Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 08, 2019

Im-patient factor returns

Research Signals - June 2019

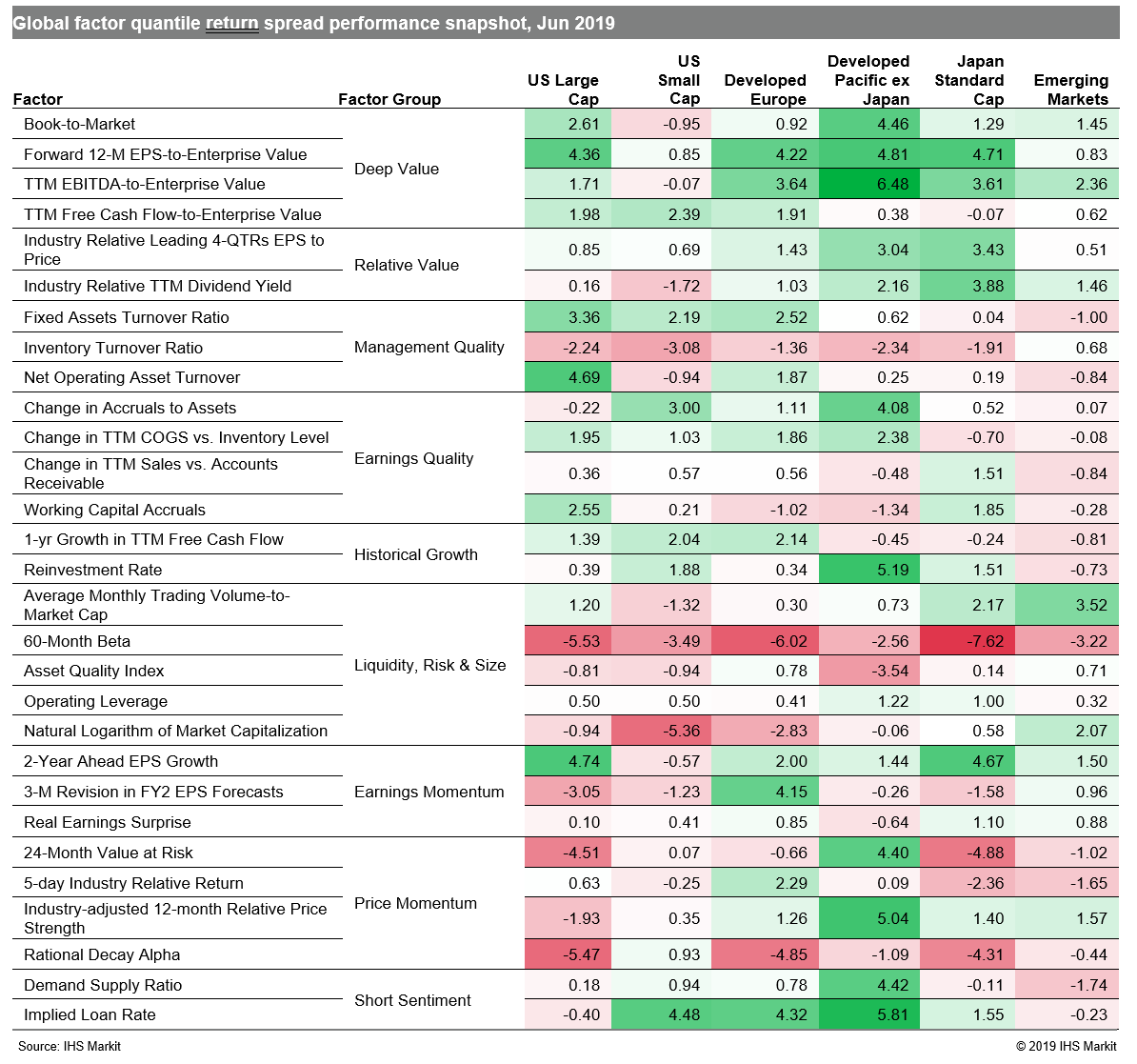

Despite trade headwinds, stocks mostly moved higher last month as monetary policy moved front and center on positive comments from the European Central Bank and the US Federal Reserve, which removed 'patient' from its policy message, an apparent dovish update. However, investors are showing no patience with value and momentum trades which swapped positions once again in June, as value retook the lead from momentum (Table 1). Only time will tell how much patience investors will also display with economic growth, as the J.P.Morgan Global Manufacturing PMI remained in contraction territory as international trade continued to weaken, with declines registered in the euro area, China and Japan, though increases were seen in the US and India.

- US: Value and momentum factors switched places once again, with strong spreads associated with Forward 12-M EPS-to-Enterprise Value, while Rational Decay Alpha lagged

- Developed Europe: Investors once again followed signals from securities lending markets, shying away from highly shorted stocks with high costs to borrow, as gauged by Implied Loan Rate

- Developed Pacific: High beta names strongly outperformed in Japan, posting a positive spread for the fourth month this year, though on volatile trading recently with another 18 percentage point month-on-month swing in 60-Month Beta spread performance

- Emerging markets: Momentum measures such as Industry-adjusted 12-month Relative Price Strength maintained their hold on leading performance, though valuation fought its way back, as captured by TTM EBITDA-to-Enterprise Value

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpatient-factor-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpatient-factor-returns.html&text=Im-patient+factor+returns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpatient-factor-returns.html","enabled":true},{"name":"email","url":"?subject=Im-patient factor returns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpatient-factor-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Im-patient+factor+returns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fimpatient-factor-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}