Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 13, 2019

The Bank of Canada’s sticky situation

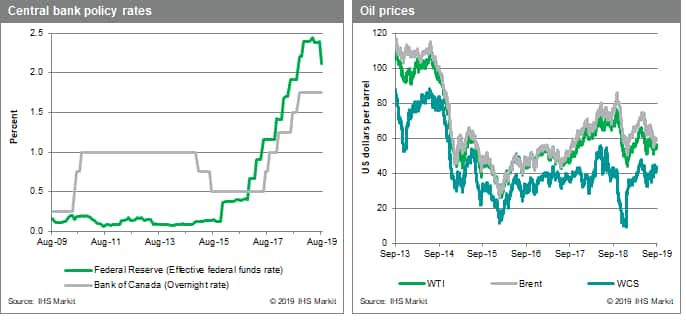

- The overnight policy rate was unchanged at 1.75% as widely expected on 4 September. The bank rate and deposit rate were unchanged at 2% and 1.5%, respectively.

- The Bank of Canada's estimate for second-quarter growth in the July Monetary Policy Report was weaker than the 3.7% quarter-on-quarter annualized rate, but growth in the second half of 2019 is expected to slow in the last half of 2019.

- The Bank of Canada was forecast to keep interest rates unchanged through 2020. However, the worsening of global trade and growth issues, coupled with the inverted yield curve, increases the odds that the next move from the Bank of Canada could be an interest rate cut.

There were no surprises in the Bank's policy announcement, as the Bank believes that "the current degree of monetary policy stimulus remains appropriate."

Some of the Bank's domestic hawkish comments include the robust second-quarter real GDP growth, higher energy production, and solid export growth. The housing market recovery is gaining momentum, which is resulting in a faster-than-anticipated upturn. Wages and labor income growth are also strong. Outside of Canada, upbeat US growth is being driven by resilient household consumption and government spending.

Some of the Bank's dovish comments include "escalating" trade conflicts and weaker commodity prices amid softening global growth. This is being reflected in many economies, including Canada, having inverted yield curves. Global uncertainty is holding back non-residential investment. Canada's big drop in machinery and equipment in the second quarter was harsh, highlighting Canada's vulnerability to global market conditions. Plus, the US-China trade dispute is weighing on global trade. Although wage growth was strong in the second quarter, household spending was tepid.

On balance, the no change in interest rates was widely expected as the upside and downside risks to the outlook are still relatively evenly split. The sticky situation for the Bank is what to do next. Given what is unfolding on the global stage as other central banks easing monetary policy, coupled with slow economic growth and soft commodity prices, it is easy for the downside risk profile to gain momentum. A cut in interest rates would support the ongoing recovery of non-residential investment. Yet a rate cut may lead to an overheated housing market and worsening household indebtedness. With these opposing issues, fiscal policy will be a useful tool to help tackle these lingering headwinds, especially with an upcoming federal election this autumn.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-bank-of-canadas-sticky-situation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-bank-of-canadas-sticky-situation.html&text=The+Bank+of+Canada%e2%80%99s+sticky+situation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-bank-of-canadas-sticky-situation.html","enabled":true},{"name":"email","url":"?subject=The Bank of Canada’s sticky situation | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-bank-of-canadas-sticky-situation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Bank+of+Canada%e2%80%99s+sticky+situation+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-bank-of-canadas-sticky-situation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}