Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2024

Global trade conditions deteriorate marginally in June

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

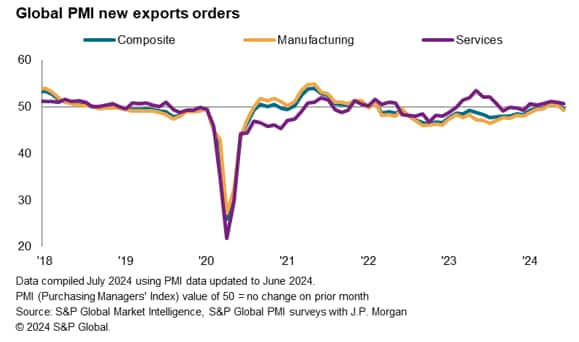

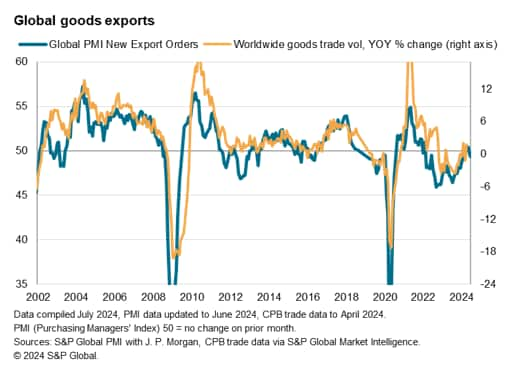

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade deteriorated in June for the first time in three months, albeit only marginally.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 49.6 in June, down from 50.6 in May. Falling past the 50.0 no-change mark , the latest reading signalled the first deterioration in trade conditions since March. The June PMI print nevertheless rounded off the strongest quarter for exports seen since the fourth quarter of 2021, thanks to the improvements seen in April and May.

Manufacturing export orders fall while services remain in growth

Underpinning the latest reduction in global trade was a renewed fall in manufacturing new export orders, which fell for the first time in three months. This marked a downturn following May's 26-month high, with indications of inventory building having eased from May, even as it remained above-average - according to comments from survey panellists. Despite the latest downturn in goods export orders, the June reading contributed to the best quarterly performance seen in the manufacturing sector since the final quarter of 2021. As such, the latest marginal reduction in goods export orders continued to reflect an overall stabilisation of trade conditions.

On the other hand, service sector export business remained in expansion, though at a softer pace compared to May. That said, the rate of growth matched the year-to-date average and indicated that services export business sustained stable growth midway through the year. June was also the sixth straight month in which services export business sustained in growth, showing that conditions have generally fared well during the first half of 2024.

More detailed PMI data revealed that the top five sectors that led the expansion in export business were all service sectors, headed by the insurance and software & services sectors. On the other hand, manufacturing sectors were bottom ranked, with forestry & paper producers and metals & mining firms seeing the sharpest reduction in export orders.

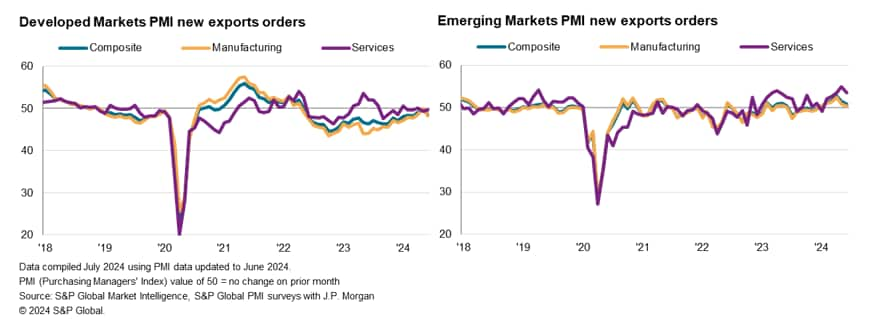

Emerging market trade remains in growth but developed markets conditions worsen

By region, emerging markets continued to see improvements in trade despite the downturn in overall global conditions. Moreover, the expansion in export business remained broad-based across both the manufacturing and service sectors. That said, the pace of expansion eased to a five-month low. Although services export expansion remained solid, manufacturing export orders rose at only a fractional pace in June.

In developed markets, trade conditions softened for the twenty-fifth month in a row and with the pace of deterioration hitting the fastest since March. Notably, a steeper reduction in manufacturing export orders contrasted with only a marginal decline in services export business within developed markets.

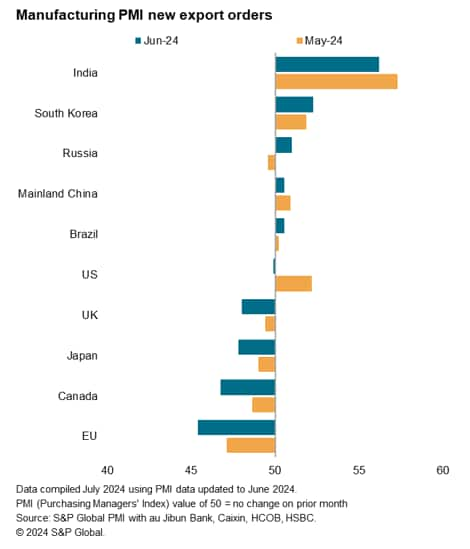

India continues to shine, key developed market nations record fall in trade

June Manufacturing PMI data revealed that the expansion in global goods trade was limited mainly to emerging market economies among the top 10 trading nations. India continued to lead the pack with manufacturing export orders having expanded at a series-record pace in June, supported by greater inflows of new work from around the world. South Korea followed with further improvements in the ongoing growth trend for exports and supported in part by the pick up in the semiconductor industry. Other economies recording growth included the rest of the BRICs nations - Russia, Mainland China and Brazil.

On the other hand, all major developed markets reported falling goods trade in June, led by the EU, which saw the sharpest fall in four months. Weakness in trade conditions were observed across Germany, France and Italy in June. US exports fell only marginally, but this represented the first fall in goods trade for five months.

In Asia, Japan was notably an exception amidst continued increase in goods trade across Asia. That said, it was encouraging to see factory output having risen for the first time in over a year in Japan while confidence improved to a six-month high to indicate rising expectations for higher production in the months ahead in Japan.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-conditions-deteriorate-marginally-in-june-jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-conditions-deteriorate-marginally-in-june-jul24.html&text=Global+trade+conditions+deteriorate+marginally+in+June+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-conditions-deteriorate-marginally-in-june-jul24.html","enabled":true},{"name":"email","url":"?subject=Global trade conditions deteriorate marginally in June | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-conditions-deteriorate-marginally-in-june-jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+conditions+deteriorate+marginally+in+June+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-conditions-deteriorate-marginally-in-june-jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}