Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 10, 2024

Global trade expansion driven by emerging markets growth

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

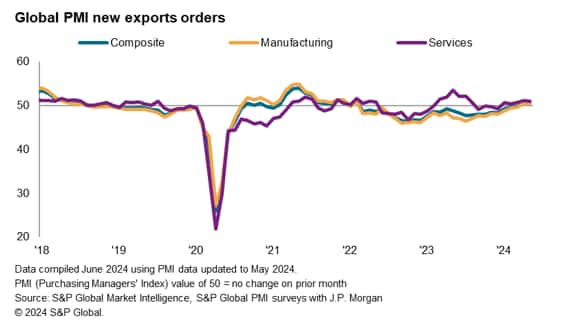

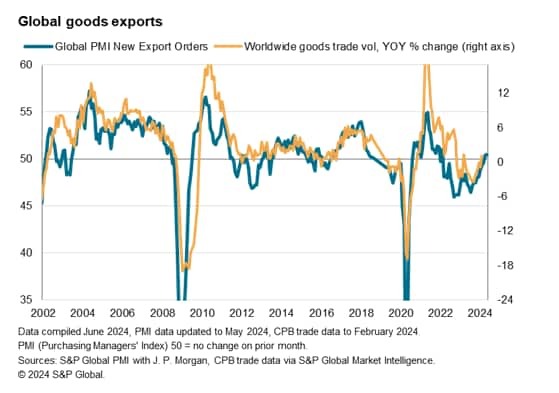

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade continued to expand midway through the second quarter of 2024, marking only the second monthly expansion since March 2022.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 50.6 in May, unchanged from April. This was not only the second month of rising exports but also the second successive month in which we have witnessed broad-based improvements in trade conditions across both the manufacturing and service sectors.

Services trade continue to lead the expansion in global trade

The service sector continued to register a stronger rate of export business expansion compared with manufacturing according to May PMI data. The rate of growth, despite having eased from April, remained above the rolling 12-month average. This was set against a backdrop of faster global services activity growth, at the most pronounced pace in a year, and spurred by the quickest expansion in overall new business in 11 months.

More detailed sector data revealed that the expansion in export business was led by the software & services sector in May, followed by transportation and insurance, underscoring how services remain at the fore in leading growth of exports. That said, robust export growth was also recorded across various manufacturing sectors, including the auto & auto parts, chemicals and food & beverages, while financial services sectors such as real estate and banks continued to see the fastest deterioration in export conditions.

Meanwhile, the improvement in manufacturing sector export conditions was sustained in May, with a second above-50.0 print for the New Export Orders Index contrasting with falling goods trade having been signalled over much of the prior two years. Anecdotal evidence suggested that better demand conditions, supported by efforts among good producers to rebuild inventory, provided a boost for global trade. At the same time, supply chain stress remained low despite rising purchasing levels among firms, according to the global PMI Supplier' Delivery Times Index.

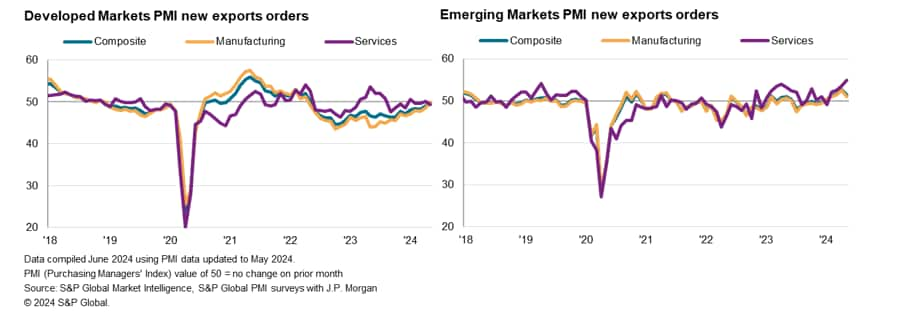

Emerging markets lead trade growth, but conditions in developed markets also near-stabilise

By region, emerging markets led the expansion of global exports again in May. Although the rate at which emerging market export business expanded eased to a three-month low, it remained among the strongest observed in the past three years and was supported by rising export orders in both the manufacturing and service sectors.

That said, developed market trade conditions near-stabilised in May. The rate at which developed markets export orders declined was only fractional and the slowest in the current two-year spell of decline. This brought the gap between the two regions to the smallest in six months, thereby indicating some regional convergence in trade conditions.

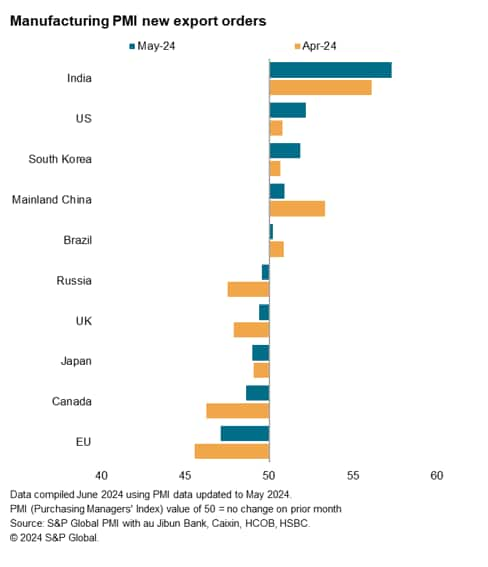

India leads global goods trade, US leads developed markets

India continued to hold pole position in the rankings of global manufacturing new export orders in May. This was as manufacturing new orders rose at one of the strongest rates in over 13 years amid greater inflows of new work from Africa, Asia, the Americas, Europe and the Middle East, according to survey respondents.

This was followed by the US, which saw the strongest upturn in goods export orders among the developed nations tracked. Moreover, the rate of new export orders growth in the US was the fastest in two years with better demand reported from Asia, Canada and Mexico.

Various North Asian economies also saw sustained growth in new export orders, though with accelerating South Korea manufacturing new export orders expansion contrasting with goods export growth slowing from mainland China in May.

On the other hand, manufacturing export conditions remained subdued especially for the EU ,UK and Canada, though each saw the rate of decline ease in the latest survey period. Japan's exports also continued to fall, though the decline was again only marginal and among the smallest recorded over the past two years.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-expansion-driven-by-emerging-markets-growth-jun24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-expansion-driven-by-emerging-markets-growth-jun24.html&text=Global+trade+expansion+driven+by+emerging+markets+growth+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-expansion-driven-by-emerging-markets-growth-jun24.html","enabled":true},{"name":"email","url":"?subject=Global trade expansion driven by emerging markets growth | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-expansion-driven-by-emerging-markets-growth-jun24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+expansion+driven+by+emerging+markets+growth+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-expansion-driven-by-emerging-markets-growth-jun24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}