Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 06, 2024

Week Ahead Economic Preview: Week of 9 December 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

ECB tops a busy week of central bank rate setting, plus US inflation

The coming week sees a clutch of central bank meetings including in Brazil, Canada, Australia, Taiwan and Switzerland, as well as in the eurozone. All bar Brazil are leaning towards looser policy, some more aggressively than others. Meanwhile inflation data for the US will help steer Fed policy at its meeting later in the month, while GDP and labour market data for the UK will likewise be eagerly assessed for Bank of England policy guidance.

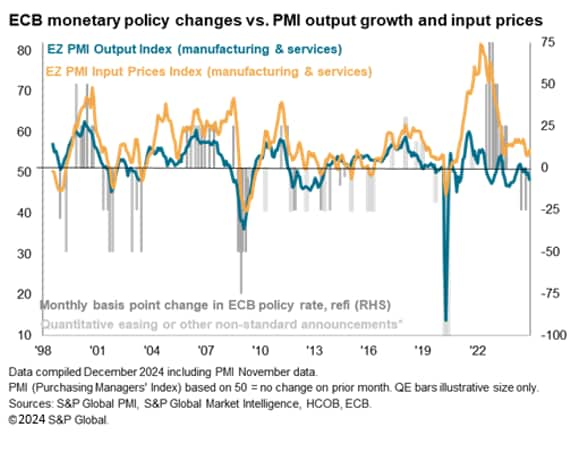

Policymakers at the European Central Bank convene for the last time in 2024 to set interest rates with a 25 basis rate cut penciled in by the markets. In fact, markets are pricing in rate cuts at each meeting through to the middle of next year as economists see the eurozone economy faltering and inflation cooling. Some therefore question whether the ECB could go for a 50 basis point cut at its December meeting, to get ahead of the curve and give the economy a boost.

Some sort of boost certainly looks needed according to the latest surveys. The eurozone PMI fell into contraction territory in November as a severe manufacturing downturn bled to the service sector. The region's construction industry is also reporting a deepening downturn in demand. The eurozone is suffering from structural issues, including poor productivity and a lack of competitiveness, as well as mounting political uncertainty, the latter exacerbated by the collapse of the French government. The threat of further disruption from US tariffs also looms large.

However, the survey data perhaps also hint at the need for caution. Some of the economic weakness seen in November was linked to flood-related disruptions in Spain, and the PMI also indicated an upturn in price pressures, with stickiness still evident in the services economy linked to wage growth. Hence our economics team sees a 25 basis point cut as the most likely outcome from the December meeting, albeit to be swiftly followed by more rate cutting in the new year should the data flow warrant more loosening.

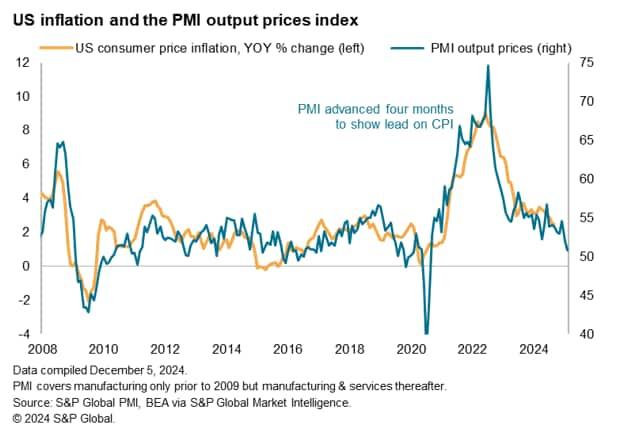

A 25 basis point cut is also priced in by markets by the FOMC on 18 December with a near 75% probability, but any surprises in the upcoming consumer price inflation data in the coming week could alter these odds. Consensus expectations point to an unchanged 0.2% monthly rise for the headline rate and the core rate to remain at 0.3%.

Key diary events

Monday 9 Dec

Japan GDP (Q3)

Australia Building Permits (Oct)

China (Mainland) CPI, PPI (Nov)

Switzerland Consumer Confidence (Nov)

Taiwan Trade (Nov)

Mexico Inflation (Nov)

United Kingdom KPMG/REC Report on Jobs (Nov)

Tuesday 10 Dec

Thailand Market Holiday

Australia NAB Business Confidence (Nov)

Australia RBA Interest Rate Decision

Malaysia Industrial Production (Oct)

Germany Inflation (Nov, final)

Turkey Industrial Production (Oct)

Italy Industrial Production (Oct)

Brazil Inflation (Nov)

Mexico Consumer Confidence (Nov)

S&P Global Investment Manager Index* (Dec)

Wednesday 11 Dec

South Korea Unemployment Rate (Nov)

South Africa Inflation (Nov)

United States Inflation (Nov)

Canada BoC Interest Rate Decision

Brazil BcB Interest Rate Decision

GEP Global Supply Chain Volatility Index* (Nov)

Thursday 12 Dec

Mexico Market Holiday

Australia Employment (Nov)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Oct)

Switzerland SNB Interest Rate Decision

Taiwan CBC Interest Rate Decision

India Industrial Production (Nov)

India Inflation (Nov)

Brazil Retail Sales (Oct)

Mexico Inflation (Nov)

Eurozone ECB Interest Rate Decision

United States PPI (Nov)

Friday 13 Dec

Australia Westpac Consumer Confidence Change

Japan Tankan Large Manufacturers Index (Q4)

China (Mainland) New Yuan Loans, M2, Loan Growth (Nov)

United Kingdom GfK Consumer Confidence (Dec)

Japan Industrial Production (Oct, final)

Germany Trade (Oct)

France Inflation (Nov, final)

Spain Inflation (Nov, final)

Eurozone Industrial Production (Oct)

United States Export and Import Prices (Nov)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Bank of Canada meeting; US CPI, PPI; Mexico and Brazil inflation

The Bank of Canada (BoC) updates their monetary policy settings in the fresh week with the consensus pointing to a further lowering of interest rates. A softening GDP growth pace in the third quarter had boosted expectations for another rate cut by the BoC, while the latest November S&P Global Canada PMI prices data showed selling price inflation remained below the long-run average, thereby providing room for the BoC to further ease rates.

Additionally, inflation data will be released in the US, Brazil and Mexico. November US CPI data will be the last set of inflation indicators due prior to the December 17-18 Federal Open Market Committee (FOMC) meeting and will be important in guiding rate cut expectations. This followed the release of the latest S&P Global US PMI which showed a further cooling of selling price inflation.

EMEA: ECB & SNB meetings; UK GDP; Germany trade

The European Central Bank (ECB) convenes with a 25-basis point cut widely expected in their final meeting of the year. This is amidst softening economic conditions in the eurozone while inflation remain subdued by historical standards according to recent HCOB Eurozone PMI data.

Key data releases in the region include UK jobs survey data and October's GDP, with more up-to-date PMI data indicating that the UK economy expanded at the slowest pace in just over a year. Meanwhile, eurozone industrial production and German trade data will be updated in the week, with PMI data alluding to further weakness of both.

APAC: RBA meeting; China inflation; Japan Tankan

The central bank meeting in Australia will unfold in the coming week while key official releases to watch in the APAC region will be mainland China's inflation data and the Bank of Japan's quarterly Tankan survey.

S&P Global Investment Manager Index and GEP Supply Chain Volatility Index

The final S&P Global Investment Manager Index of 2024 will be updated on Tuesday and watched for insights in changes to investment sentiment, sector preferences and market drivers after November's survey revealed that risk appetite improved in the immediate post-US election period.

The GEP Supply Chain Volatility Index will also be updated for November, in a month where we saw global goods demand return to expansion while lead times slightly lengthened for a sixth straight month.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-december-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-december-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+9+December+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-december-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 9 December 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-december-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+9+December+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-december-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}