Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 13, 2019

Weekly Pricing Pulse: Good news no help to commodity prices

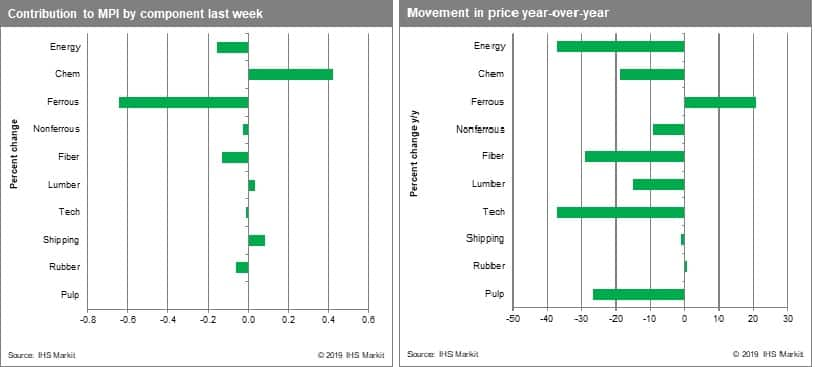

Even with a backdrop of some good news, commodity prices, as measured by our Materials price Index (MPI), fell 0.8%, their seventh straight weekly decline. Other markets welcomed reports that the US and China will soon return to the negotiation table, an easing in tensions in Hong Kong SAR, and that Parliament thwarted for now Prime Minster Johnson's bid for a 'no-deal' Brexit. Commodities instead chose to focus on disappointing US manufacturing data and an August US employment report that was below expectations.

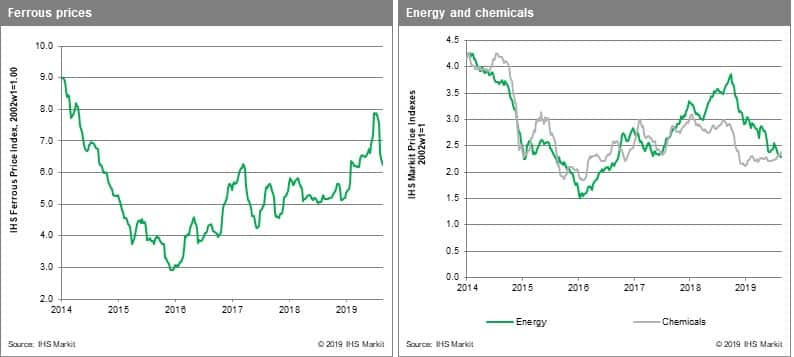

Within the MPI, the ferrous metals, chemical, fiber, pulp, lumber and DRAM sub-indexes all declined. Nonferrous metals prices were essentially flat, posting a 0.1% gain. Shipping and energy prices recorded gains. Ocean going charter rates have rallied 78% since mid-April and are now at their highest rate since 2014. Strong Chinese iron ore imports (which hit a 19-month high in August) are behind the recovery in charter rates. Energy prices rose 0.9% on 4.8% increase in thermal coal prices, which have been bouncing off recent lows. Oil prices fell 0.2% for the week, though they did recover by week's end.

As has been the case in recent weeks, commodity markets were caught between the cross currents of changing sentiment and fundamental data - in this case an improvement in the pessimistic mood that has descended on markets was checked by lackluster physical data. The question for markets in the fourth quarter is whether additional stimulus from policymakers, which is sure to buoy sentiment, will begin to improve conditions in global manufacturing activity.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-news-no-help-to-commodity-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-news-no-help-to-commodity-prices.html&text=Weekly+Pricing+Pulse%3a+Good+news+no+help+to+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-news-no-help-to-commodity-prices.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Good news no help to commodity prices | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-news-no-help-to-commodity-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Good+news+no+help+to+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-good-news-no-help-to-commodity-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}