Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

SPECIAL REPORTS

Nov 05, 2020

So, how did the Big Bang go?

We just witnessed and survived the Big Bang, and everything looks okay, right?

Between Friday 17 October 2020 and Monday 20 October 2020, USD cleared derivatives switched Price Alignment Interest (PAI) from Fed Funds to SOFR.

Many were concerned about value transfer and price dislocation on the back of the auction mechanism implemented by the clearing houses. We talked about this in detail here. So how did this go? Well… better than expected overall.

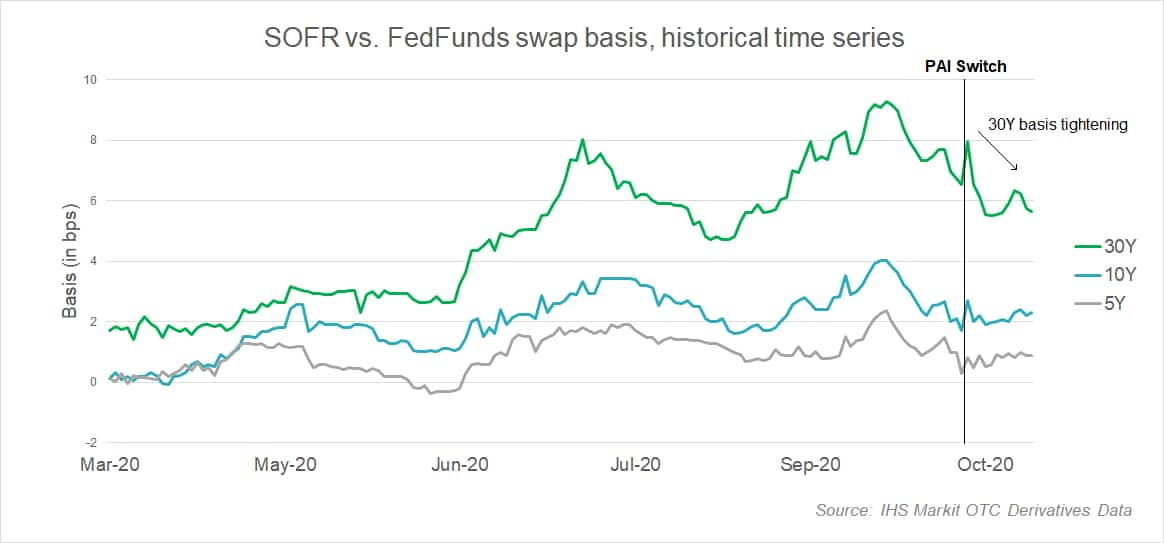

As shown on the chart below, the 30Y basis swap levels between FedFunds and SOFR continued to tighten much further than the 5Y and 10Y tenors after the PAI switch. A combination of good liquidity at the auction and better than expected two-way flows helped dampen fears of market dislocation. It is however expected that the 30Y basis will remain somewhat elevated, as firms continue to exit unwanted long dated basis risks in the coming weeks.

Liquidity in SOFR-linked derivatives was much higher in the days leading to the PAI switch and on the back of the auction with record levels of SOFR swap volumes reported. In the two weeks post PAI switch, those volumes have somewhat decreased but are still higher than what we were seeing late summer. We expect those volumes will gradually increase as firms become comfortable trading SOFR and especially early 2021 when more FRNs, loans and cash instruments will be issued on the new RFR.

So, what should firms do now? Quite a lot frankly! We will cover the points below on our blog in the coming months. Stay tuned!

- Standardization of fallback rates, contract renegotiation and ISDA protocols

- Developing liquidity on more complex derivatives, fair value, and modelling considerations

- The emergence of term rates and credit spread adjustment benchmarks

- Transitioning loans and other tough legacy contracts

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fso-how-did-the-big-bang-go.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fso-how-did-the-big-bang-go.html&text=So%2c+how+did+the+Big+Bang+go%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fso-how-did-the-big-bang-go.html","enabled":true},{"name":"email","url":"?subject=So, how did the Big Bang go? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fso-how-did-the-big-bang-go.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=So%2c+how+did+the+Big+Bang+go%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fso-how-did-the-big-bang-go.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}