Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 07, 2018

The value-momentum trade war

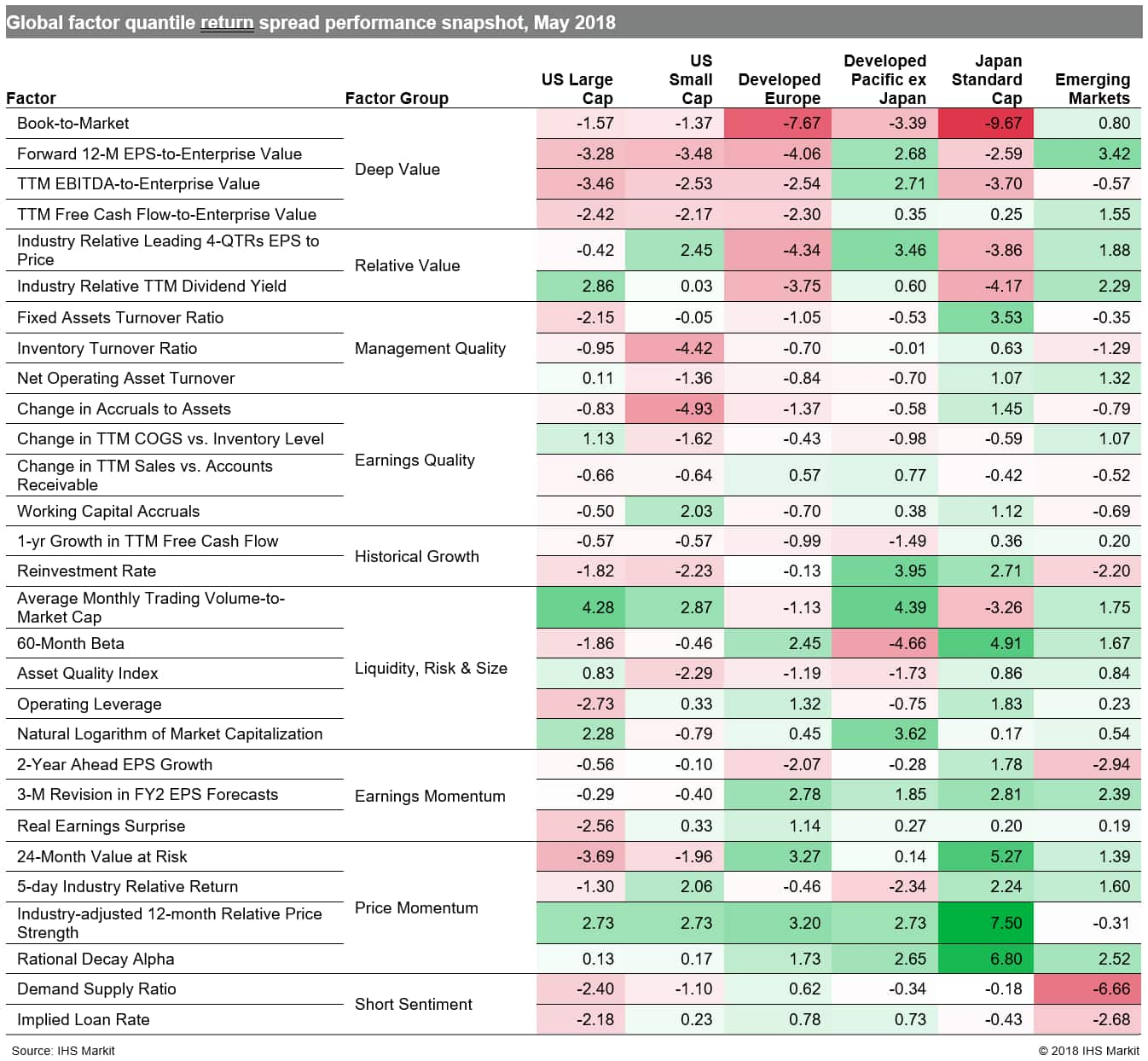

In the same way that global markets have witnessed the back and forth on trade discussions, developed market traders have sold off either value or momentum stocks one month, only to see them bounce back the next month. Momentum was the more widely preferred strategy in May (Table 1) as global markets shrugged off fears of a trade war as just a war of words. Hopes remain that growth in major economies will not be undermined, supported by global economic growth remaining solid in May according to the J.P. Morgan Global Manufacturing PMI™. Investors now wait for further developments with upcoming European Central Bank, US Federal Reserve and G-7 meetings.

- US: Natural Logarithm of Market Capitalization performance indicates stronger returns to small caps and 60-Month Beta points to outperformance to higher risk names

- Developed Europe: Deep Value measures underperformed, with Book-to-Market one of the weakest in the group, while Price Momentum metrics such as Industry-adjusted 12-month Relative Strength outperformed

- Developed Pacific: Japanese markets saw extreme movement in the Price Momentum style (e.g., Rational Decay Alpha) over Deep Value (e.g., Book-to-Market), reversing trends at the tails of factor performance the prior month

- Emerging markets: Forward 12-M EPS-to-Enterprise Value and Rational Decay Alpha, which tend to represent opposing trading strategies, were both strong performers for the month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-valuemomentum-trade-war.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-valuemomentum-trade-war.html&text=The+value-momentum+trade+war+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-valuemomentum-trade-war.html","enabled":true},{"name":"email","url":"?subject=The value-momentum trade war | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-valuemomentum-trade-war.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+value-momentum+trade+war+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-valuemomentum-trade-war.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}