Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 21, 2018

Malaysia PMI suggests further loss of momentum after a slow start to 2018

- GDP grows at annual rate of 5.4% in first quarter, down from 5.9% in the previous quarter

- Nikkei PMI surveys point to further slowdown in second quarter

- May PMI data to offer early insights into economic activity after the shock election results

The Malaysian economy grew at a slower pace in the opening quarter of 2018, according to the Department of Statistics, in line with advance signals from business surveys. The survey data also suggest that economic growth could ease further in the second quarter amid the changing post-election environment.

Still solid start to 2018

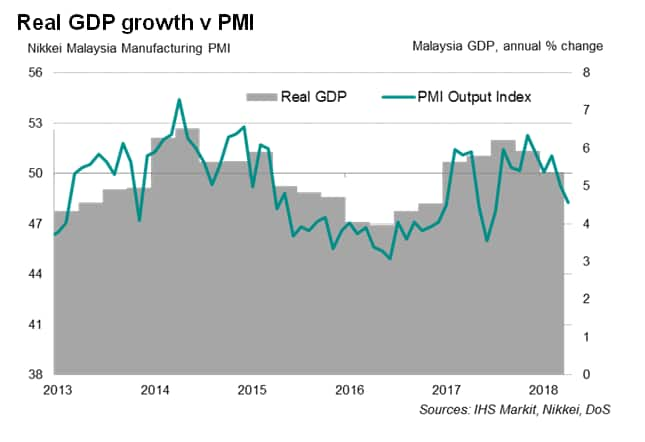

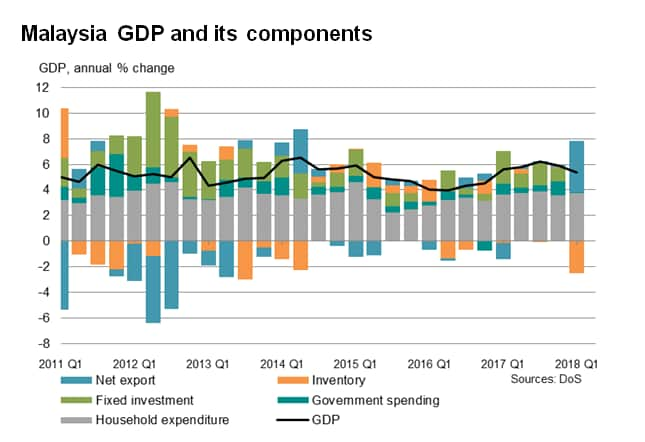

Official data showed that Malaysia's economy expanded 5.4% year-on-year in the first quarter of 2018, down from 5.9% in the final quarter of 2017. Slower growth was signalled well in advance by Nikkei PMI data (an average PMI Output Index reading of 50.1 in Q1 2018 compared with 51.2 in Q4 2017).

The economy benefitted from continued growth in private spending and a surge in net exports. However, only marginal growth in both fixed investment and public consumption failed to lift business activity. Detailed data showed overall investment was weighed down by slower spending on fixed assets. Gross fixed capital formation was just 0.1% higher than a year ago, the annual rate of increase sliding from 4.3% in the final quarter of last year.

Reduced demand for capital goods dampened import growth, which, in turn, helped to boost net exports' contribution to GDP. A slowdown in export growth suggests the recent appreciation of the ringgit had dented export competitiveness. The ringgit gained nearly 5% against the US dollar in the first quarter.

Further slowdown

The April Nikkei PMI surveys point to a further loss of momentum at the start of the second quarter, with the latest PMI's gauge of output consistent with an annual GDP growth rate of 4.8%.

The PMI Output Index exhibits an 81% correlation with the annual rate of change in Malaysia's GDP, providing a reliable and early indicator of economic activity¹.

While near-term prospects for growth may have weakened, longer-term expectations were seen as more positive. Survey data indicated that Malaysian manufacturers were the most optimistic about the 12-month outlook in four-and-a-half years during April, prior to the election. Furthermore, improved business confidence had helped boost hiring.

Monetary policy

Slower growth and relatively benign inflationary pressure reduced the likelihood of another rate hike from the central bank. Bank Negara Malaysia in fact emphasised that the January increase of the policy rate to 3.25% ought to be viewed in the context of a normalisation of monetary policy instead of a tightening move. IHS Markit expects no policy change for the rest of 2018.

Post-election

With the Goods and Services Tax (GST) set to be reduced from 6% to 0% next month, and fuel prices fixed at present levels alongside a potential re-introduction of fuel subsidies, consumer inflation will likely remain subdued in coming months.

On the downside, the new government's policy platform has raised concerns about the fiscal outlook. Moody's, a rating agency, cautioned that the GST removal and re-instatement of fuel subsidies will be 'credit-negative' if there are no offsetting measures to counter the expected loss in tax revenue.

The Nikkei Malaysia manufacturing PMI for May, out on 4th June, will be among the first major economic indicators to provide insights into activity and price trends in the country following the historic election results.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-suggests-further-loss-of-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-suggests-further-loss-of-momentum.html&text=Malaysia+PMI+suggests+further+loss+of+momentum+after+a+slow+start+to+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-suggests-further-loss-of-momentum.html","enabled":true},{"name":"email","url":"?subject=Malaysia PMI suggests further loss of momentum after a slow start to 2018 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-suggests-further-loss-of-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Malaysia+PMI+suggests+further+loss+of+momentum+after+a+slow+start+to+2018+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysia-pmi-suggests-further-loss-of-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}