Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 01, 2024

Small shipments, big problems for supply chains

Learn more about our data and insights

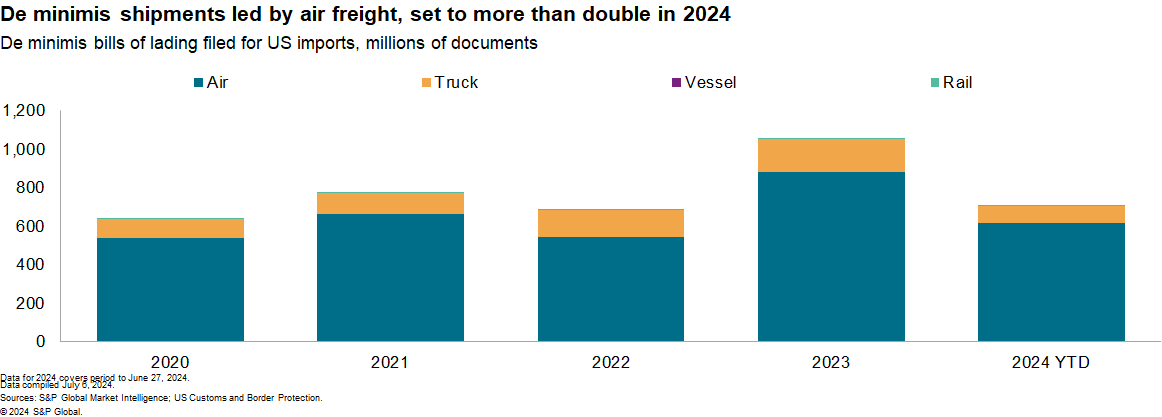

US customs authorities are tightening up the application of de minimis shipping rules, which allow shipments under $800 per buyer per day to import tariff-free. The US Customs and Border Protection (CBP) agency suspended some brokers' licenses for not following guidelines. The suspensions are likely linked to new rules implemented in February 2024, which require the filing of de minimis bills of lading in advance of delivery, rather than up to 15 days after delivery previously.

While originally designed to make the shipment of personal parcels easier, the use of de minimis shipping has surged. This growth in shipments has contributed to airfreight congestion and increased the share of US imports of apparel traveling by air to 17.9% in the three months to May 31, 2024, versus 14.5% in the same period of 2022.

Strategies to address the accelerating use of de minimis rules are not just confined to the US. The European Union is reported to be planning to remove de minimis shipment rules in response to concerns about the safety of lower quality products.

Logistics network responses to de minimis limits

The rapid expansion of the use of de minimis shipments is causing shifts in logistics network construction. The surge in e-commerce has led to increased backlogs of air-freight handling by customs authorities, according to media reports. The handling of additional inspection volumes brings further pressures on the CBP handling of freight, which may arise from the Biden administration's new immigration measures.

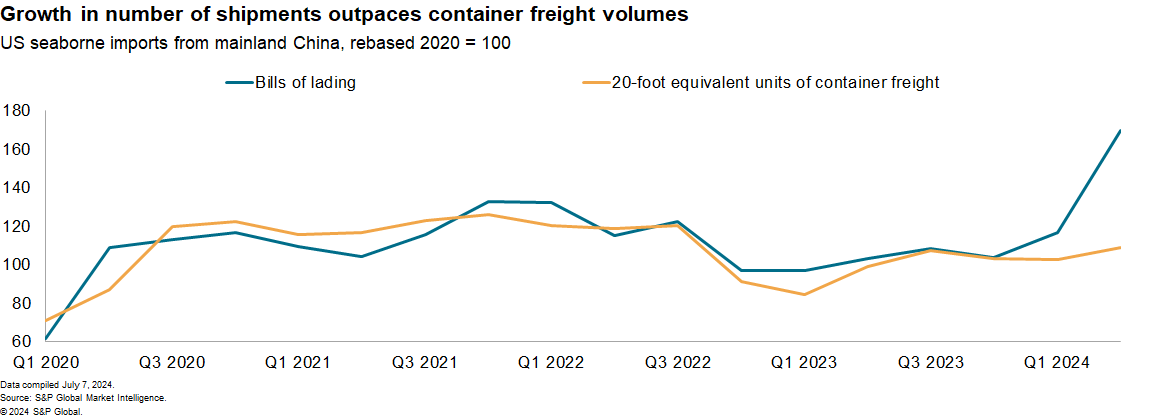

The elevated cost of airfreight shipments, increased volumes, and potential reduction in consumer demand for timeliness may be driving an increase in the use of sea freight for de minimis shipments. The volume of bills of lading booked on US seaborne imports from mainland China jumped by 64.4% year over year in the second quarter of 2024, our data shows. The volume of containers shipped rose by just 10.3% over the same period.

Another major strategic route to dealing with logistics network disruptions is to reshore sourcing closer to the relevant target market. Sourcing in Mexico, for example, would gain the benefits of geographically short supply lines and tariff-free treatment in the US-Mexico Canada Agreement free trade area.

Thus far, Mexico has been a minor supplier of apparel to the US, accounting for just 3.7% of imports in the first five months of 2024, while mainland China accounted for 18.9% and Vietnam 17.7%. Exports have nonetheless been growing, with Mexican exports of apparel to the US having risen by 10.7% year over year in the three months to May 31, 2024, versus a year earlier, our data shows.

As the global logistics landscape continues to evolve, companies must adapt to new regulations and shifting market dynamics to maintain their competitive edge.

Sign up for our Supply Chain Essentials newsletter

Gain more insight from our weekly podcast

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsmall-shipments-big-problems-for-supply-chains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsmall-shipments-big-problems-for-supply-chains.html&text=Small+shipments%2c+big+problems+for+supply+chains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsmall-shipments-big-problems-for-supply-chains.html","enabled":true},{"name":"email","url":"?subject=Small shipments, big problems for supply chains | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsmall-shipments-big-problems-for-supply-chains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Small+shipments%2c+big+problems+for+supply+chains+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsmall-shipments-big-problems-for-supply-chains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}