Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 09, 2018

The Argentine peso remains vulnerable

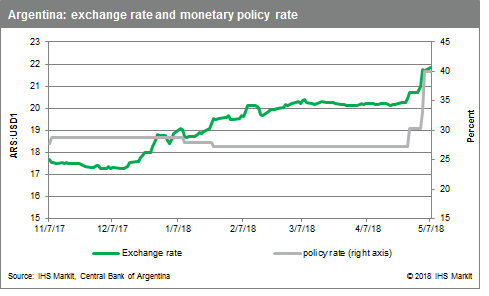

- The sudden decline in the value of the Argentine peso in the first week of May prompted a series of measures, which included raising the monetary policy rate to 40%, in order to curtail the devaluation without wiping out the country's foreign-exchange reserves.

- Volatility in the exchange rate market is expected to continue throughout the year driven in part by external factors; however, the government must work in reducing the peso's vulnerability by reducing the inflation rate and its fiscal deficit given that these sudden loss of confidence episodes have raised the country's overall risk.

- Although raising the monetary policy rate to 40% is expected to be a temporary move, it will dampen gross fixed investment and private-sector consumption leading to slower GDP growth in 2018.

- The Argentine government is working on securing a credit facility with the IMF to bring calm to the foreign exchange market and reduce the volatility.

Between the last week of April and the first week of May, the Argentine peso devalued over 11% despite the intervention of the Central Bank (BCRA, in Spanish) in the foreign exchange markets. Indeed, the BCRA had previously signaled that it would intervene more aggressively in the exchange rate market to reduce the depreciating pressure and effectively put a ceiling to the exchange rate at ARS21/USD1. Nonetheless, the peso hit its lowest level on 3 May, at ARS23:USD1, despite the hike in the monetary policy rate by 300 basic points on 27 April; the policy rate was raised by another 300 basic points on 3 May and by an additional 675 basic points effective 7 May (that is, from 27.25% on 26 April 2018 to 40% on 7 May 2018, which in turn is higher than the 38% policy rate at the start of the Macri administration in December 2015). In addition, Macri's economic team announced the reduction of the foreign exchange reserve requirement for banks, from 30% to 10%, and a significant reduction to the fiscal deficit target for 2017, from an initial 3.2% of GDP to a 2.5% of GDP, which will imply scaling down the ambitious public sector infrastructure spending plan at least in the short-term. In addition, the Macri government started the process to secure a credit facility with the IMF to ensure investors that liquidity will not be a problem in the short-term.

The previous depreciating pressure episode came after the BCRA relaxed its inflation targets for 2018-20 in December 2017. This came after missing its inflation target in 2017 (set to a 17% annual average while the actual annual average was 25.4%). The BCRA changed the target from a 10% +/- 2% annual average in 2018 to an annual inflation target of 15% for December 2018, 10% for December 2019, and 5% for December 2020; pushing back a year the timeline to reach its single-digit annual inflation goal. The BCRA had reduced the rate 150 basis points to 27.25% (in two steps from the 28.75% at end-2017) in January 2018.

Outlook and implications

Is the worst over? The series of measures taken by the economic team brought some relative calm back to the foreign exchange market however volatility is expected to continue as external factors, driven by geopolitical events, will continue having an impact on emerging markets' currencies and the international market has signaled that despite supporting the policy direction of the Macri government, much work remains to be done to be on a solid footing. Indeed, the market sensed some weakness in terms of the possibility of scaling back utility and transportation tariff adjustments initially programed for 2018 in order to appease the population. In addition, the country's inflation rate is not yet in the target path but keeping a 40% monetary policy rate for an extended period of time would hinder economic activity and goes against the central bank's earlier aim to reduce the incentives to park capital in the public bond sector and rather reallocate it to the wider economy; in addition, it's not sustainable as it would drain fiscal resources. On the other hand, massive cuts to the policy rate in the very short-term could bring more currency speculative episodes. Moreover, this could be a moment of make it or break it for the Macri administration given that the sudden loss of confidence on the peso has increased the country's overall risk. Bringing back confidence on the policy direction and the economic team's ability to tackle challenges is a must to solidify the changes made so far and keep the current positive economic outlook; the key items continue to be the country's inflation rate and fiscal deficit.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-argentine-peso-remains-vulnerable.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-argentine-peso-remains-vulnerable.html&text=The+Argentine+peso+remains+vulnerable++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-argentine-peso-remains-vulnerable.html","enabled":true},{"name":"email","url":"?subject=The Argentine peso remains vulnerable | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-argentine-peso-remains-vulnerable.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Argentine+peso+remains+vulnerable++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-argentine-peso-remains-vulnerable.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}