Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 18, 2018

Week Ahead Economic Preview - May 21-25

- Bank of England to be guided by UK GDP, HFI, retail sales and inflation data

- Flash Eurozone and Japan PMI surveys to provide steers on economic health in second quarter

- FOMC policy in spotlight amid meeting minutes and May PMI numbers

The week sees a range of data that will add to views on policy decisions at major central banks.

Bank of England policy steers

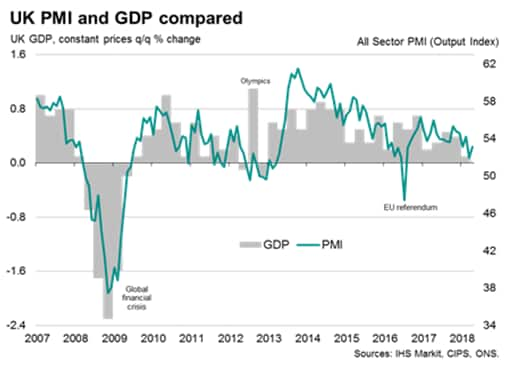

The week includes a particular wealth of data releases which will provide clues as to whether the Bank of England will remain on course to hike interest rates this year. The Bank back-tracked from a May rate rise after data showed the UK economy performing worse than expected at the start of the year and inflation falling faster than anticipated. Policymakers have pencilled in an upward revision to first quarter GDP growth, though the consensus is for the second estimate to remain unchanged at 0.1%. We suspect there may be scope for an upward revision, as PMI data indicated a 0.3% rise.

Any upward revision with improve the odds of a summer rate hike by the BoE, but other data may muddy the picture. First of all, the HFI survey (which Mark Carney referred to in the May press conference) is published on Monday and will provide the first indication of household sentiment and finances in May.

UK inflation, as measured by the consumer price index, is meanwhile generally expected to hold steady at 2.5% in April, while retail sales are forecast to rebound (albeit only partially) in April after a 1.2% slump in March. However, that would still leave sales flat on a year ago, highlighting a steadily weakening trend in consumer spending which could in turn cast doubt on the Bank of England's expectation of a solid second quarter rebound in the economy.

Eurozone slowdown?

The ECB will meanwhile be keenly eyeing the Eurozone flash PMI to gauge growth momentum and price trends. The survey data provided an advance indication of the slowdown in the single currency area earlier this year, and the May data will provide important steers on second quarter growth.

Read more about recent Eurozone trends, and the potential impact of bad weather and the timing of Easter holidays, on the PMI numbers here.

FOMC guidance from PMI

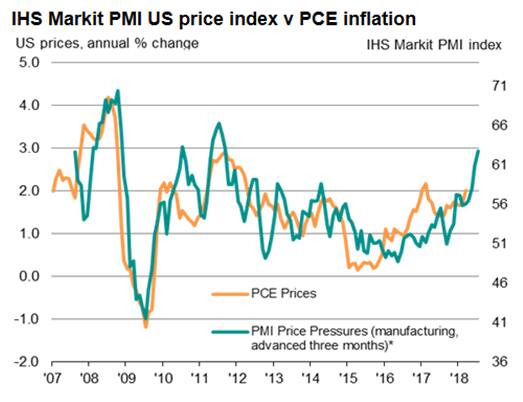

The minutes from the latest FOMC minutes will be parsed in every detail for indication of the timing of the next US rate hike. However, clues will also be found in the flash PMIs, as well as durable goods orders, the University of Michigan consumer survey and home sales data. IHS Markit's flash PMI numbers accurately anticipated the upturn in manufacturing growth at the start of the second quarter, and May's data will give a good indication of overall GDP growth. However, perhaps more important will be the survey's price gauges, which have acted as a reliable advance indication of inflation trends, and which hit a seven-year high in April.

PMI clues for Japan rebound

In Japan, a weak start to 2018 has cast doubt on the health of the economy, though PMI numbers have indicated an improved picture at the start of the second quarter, albeit with disappointing export trade. The flash Nikkei manufacturing PMI will provide a further sense of whether the economy is set to rebound in the second quarter.

Download the report for a full diary of key economic releases.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview--may-2125.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview--may-2125.html&text=Week+Ahead+Economic+Preview+%c2%ad%e2%80%93+May+21-25+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview--may-2125.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview – May 21-25 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview--may-2125.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview+%c2%ad%e2%80%93+May+21-25+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview--may-2125.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}