Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 11, 2019

NIRI Annual Conference 2019 - Survey Findings

At this year's NIRI Annual Conference, we surveyed over 50 IROs and IR team members on some of the most pressing issues in IR today. Some results were not surprising. For example, IR teams are balancing many challenges and focused on areas like Shareholder Activism, ESG and Targeting International Investors. Some responses were a bit surprising, e.g., over 50% of respondents expect minimal or no impact from MiFID II. I found the results interesting and wanted to share them.

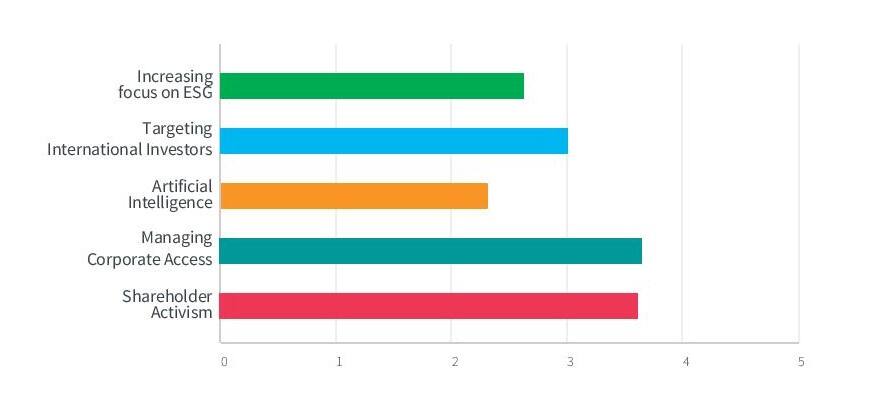

Q1. Please rank the challenges below from least impactful to most impactful for your IR program over the next 3-5 years (1 being the least impactful, 5 being the most impactful).

All 5 of the challenges we asked about seem to be on the minds of IR teams. Not surprisingly, Shareholder Activism and ESG were the two most frequently rated as 'most impactful' while the highest overall average scores went to Shareholder Activism and Corporate Access. This is consistent with what we hear from clients every day. They want to monitor any unusual activity which might be indicative of an activist entering the stock. Also, they are concerned about how to navigate the post-MiFID world of corporate access. And most of our clients want to know more about what they can do from an ESG reporting perspective as well as how investors view ESG for companies they are considering for investment.

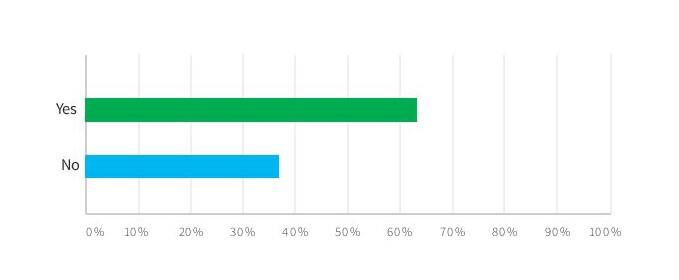

Q2. Does your IR team have defined Key Performance Indicators (KPIs) or Objectives & Key Results (OKRs) which you report to senior management on a regular basis?

Attendance at our Express Talk, "IR Planning - Establishing KPIs and Benchmarking your Program" was strong, indicating that many IROs are trying to better understand how to measure the success of their programs. However, only 63% currently have established them, so that means 1 in 3 IR programs do not regularly set objectives for themselves.

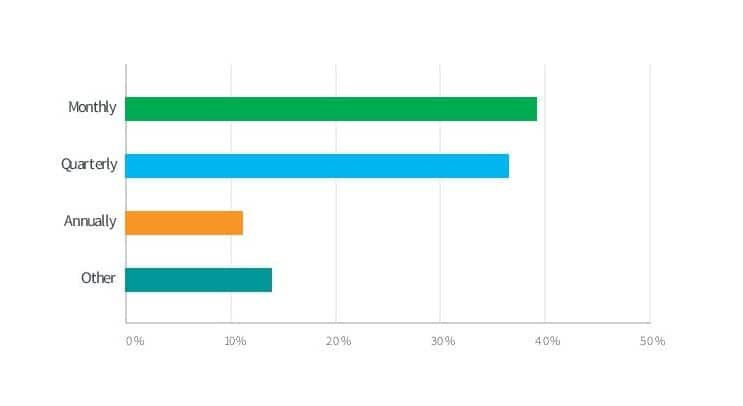

Q3. If you do have KPIs or OKRs, how often do you report to senior management?

For those IR programs that have established KPIs, the majority report on progress monthly or quarterly. While quarterly reporting was in line with expectations, we were somewhat surprised that the most frequent response was monthly. Each company must decide for itself, but quarterly or annual reporting seems like best practice to ensure the long-term strategy of the company remains in focus.

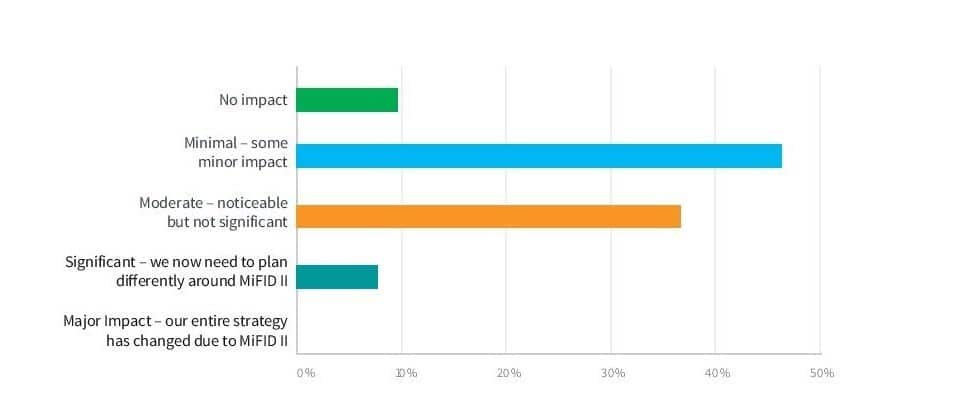

Q4. What has been the impact of MiFID II on your investor outreach efforts?

More than half of respondents indicated that MiFID II has had "no impact" (10%) or "minimal" (46%) impact on their IR outreach. What is interesting with this stat is that 50% of respondents to our 2018 Corporate Access survey indicated that they expected "no impact." It will be interesting to continue to monitor the replies over time as we have heard anecdotally that many small and mid-cap companies are having to take on more of a DIY approach.

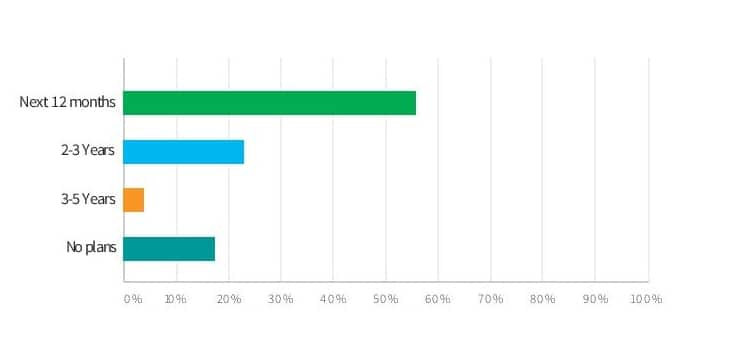

Q5. When do you plan to host your next Investor

Day? Investor Days are back! 55% of

respondents indicated that they will host an Investor Day in the

next 12 months. Based on the same 2018 survey, the average was one

every two years so this is in-line with that feedback. We believe

that

Investor Days are the most effective way to communicate

directly with shareholders on your medium to long-term strategic

direction.

Investor Days are back! 55% of

respondents indicated that they will host an Investor Day in the

next 12 months. Based on the same 2018 survey, the average was one

every two years so this is in-line with that feedback. We believe

that

Investor Days are the most effective way to communicate

directly with shareholders on your medium to long-term strategic

direction.

For further information, please visit Ipreo Corporate Investor Relation Solution.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fniri-survey-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fniri-survey-2019.html&text=NIRI+Annual+Conference+2019+-+Survey+Findings+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fniri-survey-2019.html","enabled":true},{"name":"email","url":"?subject=NIRI Annual Conference 2019 - Survey Findings | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fniri-survey-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=NIRI+Annual+Conference+2019+-+Survey+Findings+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fniri-survey-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}