Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 30, 2019

Municipal Bonds Focus on Illinois - May 2019

Illinois Muni Bonds - May 2019

Municipal Bonds for Illinois have been downgraded 21 times by the three major ratings agencies since 2009, with the current ratings, according to IHS Markit's Price Viewer data, as follows:

Moody's: Baa3

S&P: BBB-

Fitch: BBB

The BondBuyer notes these key statistics that might contribute to Illinois being the state with the lowest credit rating in the United States:

- $133.5 Billion in unfunded pension liabilities

- $3.2 Billion in budget deficits

- $7.82 Billion in the state's unpaid bills

However, throughout May 2019, the Senate and House have pushed through legislation that would effectively replace the state's current flat-tax structure with a graduated income tax. At the same time as this legislature has progressed through the Senate and the House, recent Municipal Bond Pricing data from IHS Markit shows spreads have been compressing.

Does this indicate the public's expectation that the reform will be approved on the November 2020 ballot?

"I think trade activity has reflected both newsworthy events," said IHS Markit strategist Edward Lee, "such as the Senate's passage of the graduated tax and the administration's decision to make the full $9 billion 2020 pension contribution."

Could this mean the tides are turning for Illinois?

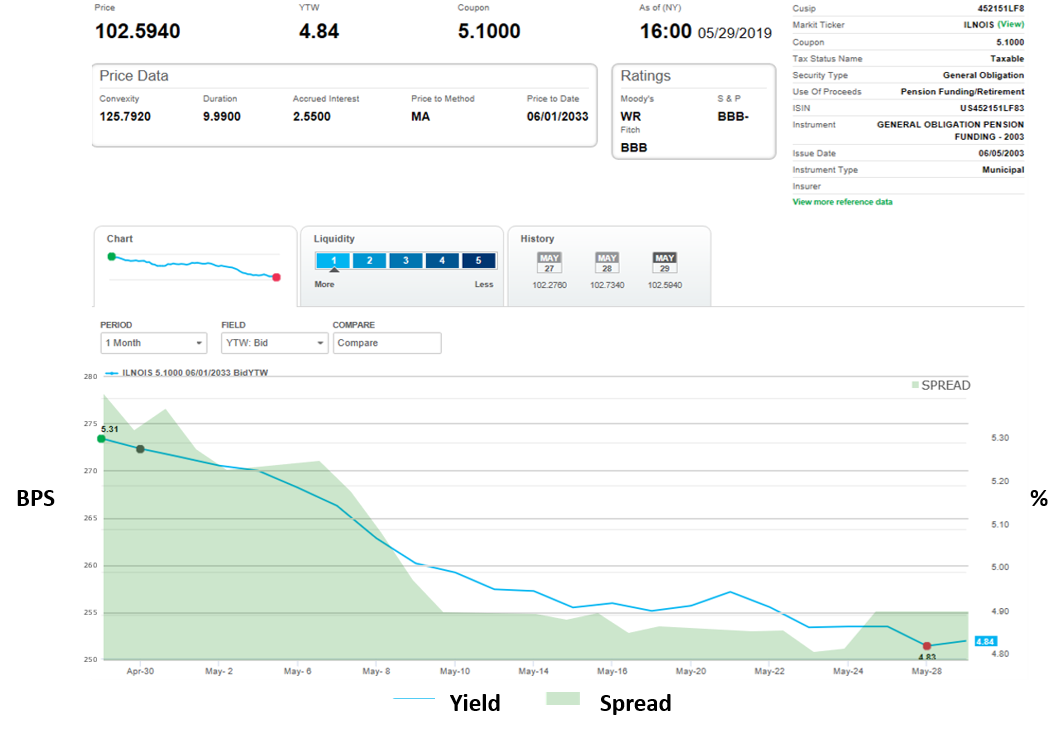

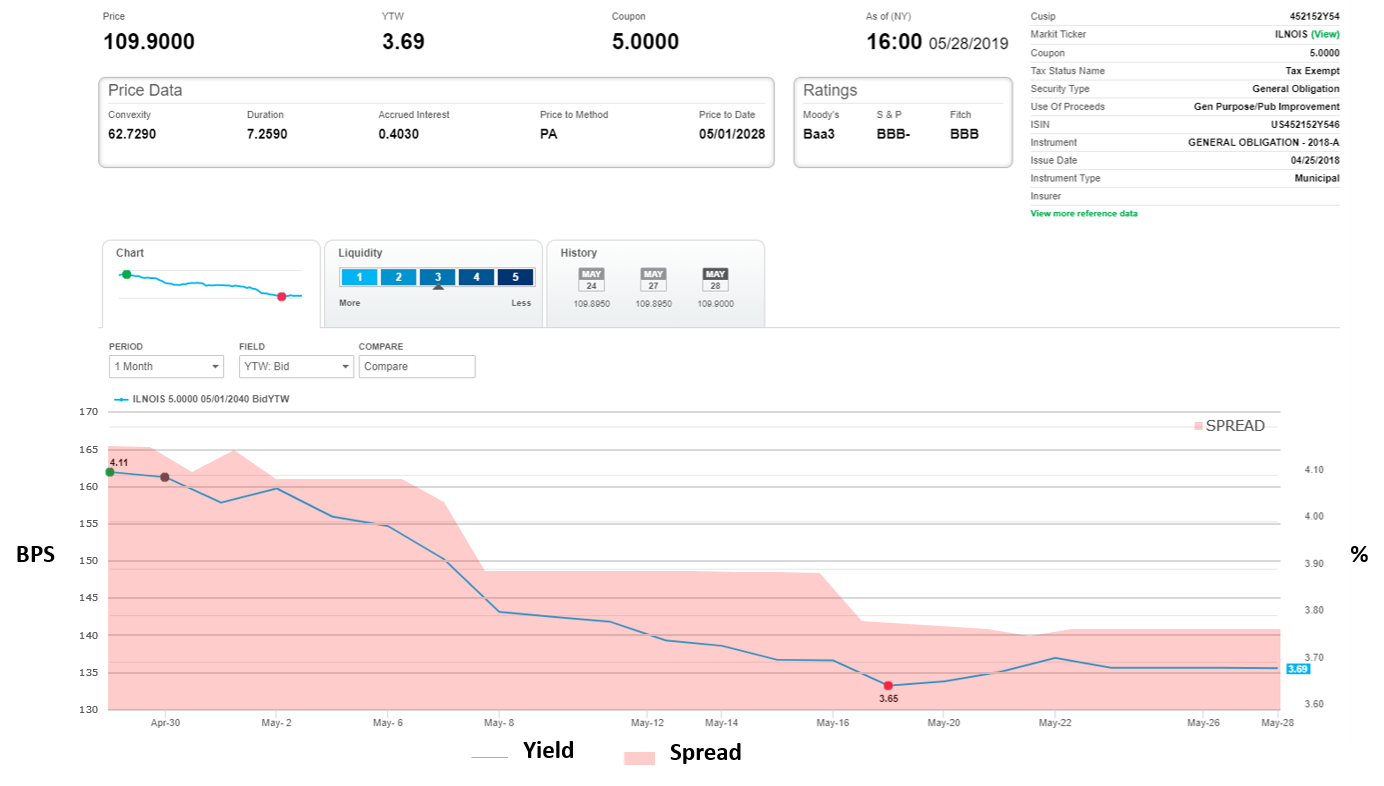

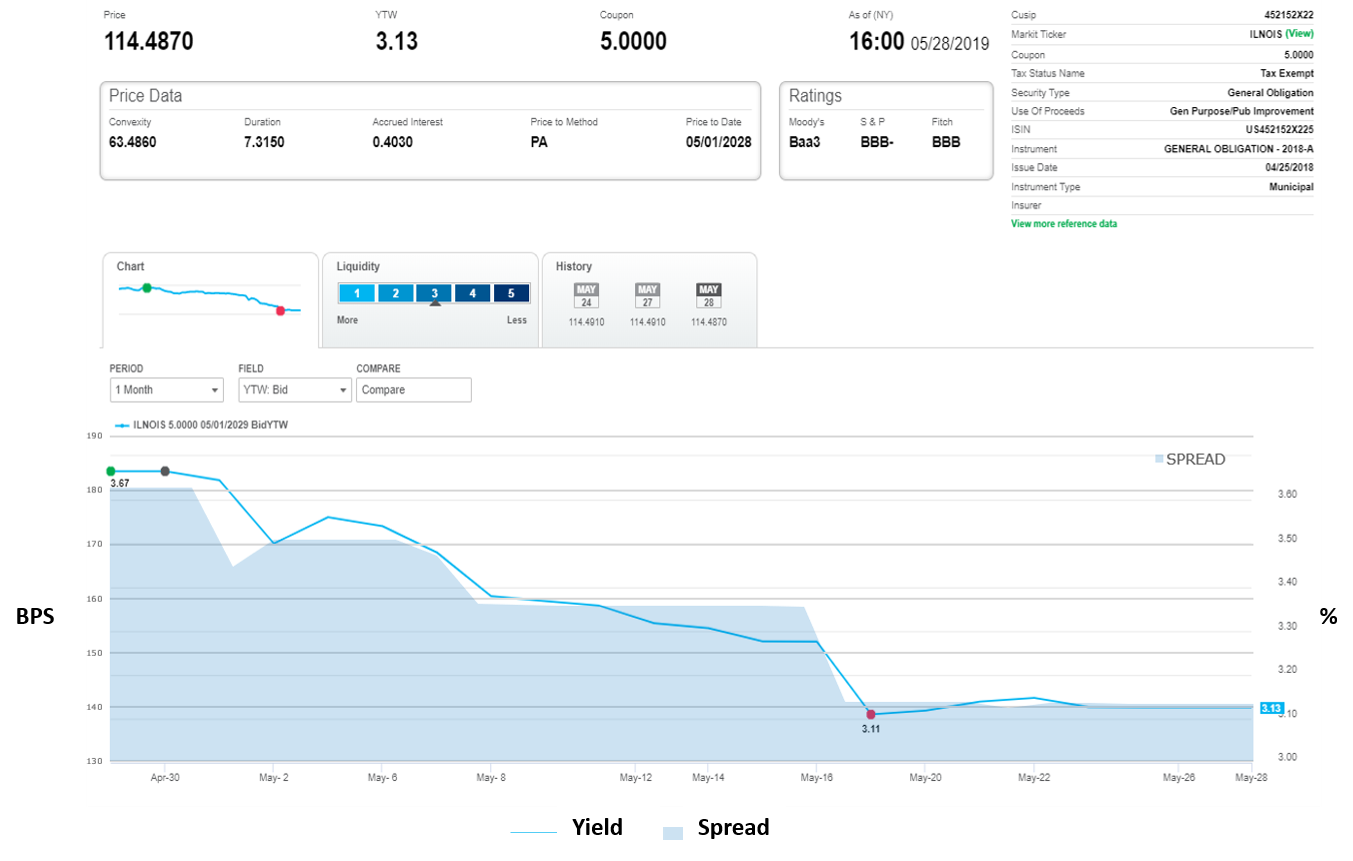

Following is a view of May 28 spreads on Illinois GO bonds, as captured via Price Viewer.

Spread on Taxable 5.1% 2033 IL GO Bond /10-Yr.

Treasury

- +277 on May 1, 2019 to +254 on May 28, 2019

Spread on Tax Exempt 5% 2040 IL GO Bond

- +162 on May 1, 2019 to +141 on May 28, 2019

Spread on Tax Exempt 5% 2029 IL GO Bond

- +181 on May 1, 2019 to +141 on May 28, 2019

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-bonds-focus-on-illinois-may-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-bonds-focus-on-illinois-may-2019.html&text=Municipal+Bonds+Focus+on+Illinois+-+May+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-bonds-focus-on-illinois-may-2019.html","enabled":true},{"name":"email","url":"?subject=Municipal Bonds Focus on Illinois - May 2019 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-bonds-focus-on-illinois-may-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Municipal+Bonds+Focus+on+Illinois+-+May+2019+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipal-bonds-focus-on-illinois-may-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}