Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 08, 2022

Private equity reboots its approach to technology as competition heats up

Private equity has reached a new stage of maturity in technology and data analytics. The focus of investment has moved from operations to investment teams, with a newly sharpened focused on competing for dealflow.

Our recent survey of 30 senior executives from US PE firms with at least US $2bn assets under management (AUM) reveals a new reality of increased focus on big data and analytics. The survey, conducted by Mergermarket on behalf of S&P Global Market Intelligence, paints a clear picture of how the increased velocity of the market has led many to look to technology for an edge in deal sourcing and diligence.

PE firms have embraced technology — and are ramping up for more

PE firms have used technology in investment operations for decades, and the results of that continued investment were apparent in the survey results. Respondents felt they have built a strong data foundation, with 90% agreeing that their firms have a long-term data strategy in place, and two-thirds agreeing strongly.

The industry is moving beyond the basics and dabbling in more sophisticated applications, with applications like CRMs now considered table stakes. Their focus is shifting toward investment team workflows and monetizing data analytics.

Firms have embraced analytics as a springboard for future growth: 83% of respondents report that big data and data analytics have become more important over the past two years.

Broadly, PE firms are ramping up their technical sophistication. Firms are investing in more sophisticated tools to source, validate, store, and manage data as they confront issues like data fragmentation and sprawl. For example, enterprise data management software is becoming a must-have, with 83% of respondents already reporting that they utilize some form of data management utility. More than half of respondents report that they now leverage machine learning (60%) or AI (57%) in investment processes, either through third-party products or in-house efforts.

Competition and value-creation now drive PE's digital technology use

The survey data helps explain why PE firms are turning their attention so strongly to digital technology-in short, differentiation.

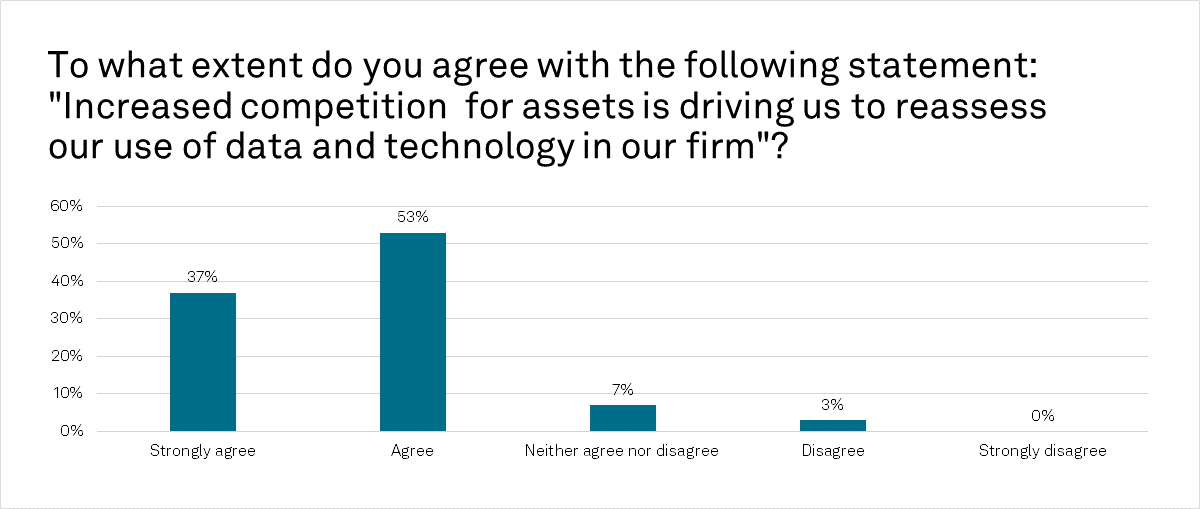

"Keeping up with competition is key. We cannot be the ones disrupted as new technologies are introduced," explains one respondent. The vast majority (90%) agree that increased competition for assets is driving their firms to reassess their use of data and technology, with just over a third in strong agreement.

Overall, firms' investment in technology is focused on generating value in the investment process, with 50% saying their top goal is identifying market trends more quickly. Only 7% identified long term cost savings as their first objective, reflecting the higher adoption already in place for efficiency-oriented business systems.

Private equity firms look increasingly set to enter the fray and explore insights from a broader range of data sources, especially when it comes to investment sourcing. Alternative data — such as social media, videos, online transactions, mobile phones, and satellite imagery — is opening a broader universe of information from which to source deals. In addition to alternative data, technology can now make sense of increasingly unstructured data sets, which were previously inaccessible. In the survey respondents claimed this capability made for more streamlined negotiations and unlocked dealmaking creativity.

Certainty matters, too. One-third of respondents say that making better decisions more quickly motivates their use of data analytics, while almost 40% say it's their second priority.

The technology and data race heats up

Although respondents report that data complexity and expanding staff skillsets present challenges for bringing data analytics more fully into the dealmaking process, a race for new analytical power is underway.

"When it comes to making investments, we have to be fast and keep up with the market trends. We cannot lag behind the competition," says one respondent.

Those PE firms who choose a steady state may lose out to faster, nimbler competitors who are scanning the market with new eyes.

Download the whitepaper to read full results.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-equity-reboots-its-approach-to-technology-as-competiti.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-equity-reboots-its-approach-to-technology-as-competiti.html&text=Private+equity+reboots+its+approach+to+technology+as+competition+heats+up+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-equity-reboots-its-approach-to-technology-as-competiti.html","enabled":true},{"name":"email","url":"?subject=Private equity reboots its approach to technology as competition heats up | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-equity-reboots-its-approach-to-technology-as-competiti.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Private+equity+reboots+its+approach+to+technology+as+competition+heats+up+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprivate-equity-reboots-its-approach-to-technology-as-competiti.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}