Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 22, 2021

Sub Saharan Africa supply chain opportunities

- SSA supply-chain diversification is more likely to succeed under the AfCFTA than under global supply-chain diversification efforts.

- Political stability, a favourable skills base, enhanced ICT infrastructure, and high readiness for AfCFTA adoption make small island economies to be better prepared in benefiting from the AfCFTA.

- Raw material producers, as well as producers of agricultural products, and food and beverages are set to benefit especially from the AfCFTA. IHS Markit sees that business opportunities and competitive advantages across countries will be diverse.

- Breaking down non-tariff barriers such as rules of origin and health and safety regulations remains essential to reap the full benefits of the AfCFTA and regional supply-chain diversification.

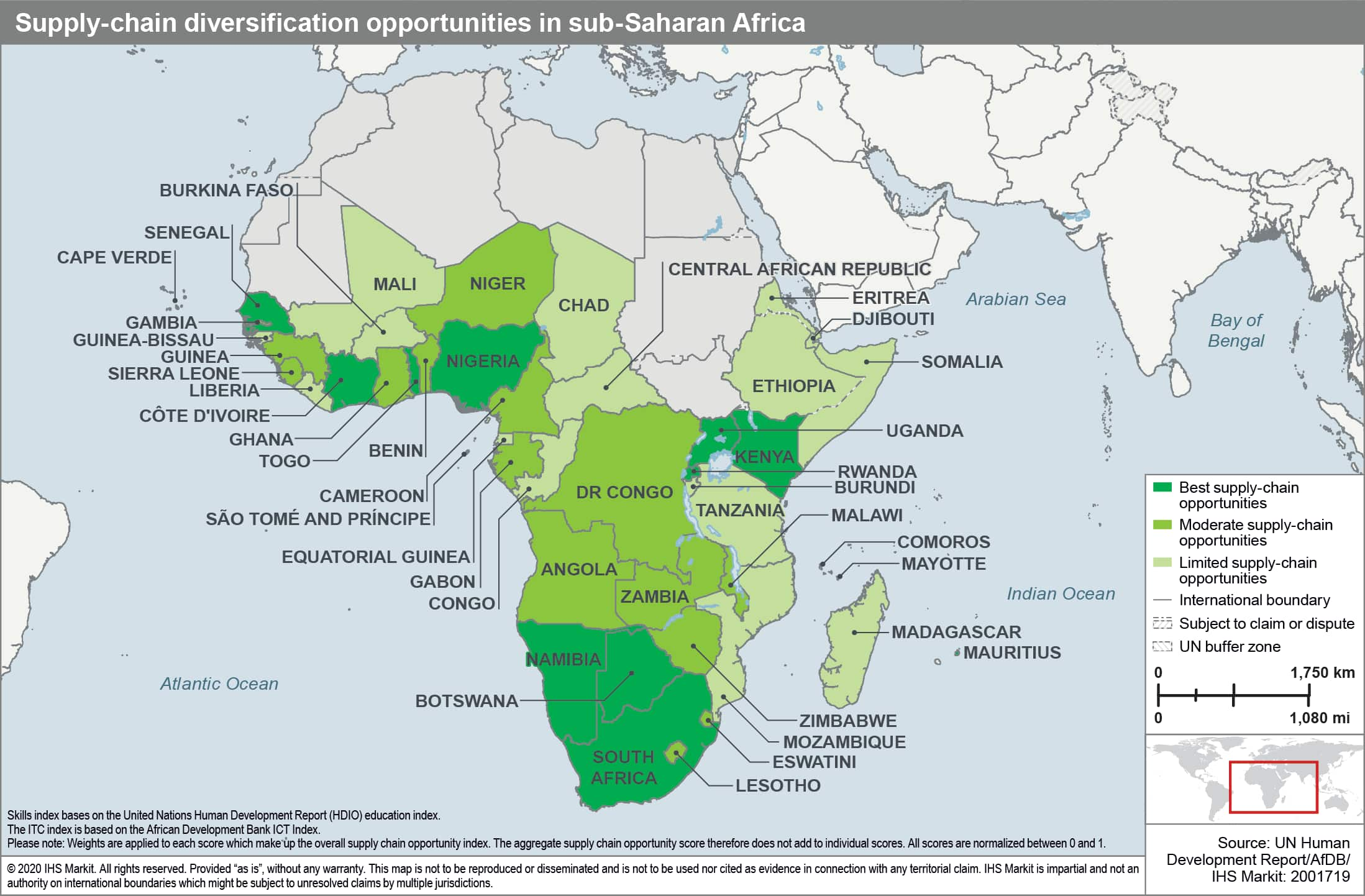

We have developed a supply-chain diversification opportunity index for the SSA region to assess which countries are better positioned and could benefit most from investing in supply chain diversification under the AfCFTA. The AfCFTA was launched on 1 January 2021. In IHS Markit's view this agreement will create enhanced supply chain diversification opportunities across the continent over the medium to longer term. SSA is however less likely to benefit from global supply-chain diversification efforts compared to other regions such as Eastern Europe, Southeast Asia, and Mexico, our analysis shows. Countries in SSA currently lack the skills, infrastructure and production capacity to produce goods that could be viable substitute products for those produced by other large global producers such as China in the global supply chain. This is shown by SSA's small share of exports compared to total world exports. In addition, SSA compares less favourably than other global producers regarding most risk factors dictating investors' decisions, such as security, operational, policy, and economic risks.

Key success factors

Under the AfCFTA, the biggest incentives and growth benefits will come through the removal of tariffs, which ultimately will reduce production costs and induce advantages of economies of scale. Countries that display a readiness to adopt the agreement and have a substantial share of inter-regional trade, as well as pursue appropriate business-policy reforms to attract global and regional investment are better positioned. Economies that show a solid consumer base and adequate skills pool achieved through inclusive growth and labour-force skills development, maintain political stability, and prioritise the development of information and communications technology (ICT) to enhance productivity and cost efficiency are also on the higher ranks.

High score countries

Small island economies such as Cape Verde, Mauritius, São Tomé and Príncipe, and Seychelles are well prepared to benefit from the AfCFTA agreement, the supply-chain diversification opportunity index shows. These economies have the advantage of political stability, a favourable skills base, enhanced ICT infrastructure, and high readiness for AfCFTA adoption. Botswana, Côte d'Ivoire, Kenya, Namibia, Nigeria, Rwanda, Senegal, South Africa, Togo, and Uganda are also expected to benefit. Most of these economies are relatively large within their sub-regions, while Côte d'Ivoire, Kenya, Senegal, and Togo have also made significant progress in improving their business environment and have a high AfCFTA readiness ranking.

Products and services beneficiaries

Benefiting greatly from economies of scale, the AfCFTA allows access to a larger pool of producers and the opportunity of centralised processing needed to be competitive in a global market. Under the AfCFTA, this will benefit particularly downstream users of products within the SSA region, as it will reduce input costs, increasing their competitiveness. This, in turn, reduces costs for the final consumer, improving living standards, while boosting the competitiveness of the region as a whole. Products and services that will benefit from larger trade blocks typically include raw materials, agricultural products, and food and beverages. Food production in Africa has especially great potential to expand. However, in order to benefit from the bigger market provided by the AfCFTA, more efficient agricultural practices will have to be employed. IHS Markit expects as a result agricultural land area use to come down in the long term.

Bottom line

The post-COVID-19 economic landscape in sub-Saharan Africa will be characterised by higher poverty and inequality, and a rising public-sector debt burden. Pre-COVID-19 GDP levels could be reached again by 2023 at the earliest. The risk to this outlook remains high, of which a second wave of COVID-19 in 2021, adverse weather conditions, political instability, a slow return of foreign private investment, and limited fiscal flexibility pose the most significant. Nonetheless, the SSA region's medium- to longer-term growth potential remains positive. The successful implementation of the AfCFTA and easing of nontariff barriers is one of the biggest growth opportunities. Investment will stretch from financial and business services to agro-processing, light manufacturing, and raw materials beneficiation. Business opportunities and competitive advantages across countries will be diverse. However, that breaking down non-tariff barriers such as rules of origin, safety, and health regulations remain essential to reap the full benefits of the AfCFTA and regional supply-chain diversification.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsub-saharan-africa-supply-chain-opportunities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsub-saharan-africa-supply-chain-opportunities.html&text=Sub+Saharan+Africa+supply+chain+opportunities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsub-saharan-africa-supply-chain-opportunities.html","enabled":true},{"name":"email","url":"?subject=Sub Saharan Africa supply chain opportunities | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsub-saharan-africa-supply-chain-opportunities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sub+Saharan+Africa+supply+chain+opportunities+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsub-saharan-africa-supply-chain-opportunities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}