

Global PMI signals cooler services inflation in June, but goods prices show further rise

Price pressures remained elevated globally, according to PMI survey data, as further signs of cooling in the service sectors of most major economies were in part countered by reviving cost pressures in the manufacturing sector. The latter poses a potential threat to efforts to tame inflation, which in many economies remains elevated relative to central bank targets.

Global PMI selling price inflation edges down to second-lowest since pandemic

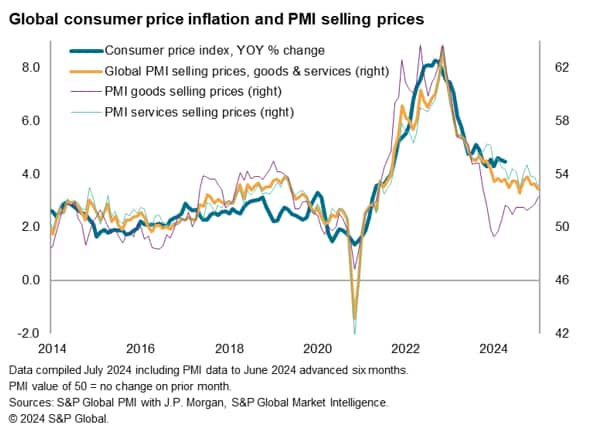

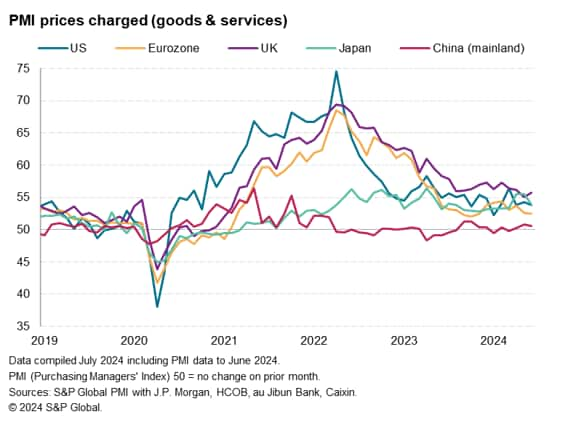

Worldwide PMI survey data compiled by S&P Global for J.P. Morgan showed average prices charged for goods and services rose globally at the slowest rate since January, registering the second-weakest monthly rise since October 2020. The rate of increase nevertheless remained elevated by pre-pandemic standards, as slower service sector inflation was offset by resurgent price pressure in the manufacturing sector.

The composite PMI Prices Charged Index fell from 53.2 in May to 52.8 in June, still running considerably above the pre-pandemic decade average of 51.2 but hinting at slower inflation in coming months. The recent PMI readings are consistent with global CPI inflation of roughly 3.5%, down from the latest estimate of 4.5%.

Rising manufacturing costs pose new threat in fight against global inflation

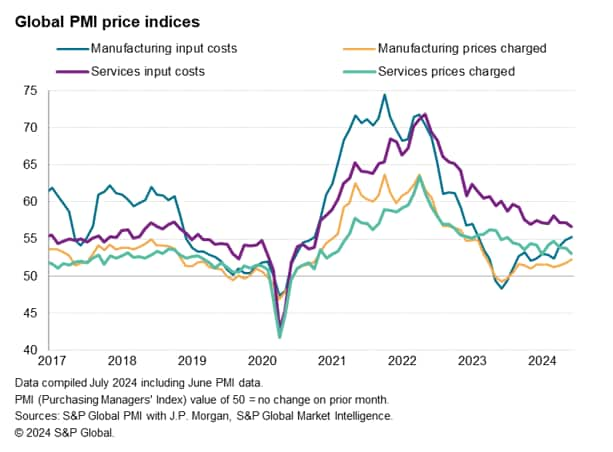

The June PMI data were characterised by cooling service sector price trends but a revival of upward inflation momentum in manufacturing, the latter thereby presenting a rising threat to the global fight against stubborn global consumer inflation.

Service sector input costs rose globally in June at the slowest rate since October 2020, though the rate of increase remained above the pre-pandemic decade average. Selling price inflation in the service sector likewise cooled but remained elevated by historical standards. A steep cooling of services inflation in 2022 has since been replaced with a much more gradual moderation.

Manufacturing sector input costs showed the largest monthly rise for 16 months in June, the rate of inflation having trended higher since the middle of last year. Higher costs were passed on to customers resulting in the largest rise in average prices charged for goods since March 2023.

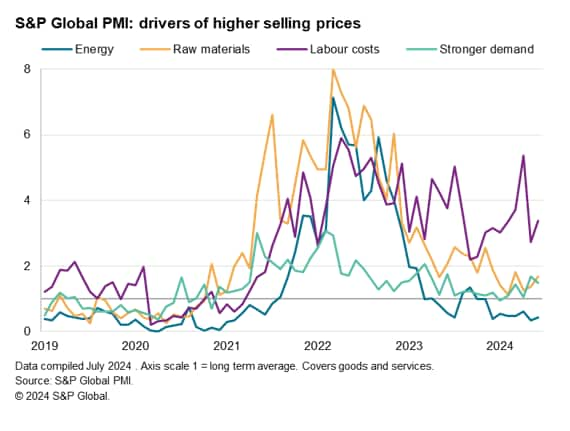

Accelerating growth of manufacturing input costs can be largely traced to reports of higher raw material prices and rising wage costs, with supply chain pressures - in contrast - remaining subdued.

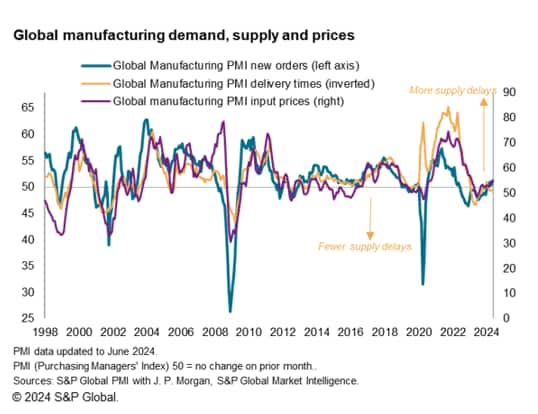

Measured overall, global supplier delivery times lengthened only marginally in June after four months of marginal improvements, pointing to few supply chain pressures on average globally despite ongoing disruptions to shipping in both the Red Sea and Panama Canal. The data therefore suggest that suppliers continue to operate with sufficient capacity to meet demand on a timely basis.

However, the recent upturn in manufacturing orders, which rose for a fifth successive month in June, has led to reports of some demand-pull price pressures developing.

Underlying inflation stubbornness more evident in UK than US and Eurozone

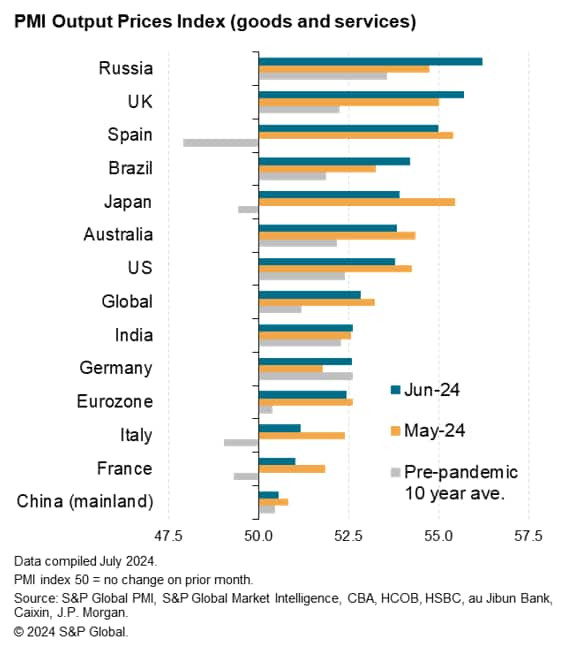

Of the major economies tracked by the PMI surveys, selling price inflation rose most sharply in Russia followed by the UK, with inflation ticking higher in both cases compared to May and rising further above pre-pandemic decade averages.

While a strong price gain was also seen in Spain, the rate of increase was below the pre-pandemic long run average - as was also notably the case in Japan, France and Italy. The latter two saw especially modest prices increases - in France the rise was the smallest for 40 months - to help bring eurozone selling price inflation down to its lowest for eight months and close to the pre-pandemic average.

Selling price inflation in Japan slowed to a three-month low and in the US the increase was among the smallest seen over the past three years.

The smallest price increase was again recorded in mainland China, though prices have now risen here (albeit marginally) for three successive months.

Access the Global Composite PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-cooler-services-inflation-in-june-but-goods-prices-show-further-rise-jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-cooler-services-inflation-in-june-but-goods-prices-show-further-rise-jul24.html&text=Global+PMI+signals+cooler+services+inflation+in+June%2c+but+goods+prices+show+further+rise+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-cooler-services-inflation-in-june-but-goods-prices-show-further-rise-jul24.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals cooler services inflation in June, but goods prices show further rise | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-cooler-services-inflation-in-june-but-goods-prices-show-further-rise-jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+cooler+services+inflation+in+June%2c+but+goods+prices+show+further+rise+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-cooler-services-inflation-in-june-but-goods-prices-show-further-rise-jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}