Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 09, 2019

USD Credit Market Highlights, April 2019

Leveraging the iBoxx Tradable Indices and Evaluated Bond Pricing, IHS Markit's own Nick Godec provides a glimpse into the YTD performance of the USD Credit Market, as well as April 2019 performance drivers.

YTD Returns and YTD Spreads, Comparing: iBoxx Liquid

High Yield vs.

Investment Grade Indices

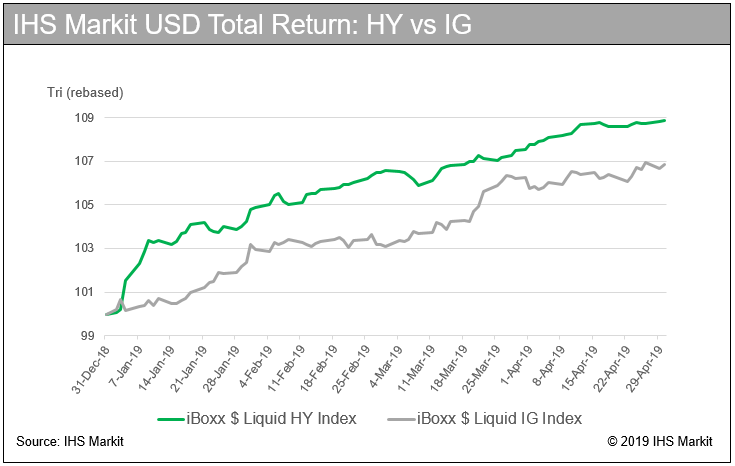

Returns

USD credit markets performance YTD, as of 4/30/19

- iBoxx Liquid High Yield - 8.88%

- iBoxx Investment Grade Indices - 6.87%

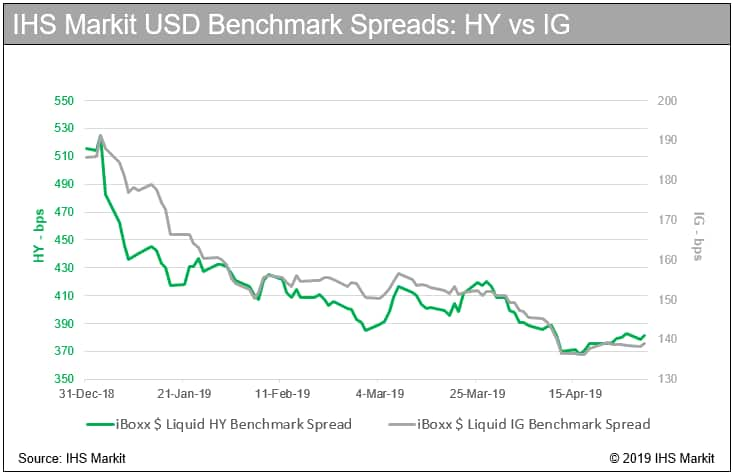

Benchmark Spreads

Investors continue seeking risk exposure on positive economic news and an accommodative Fed, thus:

- iBoxx USD Liquid High Yield tightened 134bps to 382bps

- 93 bps above five-year tight of 298bps

- Investment Grade Indices tightened 47bps to 139bps

- 32bps above five-year tight of 107bps

April Performance Drivers

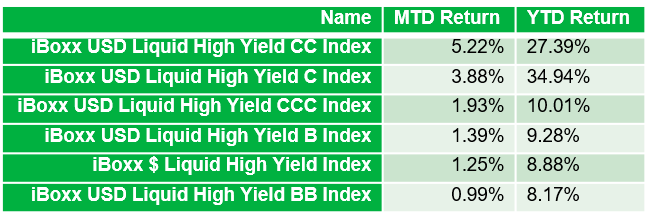

CCC through C Drives High Yield Returns

The iBoxx Liquid High Yield Index delivered a solid April return of 1.25%, driven primarily by the lowest-rated credits in the index; CCC through C-rated debt outperformed BB through B-rated credits in April and YTD, the lowest rated CC and C-rated credit segments had the strongest performance.

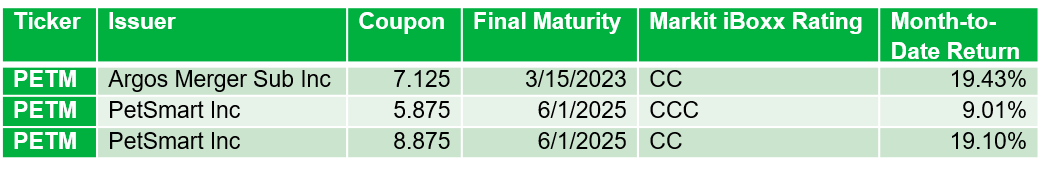

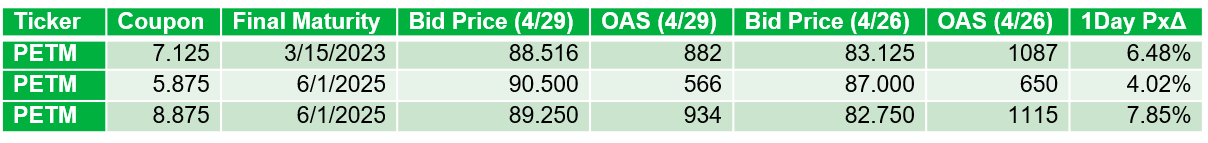

PetSmart Jumps on Online Chewy.com News

PetSmart had an especially strong April performance in the lower-rated high yield market.

iBoxx Liquid High Yield Index prices for PetSmart issuers - powered by IHS Markit's Evaluated Bond Pricing Service - jumped sharply on April 29th following the specialty retailer's announcement that they filed an IPO for its online chewy.com division, the proceeds of which could be used to pay down debt or otherwise firm up their balance sheet.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusd-credit-market-highlights-april-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusd-credit-market-highlights-april-2019.html&text=USD+Credit+Market+Highlights%2c+April+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusd-credit-market-highlights-april-2019.html","enabled":true},{"name":"email","url":"?subject=USD Credit Market Highlights, April 2019 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusd-credit-market-highlights-april-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=USD+Credit+Market+Highlights%2c+April+2019+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusd-credit-market-highlights-april-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}