Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 04, 2020

Securities Finance: May 2020

$813m in May securities lending revenue

- Revenues for May decrease 14% YoY

- Government debt & ETF utilizations remain elevated

- Convertible issuance supports US equity borrow demand

- Dividend delays & cancellations depress EU revenues

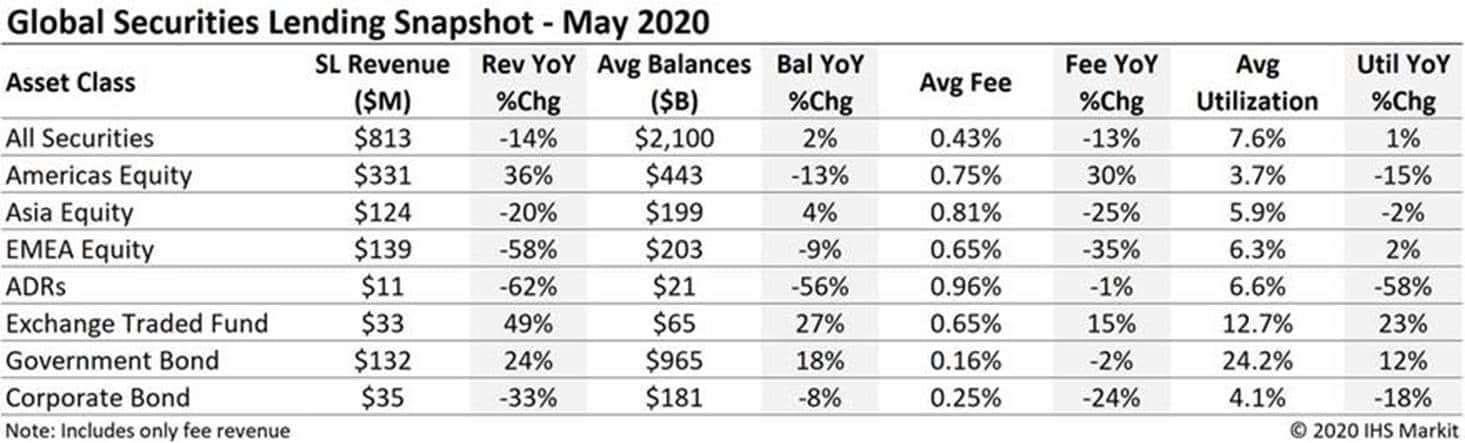

Securities lending revenues totaled $813m in May, a 14% YoY decline. With the March market shock receding into the rear-view, ETFs, Americas equities, and government bonds delivered YoY revenue increases in May as a result of varying drivers pushing on demand and spreads. In this note we'll explore some of those drivers along with some perspective on QTD and YTD returns.

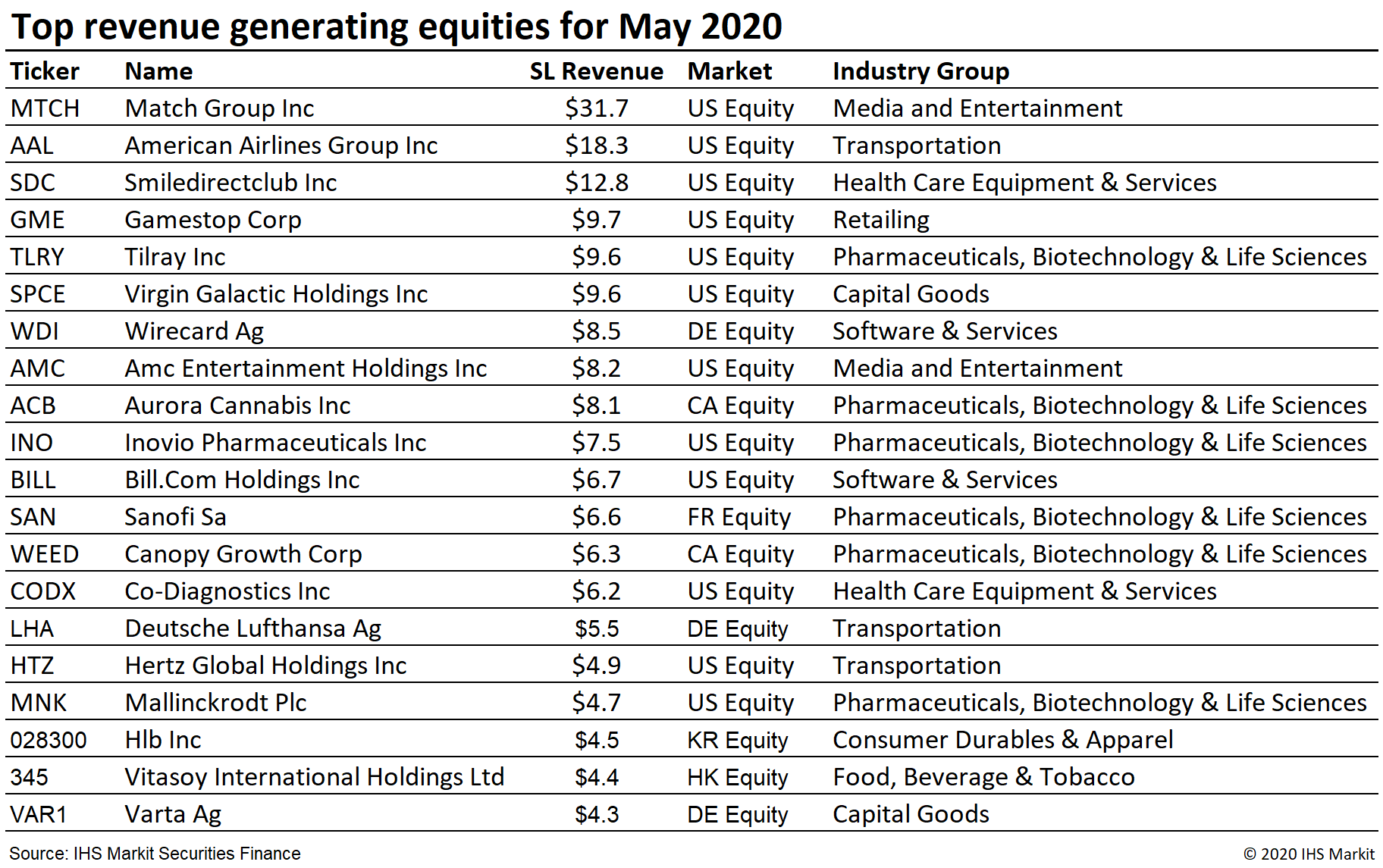

Americas equity revenues came in at $331m for May, putting the YTD total at $1.4bn, an increase of 18% YoY. May returns were the most for any month of 2020 so far, as a result of balances bouncing back while spreads widened. With $31.7m in monthly revenue Match Group continues to be the most revenue generating equity globally; May returns were supported by increasing shares on loan and share price. Surging borrow demand for American Airlines (AAL) pushed the lending fee for new loans to nearly 80% on May 11th, and generally drove the average fee higher over the course of the month, making AAL the 2nd most revenue generating equity in May.

Convertible bonds have become an increasingly popular funding source for US firms, with over $45bn raised YTD through May 29th, constituting 31% of all equity and equity related issuance per IHS Markit Capital Markets Analytics. The increase in convertible issuance is driving a corresponding increase in equity borrow demand from arbitrageurs, who short common shares as a hedge based on the proximity of the share price to the conversion price of the convertible bond. Issuers of convertible notes with conversion prices near the common share price at issuance will see a greater initial borrow demand for common shares, as the delta for the convertible's embedded call option will be higher. For example, Carnival Corporation issued $1.75bn of convertible notes on with a conversion price only 25% above the concurrently offered equity shares on March 31st; borrow demand soared following issuance as the share price increased past the conversion price. The fee for Carnival shares increased in May, making it the 15th most revenue generating US equity for the month.

Canadian equity lending revenues declined in April, largely driven by lower returns in the Cannabis sector. That trend reversed course in May with Canopy Growth fees increasing sharply over the last two weeks of the month. Aurora Cannabis is another notable firm in the sector whose fee for new loans surpassed 100% during the third week of May. Overall Canadian equity lending revenues came in at $39m for May, a 20% YoY decline. That puts the YTD total at $232m, a 2% YoY decline, with January and February being the best months of the year thus far.

Equity lending in Europe continues to lag, with $138m in May revenues reflecting a 57% YoY decline. Dividend delays and cancellations complicate the YoY comparison, however a clearer picture of total impact likely won't be known until later this year after all delays run their course. Wirecard Ag (WDI) continues to be the most revenue generating security in the region, with $8.5m in May revenue. Overall Europe equity lending revenues are down 39% YTD through the end of May.

Asia equity lending revenues remain subdued compared with prior years. May revenues of $124m reflect a 20% YoY decline. The blame for the shortfall continues to be lower fees, with balances in the region increasing by YoY in May. One bright spot was Hong Kong listed Vitasoy International Holdings Ltd, whose share price and borrow fees increase dramatically on May 15th, boosting returns sufficiently to make Vitasoy the 2nd most revenue generating Asia equity in May with $4.4m.

Global ETF revenues were $32.6m for May, a 49% YoY increase, however the elevated fees for high-yield credit ETFs are a distant memory from March and early April. In May increasing ETF loan balances mostly offset decreasing average fees, with returns relatively flat compared with April but down sharply compared with 39% March. Utilization of ETF lendable assets decreased from 15% in March to 13% in May, remaining well above 9% observed in January. Asia listed ETF lending revenues continue to increase, with $3.1m in May revenue the most for any month YTD. Some Asia focused ETFs listed in the US have also delivered increasing lending returns; Fees for the Harvest CSI 300 China A-Shares ETF (ASHR) soared, making it the most revenue generating exchange traded product with just over $3m in May revenue.

Corporate bond lending revenues continue to fall short of 2019 comparison, mostly as the result of declining fees, however balances have also declined YoY. Corporate bonds delivered $35m in May revenue, a 33% decline YoY. Central bank support for global credit may be dampening borrow demand at present, but distress hasn't been vanquished entirely and the demand to borrow credits may yet catch up to the supply, which has increased over recent years. Corporate bond lending YTD revenue totals $191m, a 29% YoY decline.

Fee-based revenue for US government bond lending came in at $83m for May, a 50% YoY increase resulting from wider spreads and larger loan balances. For beneficial owners returns from lending US sovereign debt in 2020 have been substantially bolstered by reinvestment, with the May total return including reinvestment more than doubling YoY. Returns from lending European sovereigns were $37m for May, a 6% YoY decline as the result of both lower balances and fees. Global government bond fee-based revenues are up 12% YTD through the end of May.

Conclusion:

YTD lending revenues total $3.8bn across all asset classes, reflecting a 9% decline compared with the same period in 2019. A single digit decline in fee-based returns belies the internal change, with US Treasuries, North American equities and global ETFs seeing large YoY increases in returns while corporate bonds, ex-NA equities and EU sovereign debt have generally lagged. The short sale bans put in place during the crash have not been renewed, which is supportive of global borrow demand, though it has been a challenging couple of months for managing directional short positions, bans notwithstanding. Going forward, corporate actions seem likely to be a significant driver for lending returns, with capital markets re-opened and firms seeking to optimize their structures for the new reality.

Stay tuned for monthly revenue updates from IHS Markit Securities Finance!

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2020.html&text=Securities+Finance%3a+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2020.html","enabled":true},{"name":"email","url":"?subject=Securities Finance: May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance%3a+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}