Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2024

PMI surveys point to robust global growth in November, but Europe falters as US outperforms

The worldwide PMI survey - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - indicated robust global economic growth in November. Conditions vary by region, however; the PMI data put the US on course for solid Q4 GDP growth but the eurozone is at risk of a GDP decline, with Japan and the UK also struggling to expand. Mainland China is seeing some uplift, while India continues to outperform.

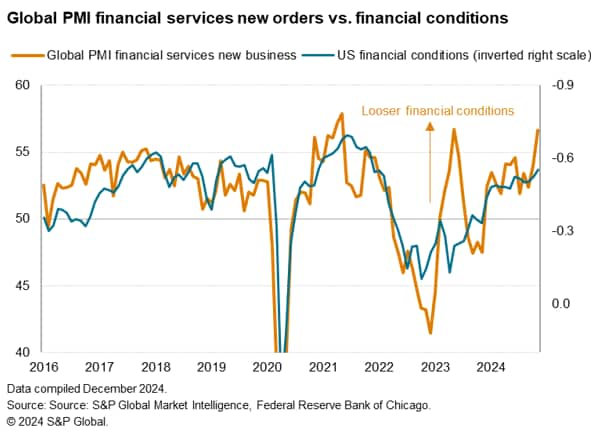

The global expansion was again driven by the service sector, and notably financial services but with increased support from consumers, reflecting looser financial conditions.

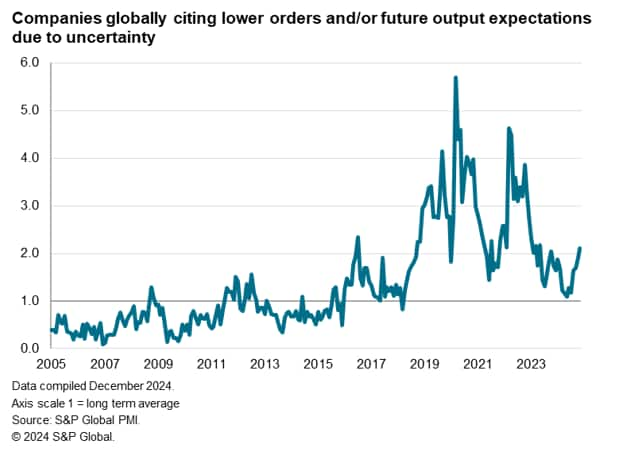

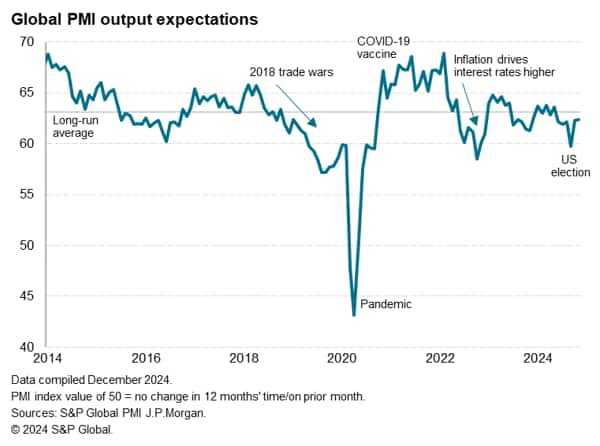

Business confidence improved notably in the US and emerging markets, including mainland China, but elsewhere (geopolitical) uncertainty dominated. This is likely to be a theme we see throughout the coming months, with much depending on the new US administration's approach to tariffs.

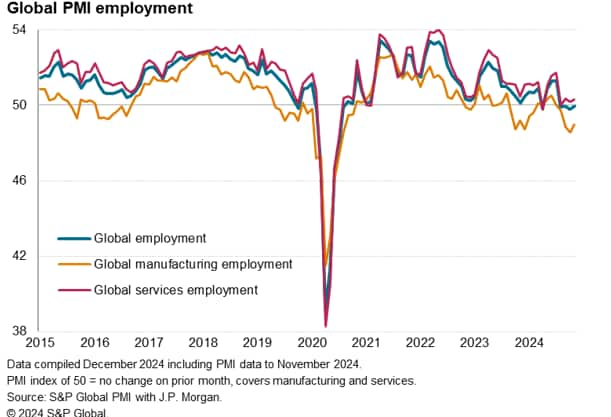

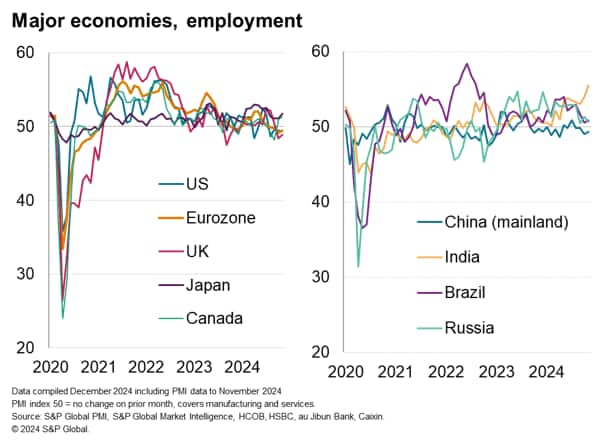

With business confidence consequently running below its long-term trend globally in November, companies also took a cautious approach to hiring, causing worldwide employment to stagnate. Lower payrolls numbers were reported in the US, Eurozone and UK.

Global economic growth edges higher

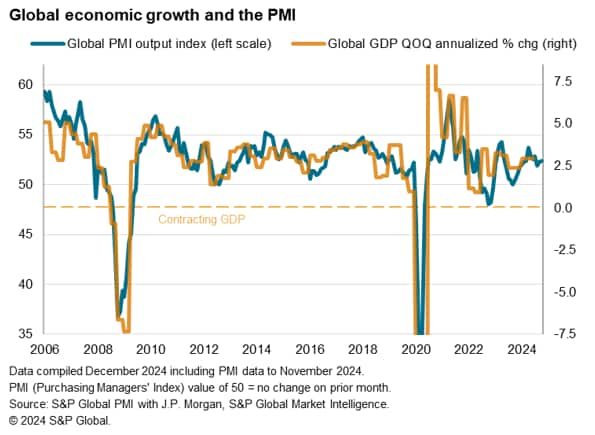

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded for a thirteenth straight month in November, the rate of expansion edging slightly higher again to add to signs of a robust fourth quarter.

The headline J.P. Morgan Global Composite PMI® Output Index, covering manufacturing and services in over 40 economies, rose from 52.3 in October to 52.4, its highest since August.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.7%. That follows the most recent GDP data having registered a 2.9% expansion in the second quarter, and compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic.

The current signal from the PMI is therefore one of robust, albeit modestly below-trend, global economic growth.

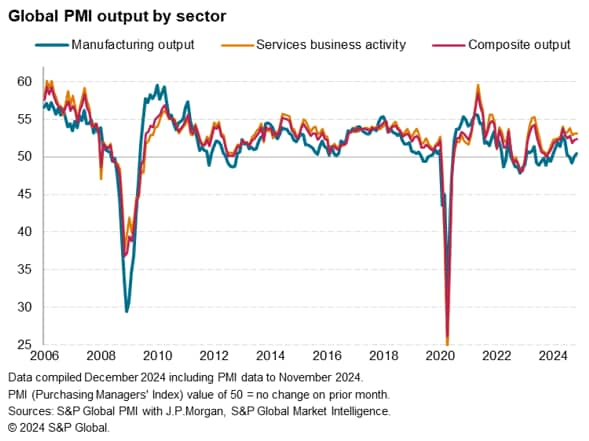

Service sector dependence

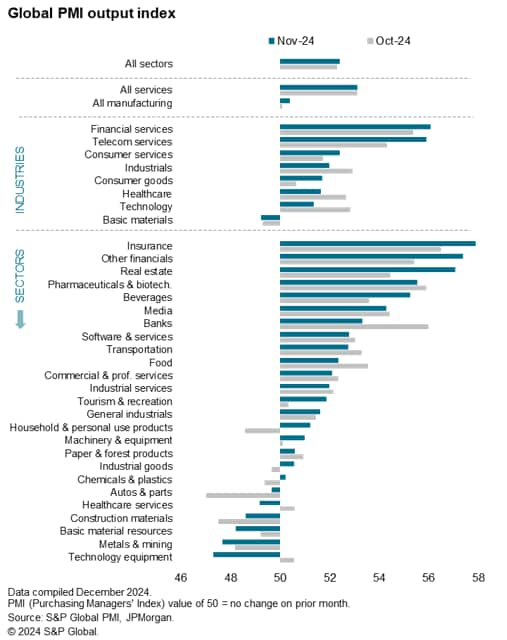

The service sector remained the main engine of growth in the global economy in November, with manufacturing mustering only a marginal rise in output.

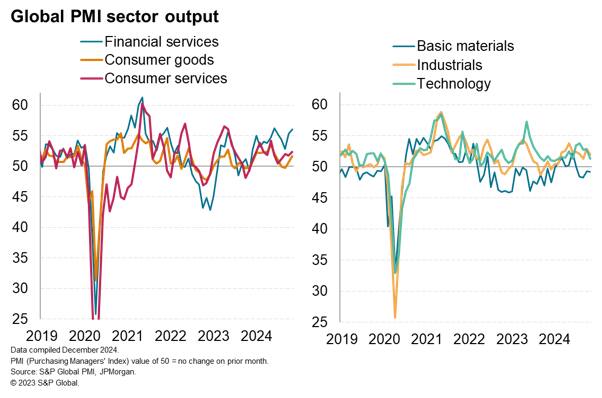

Delving deeper, any signs of impressive growth remain even more narrowly focused. By broad industry, November's expansion was led in particular by financial services, where growth was the second-highest in nearly three years, followed by the relatively small telecoms sector.

Three of the top-five sub-sectors were all financial services based, led by insurance. Real estate surged up the rankings by recording the strongest increase in activity for almost three years.

Growth meanwhile slowed for industrials, healthcare and technology, with basic materials remaining in contraction. While manufacturing is showing some signs of reviving globally, this is in part linked to the front-running of threatened tariffs, which hints at any improvement being temporary.

However, both consumer goods and consumer services were notable in reporting faster - albeit still somewhat subdued - rates of expansion, linked in part to moderating cost of living pressures and lower interest rates.

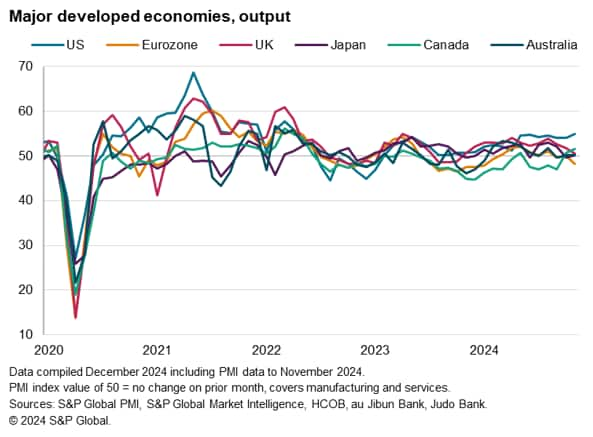

US outperforms in the developed markets

Among the major developed economies, the US recorded the strongest expansion for a seventh straight month, the rate of growth reaching the fastest since April 2022 as a surge in services activity - and notably financial services output - helped offset a further fall in manufacturing output.

Growth also revived in Canada, hitting the highest since May 2022, amid improved manufacturing and services performances, often linked to lower interest rates.

In contrast, the UK, which had seen a strong performance up to September, reported a further loss of growth momentum in November to result in the slowest expansion for 13 months. A near-stalled service sector was accompanied by a drop in factory output.

Output growth was meanwhile also largely stagnant in both Japan and Australia, as manufacturing downturns sat alongside only very modest service sector gains.

That left the eurozone reporting the worst performance, with output falling at the sharpest rate for ten months as a deepening factory downturn spread to services.

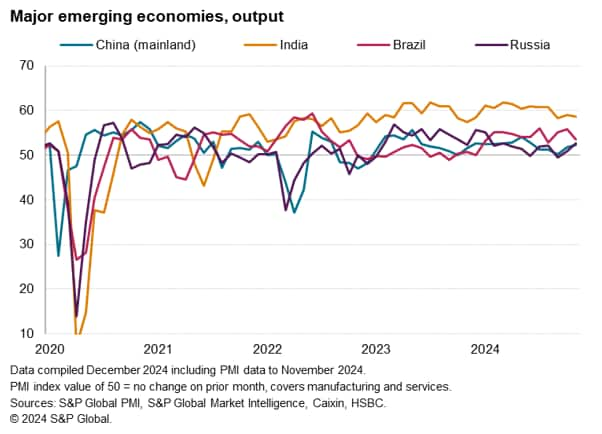

Emerging markets led once again by India

India once again led growth among the four BRIC 'emerging' economies by a wide margin, as has been the case since July 2022, albeit with slower growth reported in both manufacturing and services.

Growth also waned in Brazil, down to a three-month low, but remained robust thanks to sustained expansions across both goods and services.

Growth meanwhile continued to perk up in mainland China from the near-stalled picture seen in September. The Caixin PMI produced by S&P Global signalled the sharpest expansion for five months. However, stronger manufacturing output growth was partly offset by a slowdown in services, the latter subdued by sluggish domestic demand.

Modest but accelerating growth was reported in Russia, reaching an eight-month high, as renewed growth in manufacturing was accompanied by faster growth of service sector activity.

Measured across all emerging markets, output growth across goods and services was the highest since June.

European gloom subdues global business optimism

Looking to the year ahead, business output expectations remained more buoyant worldwide than the near-two-year low seen in September, but continued to run below the long-run average amid ongoing political uncertainty and gloomier economic prospects in many economies.

In the developed world, sentiment fell to a three-month low. The lowest confidence relative to long-run averages was recorded in the eurozone followed by the UK, the latter seeing businesses react adversely to the announcement of new tax-raising measures. Confidence also fell in Canada amid concerns over US protectionism.

US confidence meanwhile held steady on October's nine-month high, though a surge in optimism in the manufacturing sector was offset by a slight dampening of expectations in the larger services economy. That left Japan as the only major developed economy to report improved prospects.

Confidence about the year ahead across the emerging markets meanwhile hit a six-month high, buoyed in both manufacturing and services by across-the-board improvements in the four BRIC economies. Sentiment consequently rose above long-run averages in all four cases with the notable exception of mainland China, where - despite rising on the back of recent stimulus announcements - confidence remained subdued by historical standards.

Global employment stalls amid uncertainty

Global private sector employment was indicated to have stagnated in November after having fallen marginally in October. Companies often again blamed a reluctance to hire on uncertain economic and political operating environments. No employment growth has been recorded by the global PMI since July.

Only a minor rise in service sector jobs was again recorded globally, while factory jobs continued to be culled at one of the sharpest rates for over four years, albeit the rate of decline moderating in November.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-to-robust-global-growth-in-november-but-europe-falters-as-us-outperforms-Dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-to-robust-global-growth-in-november-but-europe-falters-as-us-outperforms-Dec24.html&text=PMI+surveys+point+to+robust+global+growth+in+November%2c+but+Europe+falters+as+US+outperforms+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-to-robust-global-growth-in-november-but-europe-falters-as-us-outperforms-Dec24.html","enabled":true},{"name":"email","url":"?subject=PMI surveys point to robust global growth in November, but Europe falters as US outperforms | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-to-robust-global-growth-in-november-but-europe-falters-as-us-outperforms-Dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+point+to+robust+global+growth+in+November%2c+but+Europe+falters+as+US+outperforms+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-point-to-robust-global-growth-in-november-but-europe-falters-as-us-outperforms-Dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}