Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 09, 2024

Global trade revives amid renewal of worldwide goods exports

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

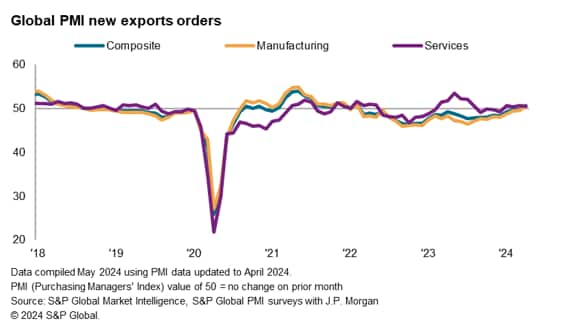

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade expanded at the start of the second quarter of 2024, thereby concluding the contraction streak of just over two years.

The seasonally adjusted Global PMI New Export Orders Index posted 50.6 in April, up from 49.8 in March. Although marginal, the latest rise in global trade conditions signalled the first improvement since February 2022. Moreover, the latest uptick in trade conditions was broad-based with both manufacturing and services export business rising in April.

Broad-based improvement in trade conditions

Global manufacturing new export orders returned to expansion territory for the first time in 27 months, supporting the advancement in overall trade conditions. The latest uptick in goods trade was set against a backdrop of sustained new orders expansion, albeit at a slower pace compared to March. The rise in new orders, alongside a fourth successive rise in global manufacturing production, signalled that wider manufacturing sector business conditions have steadied so far in 2024. The survey data therefore hint at a return to growth for both global merchandise trade and manufacturing production following two years of deterioration.

While the rise in goods trade was a first recorded by the PMI in over two years, it was services at the fore in lifting global trade back into expansion. Services export business growth expanded for a fourth straight month in April and at the most pronounced pace in nine months. Despite overall services new business and optimism levels having also eased from March, they remained more positive than that seen for manufacturing, further hinting at sustained near-term improvements for the tertiary sector.

Turning to more detailed sector data, it was encouraging to see 14 of the 21 monitored sectors indicating rising export business in April's PMI survey results. This doubled from seven in March and marked the highest proportion since last April. Ranking first in the latest survey period was the transportation sector, followed by media. On the other hand, financial sectors such as real estate and banks saw the fastest deterioration in export business conditions.

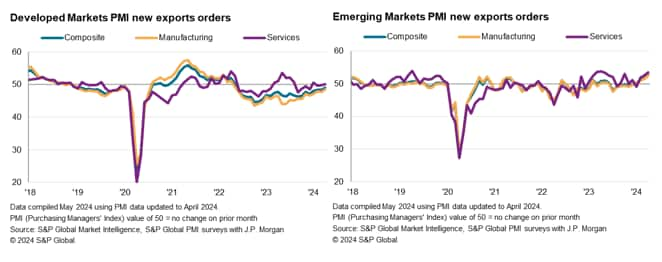

Divergence in developed and emerging market export conditions widens

April's PMI further showed developing markets attempting to play catch-up to emerging markets with respect to the pace of overall activity growth, but the divergence in export conditions persisted. While emerging market export business conditions improved solidly, and at the fastest rate in over six-and-a-half years, developed market exports remained in contraction, albeit declining at the slowest pace in the current 23-month sequence. Weakness in export business was mainly concentrated in the manufacturing sector for developed markets as services trade flows stabilised in April.

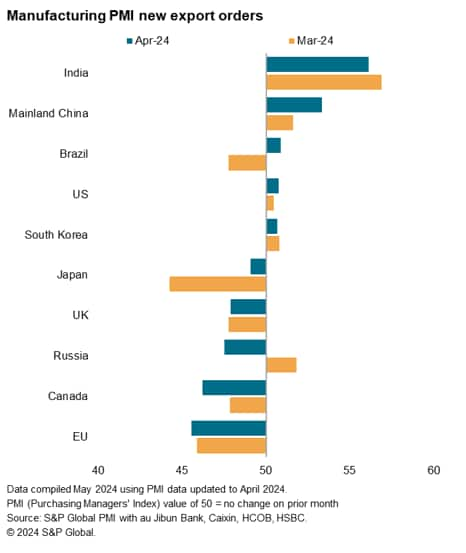

India leads global goods trade, Japan sees marked amelioration in export decline

India remained at the fore in leading the growth in global manufacturing new export orders at the start of the second quarter of 2024. This was followed by mainland China and Brazil. Russia's manufacturing new export orders contracted for the fifth time in six months, but with the renewal of Brazil goods trade growth and mainland China's export orders inflows unfolding at the fastest pace in nearly three-and-a-half years, overall emerging market manufacturing trade conditions improved at a more pronounced pace in April.

For developed markets, manufacturing sector trade conditions continued to worsen in most economies with the exception of the US, which registered a third monthly rise in manufacturing new export orders. That said, manufacturing export orders in Japan fell at the slowest pace in the current 26-month sequence, representing a marked easing of the downturn from March. Manufacturers in Japan are also poised to anticipate sales growth as observed from the latest PMI that showed near-stabilisation of broader manufacturing sector conditions. The EU meanwhile saw goods trade continuing to fall at a marked pace in April, but with the pace of decline softer than Q1's average.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-revives-amid-renewal-of-worldwide-goods-exports-may24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-revives-amid-renewal-of-worldwide-goods-exports-may24.html&text=Global+trade+revives+amid+renewal+of+worldwide+goods+exports+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-revives-amid-renewal-of-worldwide-goods-exports-may24.html","enabled":true},{"name":"email","url":"?subject=Global trade revives amid renewal of worldwide goods exports | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-revives-amid-renewal-of-worldwide-goods-exports-may24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+revives+amid+renewal+of+worldwide+goods+exports+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-revives-amid-renewal-of-worldwide-goods-exports-may24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}