Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 07, 2021

May 2021 Model Performance Report

Research Signals - May 2021

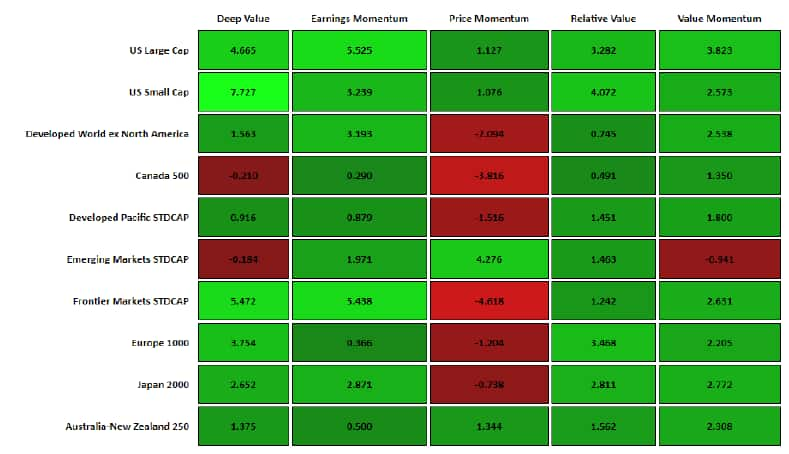

- US: Within the US Large Cap universe the Value Momentum 2 model had the strongest one month decile return spread performance, returning 6.28%, while the Historical Growth model lagged. Over the US Small Cap universe, our Deep Value model had the strongest one month decile return spread performance, returning 7.73%, while the Historical Growth model lagged.

- Developed Europe: Over the Developed Europe universe, our Deep Value model returned 3.75% on a one month decile return spread basis, while Price Momentum lagged.

- Developed Pacific: Over the Developed Pacific universe, the Value Momentum model had the strongest one month decile return spread performance, returning 1.80%, while the Price Momentum model lagged. The Relative Value model's one year cumulative performance is currently 11.43%.

- Emerging Markets: Within the Emerging Markets universe, our Price Momentum model returned 4.28% on one month quintile return spread basis, while Value Momentum lagged. The Earnings Momentum model's one year cumulative performance is still the highest for the EM universe at 11.46%.

- Sector Rotation: The US Large Cap Sector Rotation model returned -5.60%. The Cyclicals sector had a favorable ranking and the Energy sector had an unfavorable ranking.The US Small Cap Sector Rotation model struggled with a return of -3.40%. The Non-Cyclicals sector had a favorable ranking and the Basic Materials sector had an unfavorable ranking.The Developed Europe Sector Rotation model returned 3.30%. The Industrials sector had a favorable ranking and the Telecom sector had a unfavorable ranking.

- Specialty Models: Within our specialty model library the Technology model had the strongest one month quintile return spread performance returning 6.03%, while the Semiconductor model struggled. The Insurance model's one year cumulative performance is the highest at 13.46% while the Oil and Gas model's performance is the lowest at -24.68%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmay-2021-model-performance-report.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmay-2021-model-performance-report.html&text=May+2021+Model+Performance+Report+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmay-2021-model-performance-report.html","enabled":true},{"name":"email","url":"?subject=May 2021 Model Performance Report | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmay-2021-model-performance-report.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=May+2021+Model+Performance+Report+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmay-2021-model-performance-report.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}