Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 04, 2020

Daily Global Market Summary - November 4, 2020

US and European equity markets closed sharply higher, while APAC markets closed mixed. US tech equities and US government bonds had a profoundly positive reaction during last night's US election results, with both also closing significantly higher on the day alongside iTraxx/CDX credit indices and oil. The US dollar closed flat on the day after being higher overnight and gold/silver were both lower on the day. The markets will continue to focus on the US presidential election outcome and COVID-19 in addition to tomorrow's FOMC meeting statement and US initial claims for unemployment insurance report, and Friday's US non-farm payroll report.

Americas

- Joe Biden won Michigan and Wisconsin Wednesday, putting him on the brink of taking the White House from President Donald Trump, hours after the president's team opened legal fights to stop vote counting in at least two states. Both CNN and NBC projected Biden would win Michigan, which Trump took in 2016, giving him 264 Electoral College votes out of the 270 needed to win the presidency. Trump has 214. Biden needs only to win an additional outstanding state, such as Nevada where he is leading, or Georgia, where his campaign believes absentee votes will push him over the top. (Bloomberg - updated at 5:34pm EST)

- US equity markets closed higher, with tech overperforming and small caps underperforming; Nasdaq +3.9%, S&P 500 +2.2%, DJIA +1.3%, and Russell 2000 +0.1%. The Russell 2000 is +7.1% quarter-to-date versus Nasdaq +3.8% and S&P 500 +2.4%.

- 10yr US govt bonds closed -13bps/0.77% yield and -15bps/1.54% yield, rallying sharply after the results of the US Senate election indicated that the Democrats fell short of winning enough new seats to form a majority - greatly decreasing the likelihood of passing the larger of the two stimulus spending programs being debated in Congress between the Democrats and Republicans.

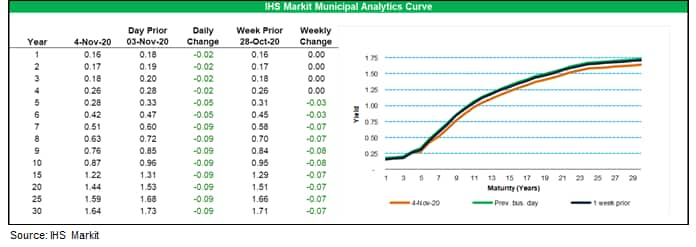

- Municipal bonds rallied alongside today's significant US

government bond post-election rally, as tax exempt yields were

lower across the entire AAA IHS Markit Municipal Analytics Curve;

7-year and longer maturities closed 9bps lower on the day.

- CDX-NAIG closed -3bps/57bps and CDX-NAHY -18bps/383bps.

- DXY US dollar index closed flat/93.54 after being as high as 94.30 at 9:47pm EST last night as US election results were being reported.

- Gold closed -0.7%/$1,896 per ounce and silver -1.8%/$23.89 per ounce.

- Crude oil closed +4.0%/$39.15 per barrel.

- Baker Hughes has acquired Compact Carbon Capture (3C), a pioneering technology development company specializing in carbon capture solutions. The acquisition signals that Baker Hughes, split out from GE Oil & Gas as an oil and gas service company, sees growth in the energy transition by providing decarbonization solutions for carbon-intensive industries, including oil and gas and broader industrial operations. According to the company, 3C's technology differs from traditional carbon capture solvent-based solutions by using rotating beds instead of static columns, effectively distributing solvents in a compact and modularized format. The rotating bed technology enhances the carbon capture process resulting in up to 75% smaller footprint and lower capital expenditures. In addition, 3C's modular and scalable configuration can be easily deployed into existing brownfield applications and can be optimized for a broad range of capacity and applications, including offshore and industrial emitters. 3C is headquartered at Marineholmen in Bergen,Norway. The 3C technology is invented in a collaboration with Fjell Technology Group, Equinor, CMR Prototech and SINTEF Tel-Tek. The development project was initiated by Equinor back in 2007, but the first patent for the technology was granted already in 1999. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- In a press release, Penn Virginia Corporation announced the signing of an agreement to sell its 59.3% outstanding shares to Juniper Capital Advisors, LP for an enterprise value of $367.8 million. The transaction is expected to close in the first quarter of 2021.Under the deal, Juniper will make a $188.4 million investment in Penn Virginia which includes: a cash investment of $150 million at $8.75 per share, and a contribution of complementary oil and gas assets for 4.96 million equity interest in a Penn Virginia subsidiary (in an up-C structure) valued at $38.4 million based on Penn Virginia's closing price on 2 November 2020. The offer price is an 13% premium to the 2 November closing price of Penn Virginia. Moreover, Juniper is restricted to sell any of its equity securities in Penn Virginia for six months following the closing of the transaction. The enterprise value includes 59.3% of Penn Virginia's 30 June 2020 working capital surplus, long-term debt and liabilities. On closing, Juniper will own approximately 59.3% of the equity. Penn Virginia holds 86,500 net acres in Gonzales, Fayette, Lavaca and DeWitt counties. Penn Virginia's net proved reserves for 59.3% were 78.9 MMboe (89% oil and NGLs; 42% developed) at year-end 2019 and the net production for 59.3% averaged 14,533 boe/d (83% oil and NGLs) during the second quarter of 2020. Juniper said the acquisition will deliver superior long-term value to its shareholders. Penn Virginia Corporation is an independent oil and gas company engaged in the development and production of oil, NGLs, and natural gas, with operations in the Eagle Ford shale in south Texas. The company is based in Houston, Texas. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 56.9 in October, up from 54.6 in September and higher than the earlier released 'flash' estimate of 56.0. The improvement indicated that the rate of growth regained momentum at the start of the fourth quarter to the sharpest since April 2015. Greater output was often attributed to stronger demand conditions and a further uptick in new business. October data indicated a steep upturn in new business at service providers, with the rate of expansion accelerating for the second month running. Some companies noted that looser coronavirus restrictions had encouraged sales. The pace of growth was the most marked since February 2019. That said, new export orders rose at a softer pace in October, as reimposed lockdown measures in key external markets dampened demand. (IHS Markit Economist Chris Williamson)

- We look forward to this week's FOMC meeting as investors,

policymakers, and indeed the world anticipate the outcome of this

week's elections in the United States. The FOMC will keep the

target for the federal funds rate at its current setting of a range

of 0% to ¼%. (IHS Markit Economists Ken Matheny and Chris Varvares)

- The committee will affirm the outcome-based forward guidance adopted in September that signaled no rate hike is likely for several years.

- With the pandemic spiraling higher and no new fiscal stimulus apparently imminent, the FOMC will continue to ponder what additional steps it might consider if the recovery falters. There have been increasingly strident calls from Fed leadership for additional fiscal support. We might have to wait until late January to see legislation enacted, depending on the outcome of US elections.

- The FOMC will discuss the Fed's balance sheet and its involvement in markets for Treasury securities. In recent months, they have hesitated to provide guidance about the outlook for the balance sheet beyond the near term, even as they have distributed forward guidance regarding interest-rate policy.

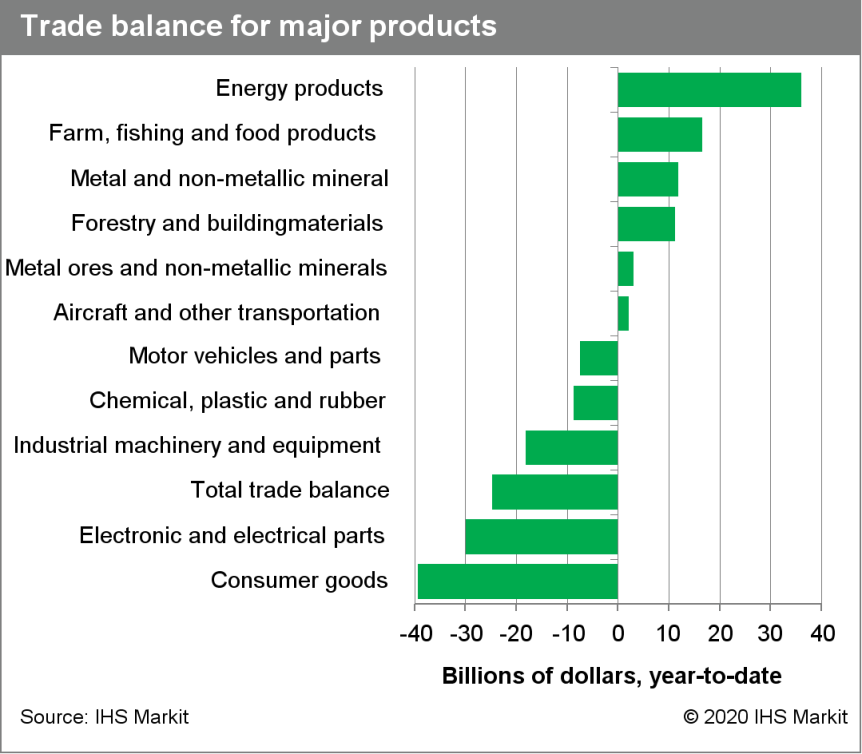

- The US nominal trade deficit narrowed in September by $3.2

billion to $63.9 billion, as a 2.6% increase in exports outpaced a

0.5% increase in imports. Both of these figures were close to our

expectations, but the narrowing of the deficit was a bit less than

we had assumed. (IHS Markit Economist Kathleen Navin)

- Both exports and imports continued to recover, with imports having shown considerably more progress than exports.

- Both exports and imports reached a pandemic-driven trough in May, when exports were down 32.4% from February and imports were down 19.1% from February.

- Since May, exports have reversed 51% of their decline, while imports have reversed 86% of their decline.

- The relatively strong comeback for imports reflects what has been a fairly robust recovery in domestic demand, a portion of which is imported goods and services.

- The relatively soft comeback for exports is a reflection of lagging foreign demand, as recovery overseas has been more tepid than that in the US. As of the third quarter, real US GDP was down 3.5% from the fourth quarter of last year, while our estimate of trade-weighted foreign GDP was down 6.0% from the fourth quarter of last year.

- We look for continued recovery for exports and imports in coming quarters.

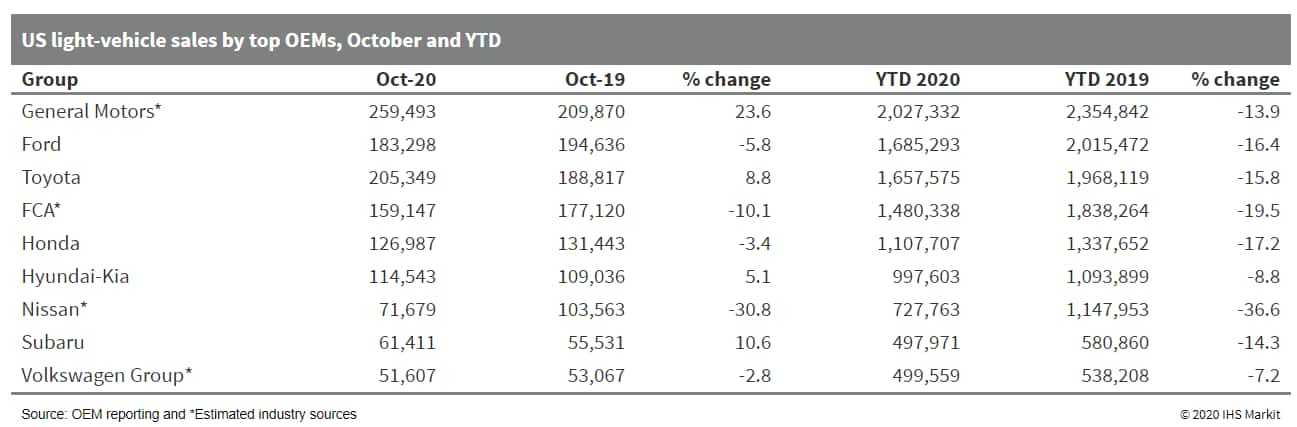

- In October, US light-vehicle sales continued to improve but

remained well below the year-earlier level. In October, sale were

estimated to be up 1.1% y/y, following a significant rebound in the

third quarter. However, YTD sales are down an estimated 16.8% y/y.

The seasonally adjusted annual rate (SAAR) of US light-vehicle

sales is estimated at 16.2-16.5 million units in October, at the

time of writing. The pace of light-vehicle sales continues to

improve from the April 2020 low SAAR reading of 8.7 million units.

While we do not expect the monthly SAAR to diverge substantially

from the average pace of the past three months (an average of

approximately 16.0 million units), we anticipate that the upcoming

monthly volume results in November and December will reflect some

y/y volatility. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Tenneco has reported on its financial performance in the third

quarter, including revenue of USD4.27 billion, down 1.5% year on

year (y/y), and an increase in EBIT. (IHS Markit AutoIntelligence's

Stephanie Brinley)

- Tenneco suffered a 42% y/y decline in revenue in the second quarter on reduced production globally, and the relative improvement in revenue performance in the third quarter reflects the resumption of production.

- In the year to date (YTD), Tenneco's revenue has dropped to USD10.73 billion, down from USD13.31 billion a year earlier.

- The supplier reported a net loss of USD499 million in the third quarter (including a non-cash tax valuation allowance charge of USD523 million), compared with net income of USD70 million in the third quarter of 2019.

- The company's adjusted net income was USD27 million in the third quarter, compared with USD99 million in income a year earlier.

- Tenneco posted EBIT (earnings before interest, taxation, and non-controlling interests) of USD236 million in the third quarter, up from USD148 million a year earlier.

- Tenneco reported adjusted EBIT of USD388 million in the third quarter, compared with USD387 million during the third quarter of 2019. Tenneco also stated that, in the third quarter, it generated cash of USD486 million from operations and paid down a revolving credit facility to reduce debt to USD5.8 billion.

- Tenneco's previously announced cost-reduction program, Accelerate, had been expected to deliver annual run-rate cost savings of USD200 million, working capital improvements of USD250 million, and capital expenditure improvements of USD100 million after two years, compared with 2019. When reporting its third-quarter results, Tenneco said the Accelerate+ program was delivering structural cost reductions as planned.

- Tenneco expects to deliver USD265 million in annual run-rate savings by the end of 2021 and USD250 million in working capital improvements. The company says it is on target to achieve USD165 million of run-rate savings from the program by the end of 2020.

- Tenneco had been expected to split its businesses in mid-2020 (see United States: 15 February 2019: Tenneco aftermarket and ride performance spin-off to be called DRiV), but the move has not been executed.

- In October, Tenneco abandoned a planned Michigan office move. Tenneco cut salaries by at least 25% in the second quarter; in the third quarter, salary costs were reduced by 10% through salary reductions or unpaid furloughs.

- US electric vehicle (EV) startup Lordstown Motors has completed a merger with special purpose acquisition (SPA) company DiamondPeak Holdings. The combined company will be called Lordstown Motors Corporation and its shares will be traded on the NASDAQ stock exchange under the ticker 'RIDE'. According to a company statement, the merger deal is valued at USD1.6 billion and it will provide Lordstown Motors with USD675 million of gross proceeds. The funds will be used for the production of the Endurance pick-up truck and its in-wheel electric hub motor. The merger deal includes USD500 million private investment in public equity (PIPE) from General Motors (USD75 million) as well as institutional investors. The merged company's board of directors will include Steve Burns, founder and CEO of Lordstown, and David Hamamoto, chairman and CEO of DiamondPeak. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Canadian merchandise trade deficit widened by $0.1 billion

to $3.3 billion in September, as imports and exports both increased

1.5% month on month (m/m). Data revisions focused on imports raised

the August deficit from $2.4 billion to $3.2 billion. (IHS Markit

Economist Patrick Newport)

- Nominal exports were 5.8% ($2.8 billion) below February's pre-pandemic level in September, while nominal imports were 2.4% ($1.2 billion) below February's level.

- Canada's trade surplus with the United States narrowed by $0.9 billion to $2.0 billion. The trade deficit with the rest of the world narrowed by $0.8 billion to $5.3 billion.

- Nominal imports in September increased $0.7 billion to $48.8 billion, $1.2 billion below February's pre-pandemic level. Imports of energy products rose $0.5 billion in September to $2.1 billion, accounting for the lion's share of the imports increase. The increase was volume driven, as Canadian refineries stepped up purchases of Louisiana crude oil.

- Nominal exports in September were $2.8 billion lower than in February, in part because low energy prices have reduced the value of energy products, which were down $2.0 billion from February. Exports of lumber products marked a 14-year high of $1.6 billion, skyrocketing 58.1% above February's levels; this increase may be related to a surge in housing starts in the United States. Farm, fishing and intermediate food products (up 14% from February) and metal ores and non-metallic minerals (up 16%) have also made strong advances recently. Motor vehicle and parts, up 4% from February, have also rebounded smartly.

- Exports to countries other than the United States surged 10.9%

m/m in September, bouncing back from an 8.1% m/m plunge in August,

to $12.3 billion, surpassing February's pre-pandemic level, driven

by increases in gold and aircraft to the United Kingdom, aircraft

and nickel to Norway, and copper to Germany. The trade deficit with

countries other than the United States narrowed by $0.8 to $5.3

billion. The trade surplus with the United States narrowed by $0.9

billion, as exports fell and imports rose.

- The Paraná state government has launched its sustainable mobility project with 10 units of the Renault ZOE electric vehicle (EV), according to company sources. The VEM PR mobility project will make 10 EVs available to public servants in Paraná, along with the installation of 10 charging stations in Curitiba (Paraná). The vehicles have been loaned by the Brazilian Agency for Industrial Development (ABDI) for use by public servants. The State Department of Health will initially be in charge of the cars. Ricardo Gondo, president at Renault Brazil, said, "Taking part in a carsharing project in the state of Paraná, which is home to the corporate headquarters of Renault Brazil, is a source of great pride for us. We do not want to simply sell EVs - our goal is to become a reference in sustainable mobility projects in the domestic market." The vehicles can be reserved and tracked via the MoVe app and can be unlocked using employee ID cards. Efforts to grow the EV business in Argentina and Brazil reflect worldwide interest in increasing the sales of these types of vehicles, although it is expected that EV infrastructure will grow relatively slowly in these two countries. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed higher again; Switzerland +2.8%, France +2.4%, Germany/Italy +2.0%, UK +1.7%, and Spain +0.5%.

- Most 10yr European govt bonds closed higher; UK -7bps, France/Spain/Germany -2bps, and Italy flat.

- iTraxx-Europe closed -3bps/58bps and iTraxx-Xover -10bps/339bps.

- Brent crude closed +3.8%/$41.23 per barrel.

- The BMW Group has posted strong third-quarter financial results, with a 17.4% y/y increase in net profit during the period to EUR1.815 billion, according to a company press statement. This improvement was fueled by a strong return of demand in key markets, especially China, as well as strong sport utility vehicle (SUV) sales and strict cost management in a difficult operating environment. This improved net profit was actually generated on the back of a slightly diminished revenue figure of EUR26.283 billion, which was down 1.4% y/y. However, the company's sales during the period increased by 8.6% y/y to 672,592 units, which indicates that model mix and exchange rates affected the revenue figure. The third-quarter sales volume figure was actually a new record for the period for the Group. The strong financial momentum in the third quarter was helped by a good result from the BMW Brilliance Automotive Ltd joint venture (JV) in China. The Group's earnings before tax (EBT) increased by 9.6% y/y to EUR2.464 billion during the period, while return on sales increased to 9.4%, up from 8.4%. Following an extremely difficult first half of the year for the entire global industry, both in terms of sales and profitability, as the impact of the COVID-19 virus pandemic closed dealerships and factories all over the world, BMW looks to have embarked on a very strong recovery path in the third quarter. Its double-digit improvement in net profit in the third quarter is, as BMW's management has commented, testament to strict cost control and management and a desirable product portfolio. (IHS Markit AutoIntelligence's Tim Urquhart)

- Brenntag, the market leader in chemical and ingredients

distribution, has reported a resilient third-quarter performance

and says the impact from the COVID-19 pandemic on its business is

"still limited."

- Net profit was down in the third quarter to €120.6 million ($141.1 million) from a prior-year figure of €128.4 million on sales of €2.88 billion, down 7.7% year on year (YOY) on a constant currency basis. The company achieved YOY growth in operating EBITDA, up 4.9% to €264.4 million.

- The EMEA, APAC, and Latin America regions "showed a particularly good development," but conditions in North America were tougher, Brenntag says. Group operating gross profit slipped 0.2% YOY to €690.6 million.

- Third-quarter operating gross profit in EMEA was €294.8 million, up 4.8% YOY. The company says that despite restrictions due to COVID-19, its business in the region achieved operating EBITDA growth of 11.3% YOY, to €112.9 million.

- The business environment in North America remained "challenging with the oil and gas industry particularly weak," Brenntag says. Operating gross profit generated by Brenntag in North America was down 9.3% YOY to €273.9 million and operating EBITDA was €110.0 million, down 11.7%.

- Brenntag reports robust third-quarter results for its business in Latin America on slowly recovering volumes, good margin management, and cost control. Regional operating gross profit of €44.5 million was up 15.7% YOY and operating EBITDA jumped 39.8% YOY to €15.1 million.

- The company says its results in APAC reflect the recovery in the regional economy in the third quarter after strict lockdown for several months due to the pandemic. At €72.5 million, operating gross profit in the region was 12.0% above the prior-year level of €68.1 million. Third-quarter operating EBITDA leapt 35.9% YOY to €33.0 million.

- Brenntag has confirmed its full-year outlook, which it reinstated in September after suspending guidance in April. The company expects 2020 operating EBITDA of €1.000-1.040 billion, compared with €1.001 billion in 2019. The forecast assumes "no further significant government measures to contain the pandemic and related negative effects on the economy," the company says. It also does not envisage any special items or significant changes in current exchange rates by the end of the year. The forecast includes contributions to earnings from acquisitions.

- The company announced details recently of its transformation program, which includes job cuts and site closures.

- Plastic Omnium has announced that it has established a new fuel-cell joint venture (JV) with ElringKlinger. Under the deal to create EKPO Fuel Cell Technologies, ElringKlinger will contribute its existing fuel-cell business and knowhow, while Plastic Omnium will invest EUR100 million (USD117 million) and bring additional development capacity to accelerate growth. ElringKlinger will hold 60% of the new company, while Plastic Omnium will hold the remaining 40%. At the same time, Plastic Omnium will also acquire ElringKlinger's Austrian subsidiary, ElringKlinger Fuelcell Systems Austria GmbH (EKAT), which specialises in integrated hydrogen systems, for an enterprise value of EUR15 million. Both agreements are expected to be completed by the end of the first quarter of 2021 following approval from the relevant authorities. These agreements will help accelerate Plastic Omnium's strategy of expanding its presence in the hydrogen fuel-cell space. ElringKlinger has been making progress in this area for the past 20 years, and among the assets that it will contribute are its fuel-cell components business, 150 patents and existing research and development (R&D), several high-power-density fuel-cell stack platforms, 150 employees, as well as a facility located in Baden-Württemberg (Germany), where the JV will also be headquartered. (IHS Markit AutoIntelligence's Ian Fletcher)

- Offshore drilling contractor Transocean reported a net income of USD359 million for the third quarter of 2020, compared to a net loss of USD497 million in the second quarter of 2021. The company's third quarter 2020 results included net favorable items of USD428 million, including a USD449 million on restructuring and retirement of debt and USD45 million related to discrete tax items. These favorable items were partially offset by a USD61 million loss on disposal of assets and USD5 million in restructuring costs. After consideration of these net favorable items, Transocean's third quarter 2020 adjusted net loss was USD69 million. Transocean's total contract drilling revenues for the quarter were USD773 million, compared with USD930 million for the second quarter of the year. Contract drilling revenues decreased primarily due to USD177 million of revenues recognized in the second quarter 2020 as a result of a legal settlement agreement with a customer for performance disputes, partially offset by higher revenues from increased utilization and an additional operating day. Transocean President and CEO Jeremy Thigpen stated that the company was increasingly encouraged by contracting activity that could unfold in the second half of 2021. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

- In the first four months of 2020 sales of frozen food products in Italy rose by 13.5%, with frozen savory snacks growing by 21.5% and frozen fish by 16.5%, the Italian Frozen Food Institute (IIAS) estimates. Frozen vegetables remain the most purchased product in the category with a 45% market share, followed by frozen fish (17-18%). The categories that grew the most were: frozen seafood (+16.5%), savory snacks (+21.5 %), pizzas (+12.5%) and potatoes (+12%). IIAS president Vittorio Gagliardi explained that the lockdown, including the prohibition on farmer markets and measures aiming to reduce supermarket trips, has boosted demand for long-life food and in particular for frozen products which are perceived as being the closest alternative to fresh. Door-to-door sales, which are widely popular in Italy, rose by 40% during the analyzed period as supermarkets home deliveries is not an established practice in medium and small-size towns. At the same time, sales of frozen products in the foodservice fell sharply with losses estimated at EUR600 million (USD701 million) for full-year 2020. Gagliardi recalled that recent studies published by government's agencies suggest that frozen products' nutrients are at the same level and in some cases higher than those of the fresh product. He pointed out that preservatives cannot be used in frozen products, with the exception of pre-fried ones. Those factors have certainly helped in boosting sales for the category, as consumers are increasingly looking for high-vitamin content products. He said that current market trends suggest a substitution of animal protein with vegetable proteins for a wide range of products as more consumers adopt vegan or vegetarian diets and are keener to consume vegetable and fruit-based products because they are perceived as healthy. In 2019, Italians purchased almost 850,000 tons of frozen food, with a 1.5% increase in sales for retail and 1.1% for foodservice. Per capita consumption hit a record high of 14 kilograms per person. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Tesla is planning to expand its deployment of full self-driving technology to its electric vehicles in Canada and Norway, reports industry news website Electrek. The Electrek report cites a Twitter post from Tesla CEO Elon Musk naming the two countries as being next for deployment of the technology. However, reportedly, the deployment will not occur until the system is out of the "early beta" stage for selected US customers, which is expected to happen as soon as December. Tesla says its full self-driving system has the ability to set a destination and navigate the car autonomously to the destination, although the automaker warns that the driver must monitor and always be ready to take the wheel. Norway is a significant market for Tesla and electric vehicles, as they have received heavy incentives. Tesla's rolling out of the technology to other countries as well as the United States reflects its method of gathering data from its vehicles on the road, and being less reliant on high-definition maps or lidar. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Passenger car registrations in Finland fell again during October. According to the latest data published by the country's Automotive Information Centre (Autoalan Tiedotuskeskus: AuT), registrations during the month dropped by 20% year on year (y/y) to 7,499 units. Registrations for the year to date (YTD) are now down 16.9% y/y at 80,903 units. The light commercial vehicle (LCV) market gained by 8.0 y/y to 1,214 units in October, while in the YTD it is now down 16.9% y/y at 10,430 units. Registrations in the medium and heavy commercial vehicle (MHCV) category slipped by 8.9% y/y to 337 units last month, and its YTD registrations are now down 19.5% y/y at 2,820 units. The COVID-19 virus pandemic has been a drag on the Finnish market so far in 2020, as it has in other parts of Europe, and this continued in October. The trade association said that the fall suffered by the passenger car market last month was partly down to a rapid reduction in order books after the number fell at the height of the health crisis. Looking forward, the government is pushing ahead with its plans for a scrappage incentive that emerged last month and which are intended to stimulate demand for new vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.7%, India +0.9%, South Korea +0.6%, Mainland China +0.2%, Australia -0.1%, and Hong Kong -0.2%.

- Mitsubishi Chemical Holdings reports a net loss of ¥49.68

billion ($474.7 million) for the company's fiscal first half ended

30 September, swinging from net income of ¥81.3 billion a year

earlier.

- Mitsubishi registered a third-quarter operating loss of ¥28.1 billion, compared with an operating profit of ¥130.5 billion a year earlier.

- Revenue decreased 17.6% year on year (YOY) to ¥1.5 trillion.

- The company says that during the first half of the fiscal year, demand was slower YOY, particularly for automotive applications, owing to the impact of the COVID-19 pandemic. Notwithstanding a recent pickup in demand, business conditions remain challenging, says Mitsubishi.

- Sales decreased by 16% YOY to ¥473.6 billion at Mitsubishi's performance products business. Operating income plunged 46% YOY to ¥21.4 billion. Functional products' revenue declined because of reduced demand principally in automotive applications, despite the recent pickup in demand. Sales volumes fell for high-performance engineering plastics and other offerings for advanced moldings and composites. In performance chemicals, revenue decreased amid lower overall sales volumes to the automotive industry, including for performance polymers in the advanced polymers segment. Another downside for sales volumes was the impact of scheduled maintenance and repairs at phenol-polycarbonate chain facilities in the advanced polymers segment.

- Sales decreased by 31.5% YOY to ¥381 billion at the chemicals business, Mitsubishi's largest segment. It swung to an operating loss of ¥14.6 billion from an operating profit of ¥35.8 billion a year earlier. In the methyl methacrylate (MMA) business, revenue declined despite improving conditions in the MMA monomer and other markets. In petrochemicals, sales decreased because of a greater impact from scheduled maintenance and repairs at an ethylene plant, with selling prices down following declines in raw material costs and other factors. In carbon products, revenue was down because of lower prices in line with reduced raw material costs and a drop in sales volumes from declining demand for coke and other offerings.

- Mitsubishi has downgraded its forecast for the fiscal year ending 31 March 2021. It now projects a net loss of ¥34 billion, compared with a previously estimated net profit of ¥49 billion. Sales projections have been lowered to ¥3.1 trillion, versus an earlier estimate of ¥3.3 trillion. In the first half, the company included an ¥84.5-billion impairment loss on technology-related intangible assets in the healthcare segment.

- No changes have been made to guidance for full-year operating income, which is expected to reach ¥137 billion. This is because while market conditions for MMA and other products in the chemicals segment are likely to be less favorable than initially expected, selling, general, and administrative expenses and R&D expenditure in the healthcare and other segments are projected to decline, Mitsubishi says.

- Subaru's earnings took a significant hit during the first half

of the fiscal year (FY) ending 31 March 2021 (April-September) as

the COVID-19 virus pandemic hit its business. During the six months

ended 30 September, the automaker reported profit attributable to

owners of the parent at JPY23.7 billion (USD226.4 million), a

decline of 65.2% year on year (y/y) from the same period last year.

(IHS Markit AutoIntelligence's Nitin Budhiraja)

- Revenues during the period stood at JPY1.218 trillion, down by 24.1% y/y, while operating profit experienced a 67.7% y/y fall to JPY30.61 billion.

- During the period, Subaru's consolidated global vehicle sales decreased by 27.9% to 363,000 units because of the major impact of the COVID-19 virus pandemic on first-quarter FY 2020/21 operations.

- Overseas vehicle sales fell by 26.4% to 321,000 units, while vehicle sales in Japan dropped by 37.4% to 43,000 units.

- In terms of production, the automaker reported that its global output was down by 28.9% to 354,000 units as a result of production adjustments including temporary suspensions of plant operations globally.

- Overseas production fell by 22.7% to 133,000 units, while production in Japan declined by 32.2% to 221,000 units during April-September.

- The decline in profits and revenues during the first half of the current FY can be attributed to the poor performance by the automaker in the first quarter of the FY driven by the impact of the COVID-19 virus outbreak.

- Subaru undertook several rounds of production suspensions and adjustments during March-June owing to the pandemic.

- South Korean automakers Hyundai's and Kia's combined global vehicle sales in October stood at 651,661 units, marginally down by 0.2% year on year (y/y) from 653,227 units in October 2019, according to separate data releases issued by the two companies and compiled by IHS Markit. Hyundai posted a decline of 4.2% y/y in its global vehicle sales last month to 385,947 units. Of this total, domestic sales accounted for 65,669 units, up by 1.2% y/y, while overseas sales declined by 5.2% y/y to 320,278 units. The marginal decline in Hyundai Motor Group's global sales during October was largely due to a poor performance by the Hyundai brand in overseas markets owing to weak demand caused by a contraction in consumer spending and the sluggish global economy amid the coronavirus disease 2019 (COVID-19) virus pandemic. However, Kia posted growth in overseas markets on the back of strong demand for its Sportage and Seltos SUVs and K3 sedan. Meanwhile, Hyundai Motor Group benefitted in its domestic market from encouraging demand for new models, attractive sales promotions, and consumption tax relief on passenger vehicles. In an attempt to boost vehicle sales, the South Korean government reduced consumption tax on purchases of passenger vehicles to 3.5%, from the previous 5%, between March and June. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai has signed two memorandums of understanding (MOUs) with partners in the Yangtze River Delta region and the Jingjinji region to build a local hydrogen ecosystem in China, according to a company press release. Under the first MOU, which was signed between Hyundai, Shanghai Electric Power Company Limited, Shanghai Sunhwa New Energy System, and Shanghai Yonghwa Electric and Financing Leasing Company, a hydrogen commercial vehicle platform will be built in the delta region. The four companies will build a fuel-cell electric vehicle (FCEV) ecosystem such as hydrogen production, the construction of hydrogen charging facility, and vehicle sales and operation (finance) based on Hyundai's fuel-cell truck in the Yangtze River Delta, the backbone of China's economy. They aim to co-operate to establish a low-cost and high-efficiency business model based on their respective expertise, and supply more than 3,000 fuel-cell trucks in the region by 2025 through continuous discovery of potential customers. Hyundai signed a second MOU with the Chinese Antai Science and Technology Company Limited and Hebei Steel Industrial Technology Service Company Limited to build a FCEV platform in the Jingjin area. Under this agreement, Hyundai will supply fuel-cell trucks suitable for market needs, while Antai Science and Technology will provide hydrogen storage, transportation, and support for the construction of hydrogen charging stations. Heogang Industrial Technology will supply hydrogen using by-product hydrogen resources. It will be in charge of discovering customers who will use fuel-cell heavy trucks. The three companies plan to co-operate with the goal of promoting a pilot project of fuel-cell heavy-duty trucks in the Jingjinji area and supply 1,000 units of such trucks by 2025. Hyundai is working with various parties in China, which aims to have 1 million FCEVs on its roads by 2030 as the country's hydrogen industry is on a sharp growth trend, creating massive potential. Initially, the automaker will focus on China's four major hydrogen hubs: Jinjinji, Yangtze River Delta, Guangdong Province, and Sichuan Province. (IHS Markit AutoIntelligence's Jamal Amir)

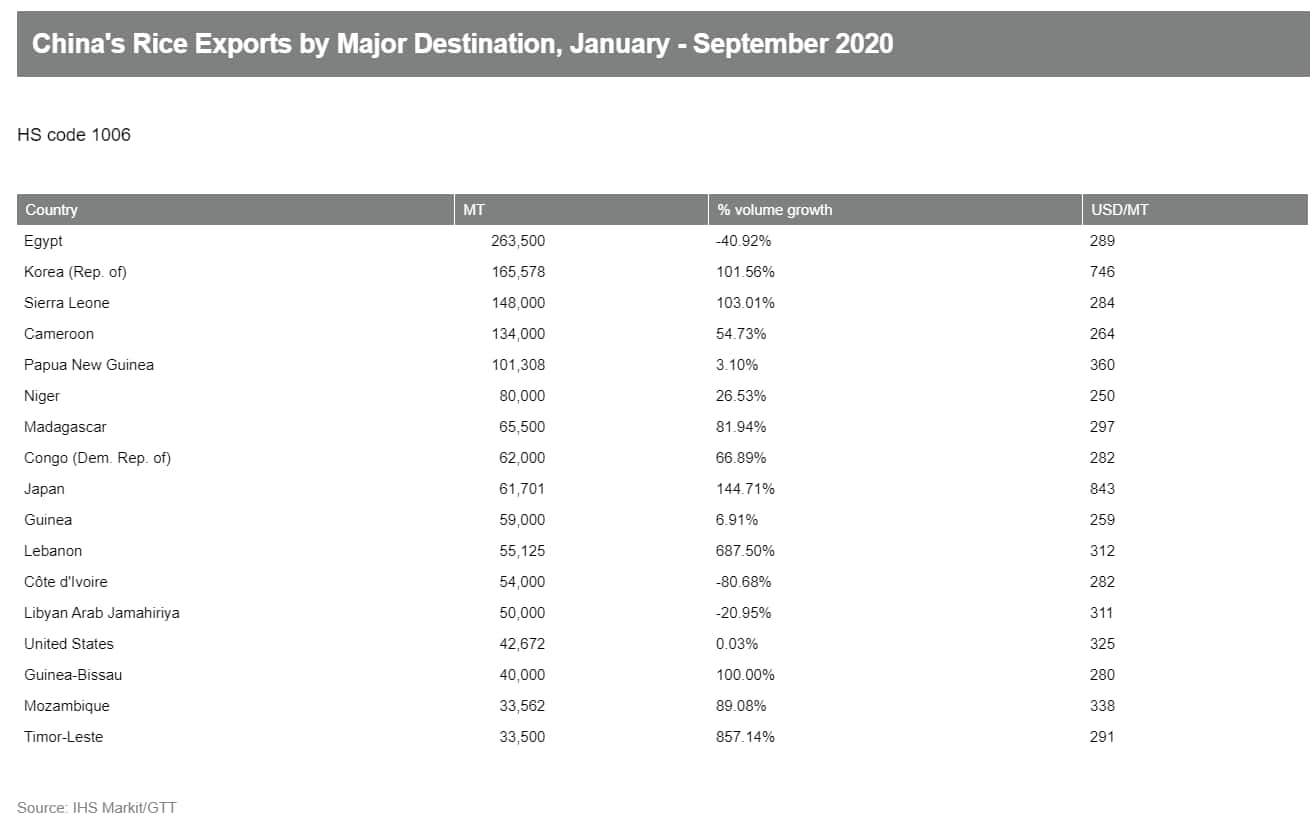

- Chinese third-generation hybrid rice yield has broken a record.

The research team, headed by the 'father of hybrid rice' Yuan

Longping, has achieved a record yield of 23 tons per hectare from

an experimental field at Hunan province. The average yield from

fields planted with the third generation of hybrid rice varieties

(Sanyou No 1) had reached 13.68 tons per hectare on (2 November),

according to China Daily (3 November). In July, early harvests from

the same field growing another strain of third-generation hybrid

rice yielded an average of 9.29 tons/ha. That said, the combined

harvest (early and late seasons) reached 22.5 tons, an increase of

1.5 tons per hectare compared with other high-yield hybrid

varieties. This means one-hectare hybrid rice field can feed as

many as 75 people, Yuan added. "There are 16.7 million ha of hybrid

rice fields in China. The new strain, if planted nationwide, will

significantly boost overall rice production." The strain, Sanyou No

1, is known for its high yields, quality, resilience to poor

weather conditions and relatively easy breeding methods. It also

grows quickly. (IHS Markit Food and Agricultural Commodities' Hope

Lee)

- Preliminary data show that Taiwan's real GDP resumed growth in

the third quarter of 2020, increasing 3.3% year on year (y/y),

marking the strongest expansion since the second quarter of 2018.

It reversed a 0.6% y/y fall posted in the second quarter of 2020,

which was the largest decline since the third quarter of 2009 amid

the adverse effect from the COVID-19 virus outbreak. (IHS Markit

Economist Ling-Wei Chung)

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy rebounded sharply in the third quarter of 2020 at an annualized 18.9% from the preceding quarter, representing the fastest expansion since the fourth quarter of 2009. It reversed two consecutive quarters of a steep contraction in early 2020 that came in the worst since 2008.

- The rebound in the third quarter of 2020 was mainly driven by robust net exports, contributing 3.2 percentage points to the third-quarter GDP growth, as exports rebounded with growth hitting a two-year high, while imports continued to contract.

- Domestic demand, although continuing to lag behind exports, recovered some ground as well. Domestic demand gained marginally by 0.2% y/y, reversing a 0.6% y/y fall in the second quarter, as private consumption contracted at a slower pace, despite a deceleration in investment growth.

- Booming technology demand, especially from mainland China and the US, has provided the key boost to Taiwan's export performance during the third quarter as shipments of electronics as well as information and communication products surged 20.4% y/y and 20.6% y/y, respectively.

- Shipments of non-technology products continued to shrink but at a slower pace, as a gradual reopening of the economies around the world helped offset the adverse effect from the pandemic.

- Exports of goods rebounded with a 6% y/y increase (in US dollar terms, or 0.2% y/y gain in Taiwan dollar terms) in the third quarter, after contracting 2.4% y/y in the second quarter. Together, total exports of goods and services expanded by a stronger-than-expected 3.5% y/y, after dropping 3.5% y/y in the second quarter. This came despite a still-stagnant tourism sector that dragged on exports of services.

- Private consumption remained the drag to real GDP growth in the third quarter, despite some improvement. Private consumption fell 1.5% y/y, although narrowing from a record pace of 5% y/y in the second quarter when consumption and tourism-related activities were hit the hardest by the pandemic.

- Dampened by travel restrictions locally and globally, outbound tourism remained at a standstill, with the numbers of residents travelling overseas plunging 97.8% y/y and resulting in a 93.4% y/y slump in overseas travel spending, which subtracted over 6 percentage points from private consumption. Coupled with the plunges in consumption related to public transportation, lodging, hotels, and recreations, they remained the key factors weighing down private consumption in the third quarter.

- The result for the third quarter came in stronger than expected, and signaled the end of the economy's recession that came brief but deep in the previous two quarters. Taiwan's largely successful containment of the outbreak at home has helped provide support to consumer and business sentiment, offsetting the adverse effect from the pandemic, especially on the still-stagnant tourism sector.

- The Reserve Bank of Australia (RBA) monetary policy board

simultaneously cut the official cash rate target and the yield

target for three-year Australian government securities (AGS) to

0.10% from 0.25%. There was also a reduction to the interest rate

for new drawings under the Term Funding Facility to just 0.10%.

(IHS Markit Economist Bree Neff)

- The interest rate for Exchange Settlement balances was dropped to 0% from 0.10%.

- Over the next six months, the RBA will buy AUD100 billion (USD70.4 billion, equivalent to 5% of Australian GDP)-worth of AGS and state/territorial government bonds with maturities of 5-10 years. The split is expected to be 80% AGS and 20% state/territorial. The first purchases will be made in secondary market auctions on 5 November, and the RBA will review the size of the program in the coming months to determine whether it is sufficient to support the economic recovery.

- In order to convey the breadth of these changes, RBA governor Philip Lowe made a rare media appearance and greatly expanded the standard press release that follows the monetary policy board's decision. Lowe indicated that the measures would help to lower interest rates across the yield curve, thus supporting the country's economic recovery by keeping financing costs and the exchange rate lower.

- According to Lowe, based on the bank's forecasts the monetary policy board does not expect to raise the policy rate for at least three years, and is "prepared to do more if necessary". The RBA has explicitly stated that it will adjust the yield targeting program for three-year AGS before making any change to the policy rate.

- The RBA's updated forecasts - which will be released in full at the end of this week - project real GDP growth of about 6% for the year to June 2021, up from the previous forecast's projection of 4% for the same period due to effective domestic containment of the COVID-19 virus pandemic.

- IHS Markit had expected the RBA to retain its last room for maneuver on the official cash rate target and the three-year AGS yields - and to leave the policy rate unchanged at 0.25% - because of the strong aversion to negative interest rates that it has expressed for much of the past year. With the policy rate down to 0.10%, we do not expect further action by the RBA on interest rates. Efforts will instead focus on the bond buying program, with clear indications that the RBA is willing to extend the program.

- High-frequency data show that Singapore was slowing in August

and September 2020, in accordance with forecasts, and likely to be

followed by only marginal growth into early 2021. (IHS Markit

Economist Dan Ryan)

- Consumer spending, as manifested by retail sales, hit a bottom in May and then recovered. However, the August data point towards a flattening, which would follow the pattern of other countries and which implies only marginal growth in the third quarter.

- International reserves have been slowly trending upwards, meaning that the central banks have been buying foreign currency and selling Singapore dollars. The amounts, however, are too small to suggest that Singapore is trying to weaken its currency.

- After bouncing back from the initial pandemic nadir, exports then corrected in September and are left down slightly from a year earlier. With imports actually trending up, the resulting trade balance is in the two-plus billion dollar range.

- Industrial production rebounded strongly in August and September. Since exports did not follow a similar pattern, this implies a boost to fixed investment and to a lesser extent purchases of consumer goods.

- Inflation has been low and relatively constant for consumer prices. Core prices are still lower than a year earlier, while the overall Consumer Price Index (CPI) is even with a year ago, albeit with more volatility.

- Producer and wholesale prices remain much lower than a year ago. This could be considered normal under coronavirus disease 2019 (COVID-19) conditions, since these indices tend to grow more slowly than overall inflation, which in turn has been negative.

- Interest rates remain low. The Monetary Authority of Singapore is unlikely to raise rates until the pandemic is quelled, likely in mid-2021.

- The Singapore dollar weakened in the second quarter of 2020, as the pandemic caused capital outflows, but the currency has since returned to normal levels. It now appears that the dollar will be relatively stable in the short run, until trade and investment flows return to pre-pandemic levels.

- The pandemic hit Singapore about a month later than other Asian countries; therefore, its recovery has been correspondingly delayed. However, the economy now appears to be flattening at the end of the third quarter.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-4-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-4-2020.html&text=Daily+Global+Market+Summary+-+November+4%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-4-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 4, 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-4-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+4%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-4-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}