Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 03, 2019

Securities Lending Q2 Update

- $2.6bn in global securities lending revenue

- IPOs drive increased specials demand

- Government bond balances and revenues decline

- Bright spots for ex-USD corporate bond lending

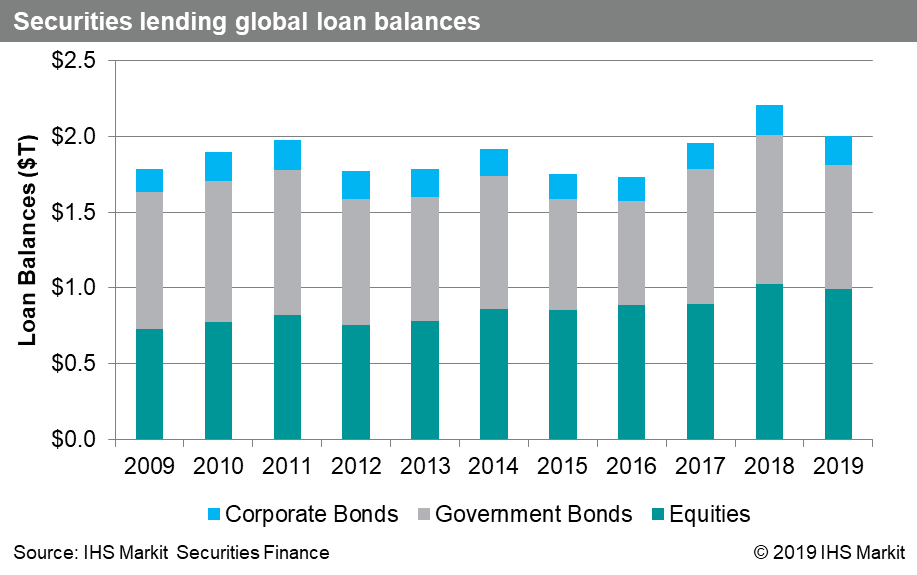

Global securities lending revenues for Q2 2019 totalled $2.6bn, 10% below the average Q2 revenue over the last three years. There were some bright spots, with an increase in special balances in some of the larger markets along with continued expansion in emerging asset classes. Total loan balances fell 12% YoY, with the largest driver being declining demand for government bonds. The largest contributor to the revenue shortfall was European equities, however even within that asset class there were some bright spots such as specials demand for UK equities.

The spate of recent US IPOs boosted demand for equity specials. The most notable was Beyond Meat, where fees for new borrows exceeded 300% during the second week of June. Those lofty fees made the plant-based meat-alternative the most lending revenue generating security globally for Q2, at just over $50m. The other significant revenue generator from the US IPO space was LYFT (UBER also attracted significant borrow demand, however a larger float kept a lid on fees).

The first quarter of 2018 represented the post-crisis peak in demand for government bonds, with average loan balances greater than $1tn. Each subsequent quarter has seen declining balances, with Q2 2019 balances averaging $815bn. The primary driver of demand has been the collateral needs of broker-dealers in relation to regulatory requirements for holding high quality liquid assets (HQLA). Increased issuance, reflected in additional holdings on broker-dealer balances sheets, may be contributing to the declining overall demand. Despite the cooling overall demand, there were some short-lived opportunities to generate lending revenue, most notably the 10Y bond in early June.

Corporate bond lending revenue fell 18% YoY, primarily driven by declining demand for dollar denominated credits. Revenues for EUR and CAD denominated bonds increased on the back of higher fees, despite lower loan balances. Overall revenues fell for both investment grade and non-investment grade issues, however within each there were some countertrends. The largest positive contribution to investment grade revenue growth was from the CAD denominated bonds; the largest positive contributions to non-investment grade revenue growth were EUR and GBP denominated issues.

Equity lending revenues came in at $2.1bn, a decline of 17% compared with Q2 2018. Asia equity lending revenues fell 14.6% compared with Q2 2018, the first YoY decline in quarterly revenues since Q3 2017. The YoY decline for Asia was entirely driven by lower fees, however balances remain elevated though they have fallen from record Q1 levels. Asian equities also contributed to ADR revenues, which were 9.5% higher than Q2 2018. ADR revenues failed to match the all-time record revenue set in Q1.

ETF lending revenues continue to underperform 2018 as they did in Q1, primarily the result of lower fees and balances for high-yield bond funds. Borrow demand for exchange traded products remains robust, with Q2 balances 12% higher YoY. The most revenue generating products continue to be USD HY credit, broad US equity indices, leveraged loans and emerging markets.

Conclusion:

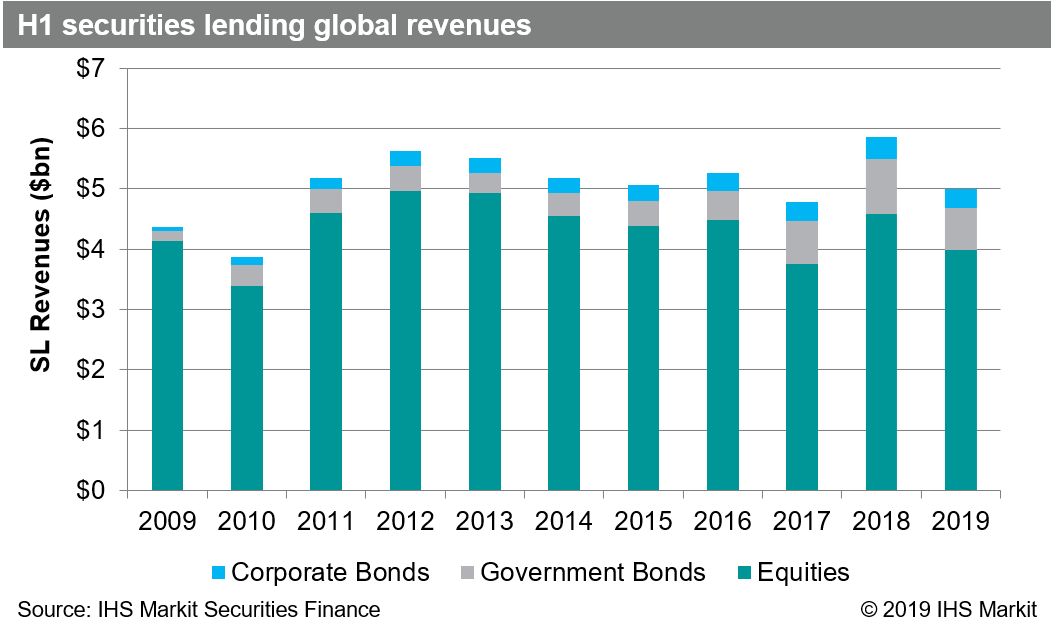

The YoY revenue shortfall in the first half of 2019 relative to 2018 appears rather large, however it's worth noting that H1 2018 was the best six month span post-crisis, making for a tough comparison. For some perspective, the H1 2019 revenues were a 4% improvement compared with H1 2017. Against the broad trend of declining fees and balances, some asset classes have presented opportunities to generate incremental income, notably including the Cannabis sector, emerging markets, ex-USD corporate bonds, US IPOs and hard-to-borrow UK equities.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-q2-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-q2-update.html&text=Securities+Lending+Q2+Update+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-q2-update.html","enabled":true},{"name":"email","url":"?subject=Securities Lending Q2 Update | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-q2-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Lending+Q2+Update+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-lending-q2-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}