Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 04, 2018

Value trade protectionism

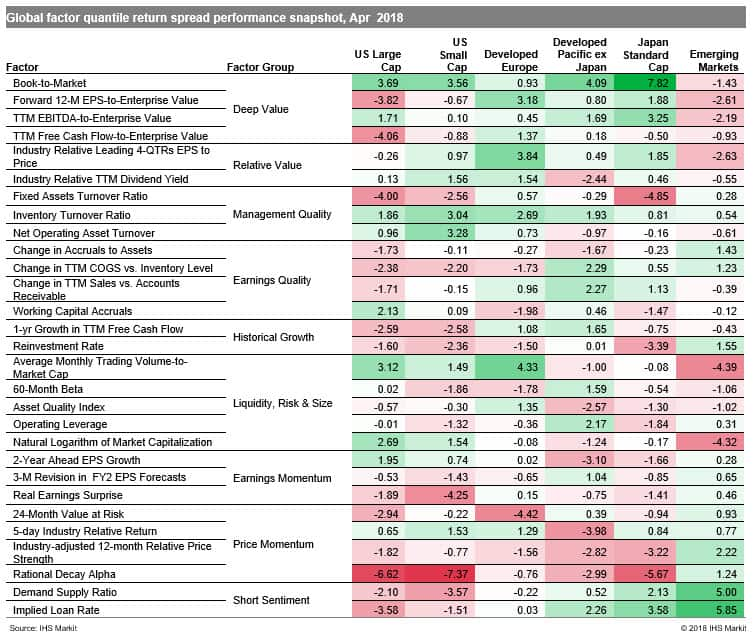

After tumbling from the January high in the first quarter, global stocks were relatively more range bound to start off the second quarter. Global economic growth did see a mild improvement in April according to the J.P. Morgan Global Manufacturing PMI™, yet developed market investors shied away from momentum toward value, as inflation fears and concerns of escalating trade tensions and higher interest rates remained (Table 1).

- US: Rational Decay Alpha was a particularly weak performing factor among large and small caps

- Developed Europe: Valuation was a positively rewarded theme, as demonstrated by Forward 12-M EPS-to-Enterprise Value and Industry Relative Leading 4-QTRs EPS to Price

- Developed Pacific: Markets followed suit with other developed regions, favoring value over momentum, while also taking direction from the securities lending market, as gauged by Implied Loan Rate

- Emerging markets: Industry-adjusted 12-month Relative Price Strength captured positive investor outlook, though optimism was kept in check by short selling demand signals (e.g., Demand Supply Ratio)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-trade-protectionism.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-trade-protectionism.html&text=Value+trade+protectionism","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-trade-protectionism.html","enabled":true},{"name":"email","url":"?subject=Value trade protectionism&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-trade-protectionism.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Value+trade+protectionism http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-trade-protectionism.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}