Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2024

Japan flash PMI signals faster growth and higher prices at start of second quarter

Japan's private sector growth momentum accelerated to the joint-fastest in nearly a year at the start of the second quarter, according to flash PMI data. Stronger services activity growth was accompanied by a slowing in the pace at which goods production declined, with the survey's New Orders Index having also signal improvements in demand conditions.

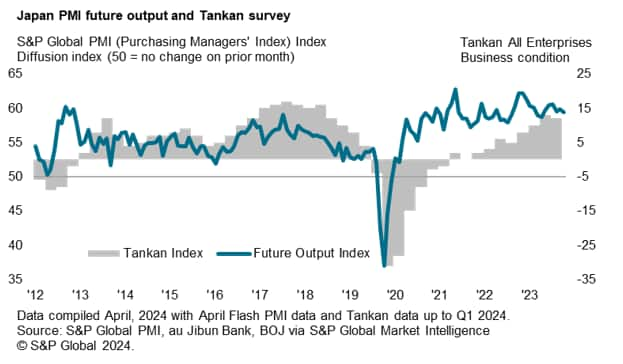

Sentiment among Japanese private firms meanwhile remained positive which' alongside improvements in forward-looking indicators' hints at business activity expansion being sustained in the near-term.

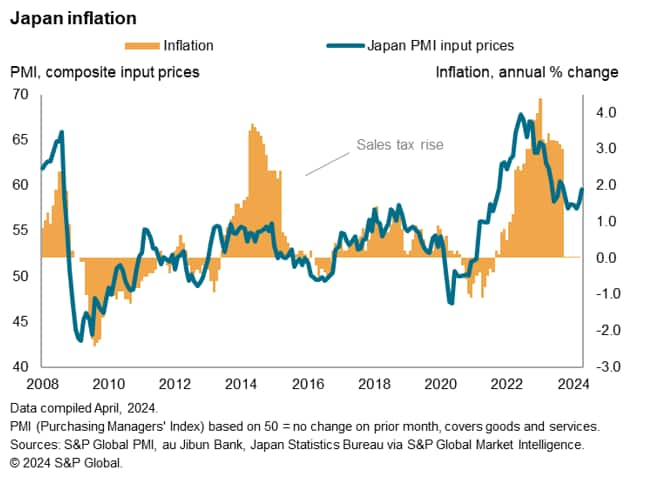

That said, price pressures intensified amid the acceleration in business activity growth, resulting in the fastest increase in average selling prices in a year. The rising inflation trend, according to PMI prices data which precedes official indications, therefore lends some support to the Bank of Japan's consideration for further lifting rates.

Japan's flash PMI rises for second consecutive month

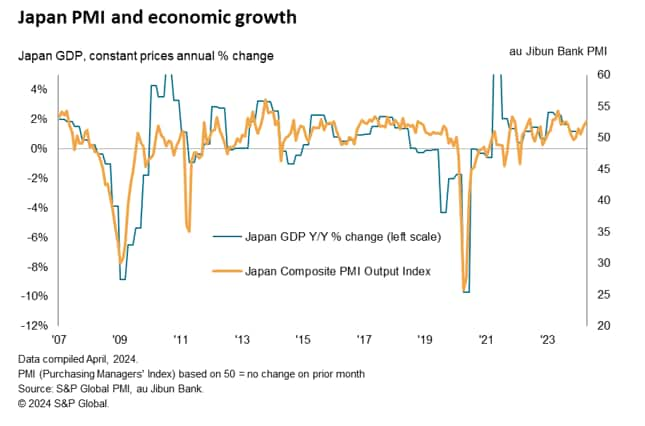

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 52.6 in April from 51.7 in March. The flash reading, based on approximately 85%-90% of typical PMI survey responses each month, indicated that Japan's private sector conditions improved at the fastest rate in 11 months, matched only by the rate of growth seen back in August 2023. The latest composite output reading - covering both manufacturing and services - is historically consistent with GDP growing at an annual rate of around 2% at the start of the second quarter.

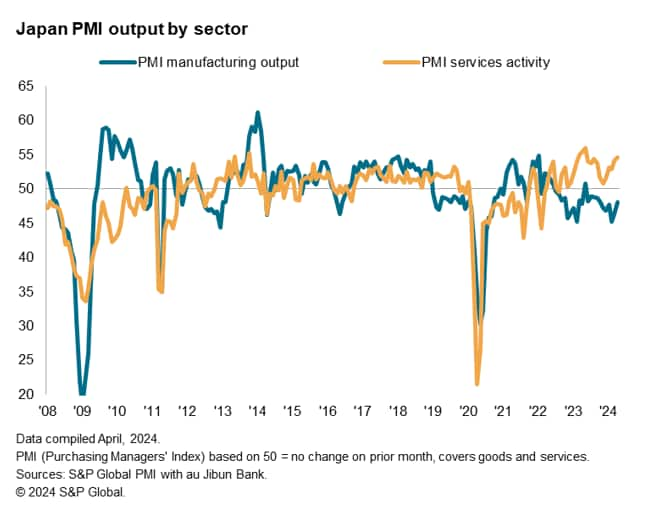

Service sector remains growth engine while manufacturing output contraction eases

For the eleventh successive month, the service sector remained the main source of growth as manufacturing production continued to fall. Services new business inflows and export business inflows grew solidly at the fastest rates in ten and nine months respectively.

According to anecdotal evidence, better underlying demand conditions and increased tourism activity underpinned the latest uptick in new business for service providers. Forward-looking indicators such as the Backlogs of Work Index further showed persistent pressure on capacity which, alongside lower but still elevated, business optimism, outlined the likelihood for further growth in services activity in the near-term.

Meanwhile the manufacturing sector saw the rate of output contraction ease for a second successive month, providing an encouraging sign for a sector which has now seen output fall in all bar one of the past 22 months. This was as goods new orders fell at a slower and only marginal pace in April, with some firms seeing better demand conditions at the start of the new quarter. Additionally, the level of business confidence in factories rose further above the series average in April to indicate an improvement in growth expectations in the year ahead among goods producers.

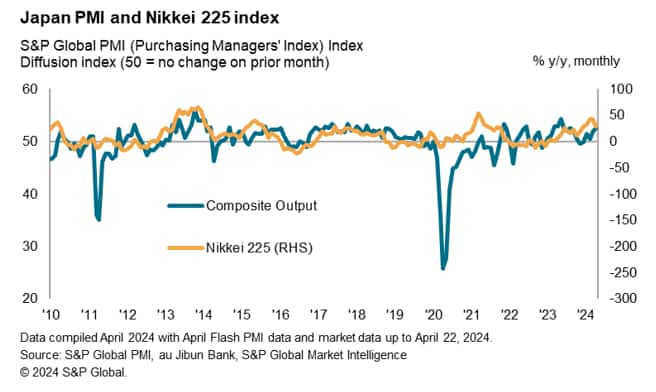

PMI data indicate support for Japanese equity market gains

The latest uptick in April's au Jibun Bank Flash Japan Composite PMI is therefore supportive of recent equity market gains such as for the Nikkei 225, with which the PMI has a strong historical correlation.

Despite the slight fall in prices alongside global equity markets recently, the Nikkei 225 index has merely coincided again with the PMI index as shown in the comparison chart below. This therefore suggests that the pullback for the Nikkei 225 index may be temporary at present.

Additionally, future sentiment across the Japanese private sector remained positive at the start of April. Despite having eased slightly from March, the level of business confidence remained well above the series average to reflect an elevated level of optimism among private sector firms regarding output expanding in the coming 12 months, further lending support to equity markets.

Price pressures rise moderately

While business conditions generally improved across Japan's private sector in April, the latest flash PMI data have also outlined rising cost pressures for Japanese private sector firms.

Both the manufacturing and service sectors saw average costs rise at quicker rates according to the seasonally adjusted Input Prices Indices. Anecdotal evidence pointed to higher input materials, energy and wage costs, aggravated by a weaker domestic currency, contributing to the uptick in average costs. This was as the yen sank to the weakest since 1990 against the greenback late into the survey period.

Consequent of rising cost pressures, Japanese private sector firms sought to share their increased cost burdens with clients, leading to the fastest increase in selling prices in one-and-a-half years. The service sector, where inflation is relatively more elevated, notably saw average selling prices rise at the fastest pace in a decade.

Overall, the latest PMI price indications are consistent with the headline CPI climbing in the months ahead towards the 2.0% level. Expectations for another Bank of Japan (BoJ) hike have built after the central bank exited the negative interest rate regime in March. While the BoJ is not expected to update monetary policy settings in April, changes in conditions in the past few months have been well-reflected in PMI data, which backs potential upgrading of inflation expectations in the BoJ's quarterly outlook report at the end of week. The latest intensifying of inflationary pressures thereby provides leeway for the BoJ to consider next a hike to interest rates.

Access the press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-faster-growth-and-higher-prices-at-start-of-second-quarter-apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-faster-growth-and-higher-prices-at-start-of-second-quarter-apr24.html&text=Japan+flash+PMI+signals+faster+growth+and+higher+prices+at+start+of+second+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-faster-growth-and-higher-prices-at-start-of-second-quarter-apr24.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI signals faster growth and higher prices at start of second quarter | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-faster-growth-and-higher-prices-at-start-of-second-quarter-apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+signals+faster+growth+and+higher+prices+at+start+of+second+quarter+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-faster-growth-and-higher-prices-at-start-of-second-quarter-apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}