Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 07, 2019

Should auld volatility be forgot

Research Signals - December 2018

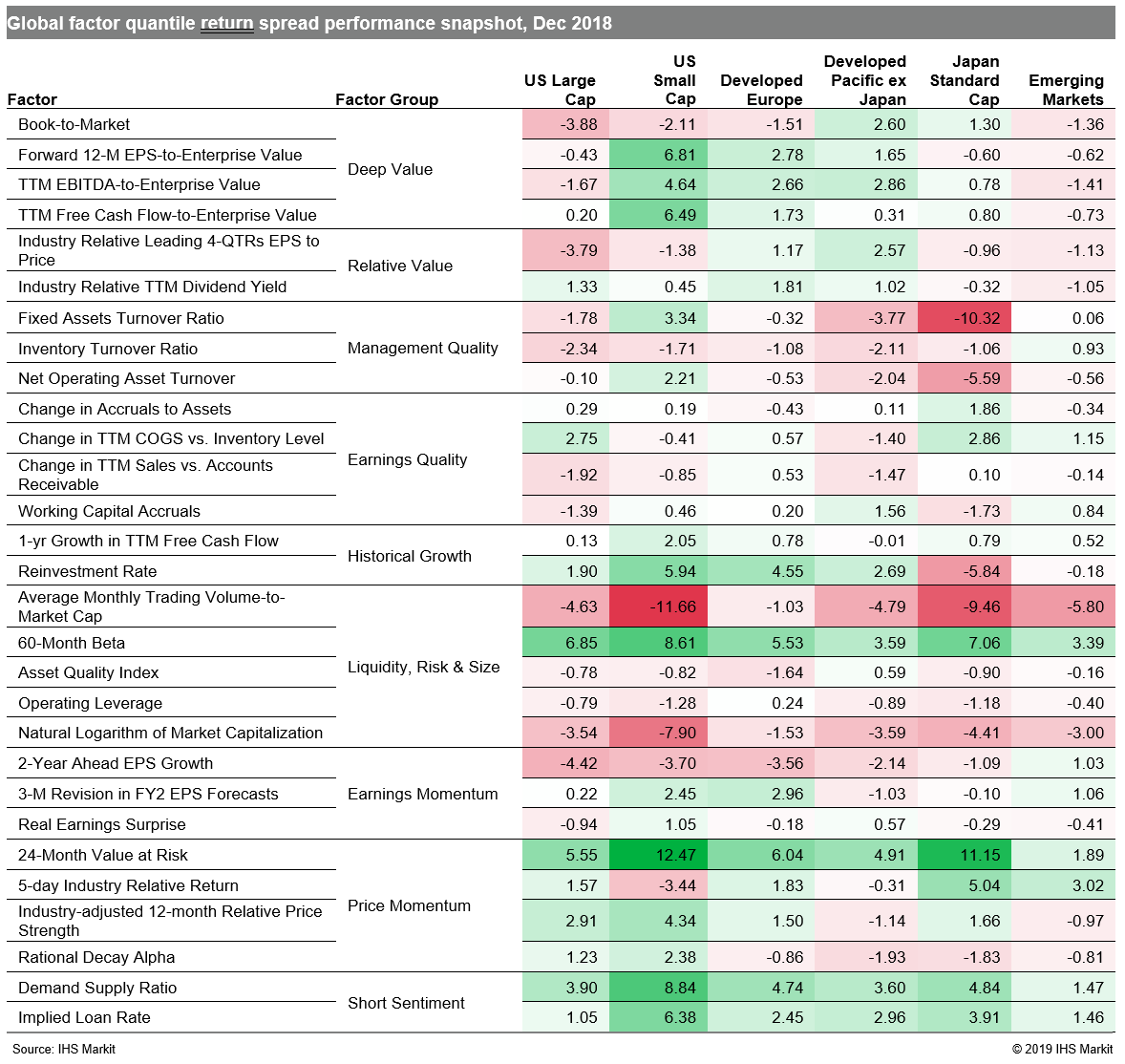

Traders rang in the New Year to the tune of "Auld Lang Syne", as they bid farewell to a rough year for stocks. Regional markets were in harmony with the risk-off trade, as trade wars and slowing economic growth gave global equity investors reason to be concerned. In turn, low beta, low value at risk and short sentiment signals were consistently positive indicators across all our coverage universes (Table 1). The economic outlook for the coming year is set by the common refrain of the J.P.Morgan Global Manufacturing PMI which fell to a 27-month low last month, as international trade flows deteriorated, rates of growth in new orders slowed and business confidence dropped to its lowest level in the series history.

- US: For large caps, 60-Month Beta posted a cumulative spread of 24.5% over the past three months

- Developed Europe: 3-M Revision in FY2 EPS Forecasts returned to its winning ways, reaching its highest spread for the year

- Developed Pacific: 24-Month Value at Risk posted strong performance, particularly in Japanese markets

- Emerging markets: Valuation swung full cycle from a positive to a negative indicator, as displayed by factors such as TTM EBITDA-to-Enterprise Value

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshould-auld-volatility-be-forgot.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshould-auld-volatility-be-forgot.html&text=Should+auld+volatility+be+forgot+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshould-auld-volatility-be-forgot.html","enabled":true},{"name":"email","url":"?subject=Should auld volatility be forgot | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshould-auld-volatility-be-forgot.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Should+auld+volatility+be+forgot+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshould-auld-volatility-be-forgot.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}