Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 22, 2021

The global economic recovery disrupted

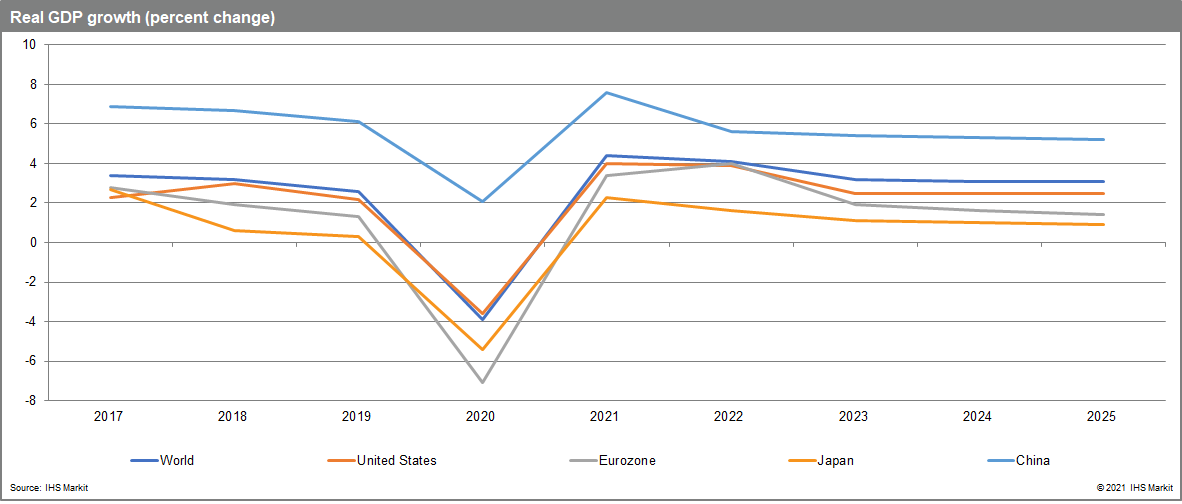

Another wave of the COVID-19 pandemic has disrupted economic activity in early 2021. Global infections and deaths are reaching new highs, while the rollout of vaccines is uneven across geographies. Activity restrictions will stall global real GDP growth in the first quarter, with most of Europe in recession.

We anticipate that new COVID-19 infections will decline in the months ahead as vaccines will become more widely available. As lockdowns end, a revival in consumer spending will spark an acceleration in the global economy in the second quarter. World real GDP is projected to surpass its late-2019 pre-pandemic peak in the third quarter of 2021.

In the United States, a new USD900-billion fiscal stimulus will avert a contraction in real GDP in the first quarter, offsetting the drag from a higher winter peak in COVID-19 virus infections. This front-loaded fiscal support will provide a bridge to the second half of the year, when pent-up consumer spending will likely push real GDP growth above a 5% annual rate.

The resurgence of COVID-19 and widespread lockdowns led to a second wave of recessions across most of Europe in late 2020 and early 2021, albeit less severe than downturns in the first half of 2020. IHS Markit economists continue to forecast a consumer-led growth spurt from spring 2021 as vaccinations facilitate a reopening of economies.

A last-minute trade agreement at the close of 2020 averted the tail risks associated with a disorderly United Kingdom exit from the European Union. However, the deal does not replicate the frictionless trade that existed previously, and ongoing adjustments to the new arrangements will hinder the UK's recovery from the pandemic shock.

Mainland China's real GDP grew 6.5% year on year in the fourth quarter of 2020, up from 4.9% in the third quarter. Growth strengthened broadly across industrial and service sectors. New local outbreaks of the COVID-19 virus should not derail the expansion, although consumer demand could lose steam. After a cyclical rebound of 7.6% in 2021, the economy will return to the deceleration path that began in 2012, as productivity growth slowed in response to stalled economic reforms.

The recent surge in industrial materials prices is expected to bring a burst of finished goods price inflation by mid-2021, leading to an acceleration in consumer prices. Global consumer price inflation is projected to pick up from 2.1% in 2020 to 2.3% in 2021 and 2.6% in 2022, led by accelerations in the United States and other advanced economies. If demand proves more resilient than anticipated once the pandemic subsides and commodity prices remain elevated, downstream inflationary pressures would intensify.

The US dollar's exchange rate is expected to depreciate over the next two years in response to low interest rate spreads, an increase in investor risk tolerance, and a widening trade deficit. European Central Bank policy accommodation will limit the extent of further euro appreciation. The Japanese yen will benefit from strengthening exports and relatively low inflation. The renminbi will be supported by mainland China's accelerating economy and comparatively conservative monetary policy.

After stalling in early 2021, the global economy should prove resilient as vaccines are deployed and the pandemic subsides. After a 3.9% decline in 2020, world real GDP is projected to increase 4.4% in 2021 and 4.1% in 2022.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-economic-recovery-disrupted.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-economic-recovery-disrupted.html&text=The+global+economic+recovery+disrupted+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-economic-recovery-disrupted.html","enabled":true},{"name":"email","url":"?subject=The global economic recovery disrupted | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-economic-recovery-disrupted.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+global+economic+recovery+disrupted+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-global-economic-recovery-disrupted.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}