Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 15, 2024

Week Ahead Economic Preview: Week of 18 November 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI surveys to provide first post-election economic signals

The first indications of economic trends in the world's major economies after the US Presidential Election will be eagerly awaited from the November flash PMI surveys, with US consumer confidence also updated. Clues as to next monetary policy moves from the Bank of England and Bank of Japan will meanwhile be gleaned from inflation updates.

If the US election result was not a complete surprise to everyone, the scale of the Republican win and the capture of full control of both chambers of the US Congress certainly seems to have been, focusing minds on the likely reality of fresh trade tensions. How the result affects economies around the world will take time to appear and will depend on the policies the new administration chooses to adopt once in power. In the meantime, there could well be a near-term impact, through the pre-ordering and shipping of goods around the world to front-run the imposition of potential tariffs, notably from mainland China.

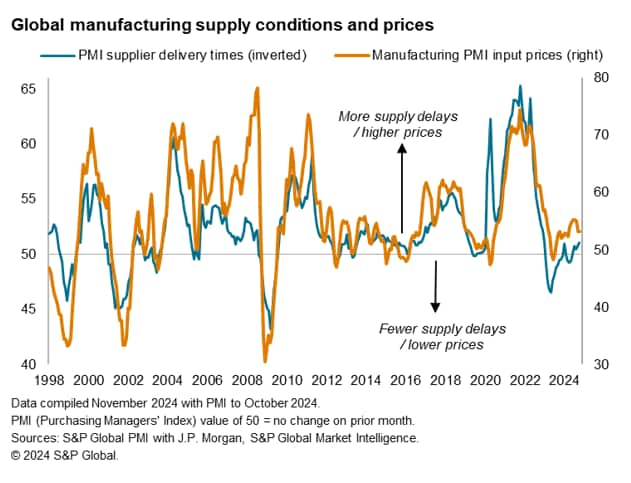

Hence the flash PMI surveys will be eyed for any signs of shipping congestion and for the potential impact that any stretching of supply chains or spike in demand may have on prices, even if just through raised shipping costs. The global PMI suppliers' delivery times index is one of the most widely cited barometers of supply chain constraints, and acts as a reliable indicator of how changing supply chains are affecting prices, so the national readings out of the US and Europe in particular will provide important signals for whether inflation might take off again. Both input cost and selling price gauges will also be eyed for any immediate pricing impact.

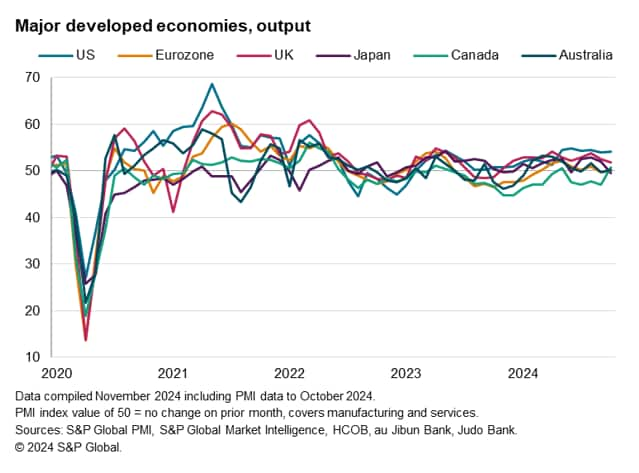

Meanwhile, the flash PMI surveys' export orders indices will help assess changing trade patterns, and the broader new orders and output data will help guide fourth quarter GDP estimates. Any widening of the existing growth divergence between the US and Europe will be a concern, especially in relation to rising recession risks in the Eurozone, which has been broadly stagnant in recent months. However, the UK PMI data has also shown a worrying loss of growth momentum in October. Japan's PMI has meanwhile also fallen into contraction, and any further weakening could complicate the Bank of Japan's conviction of the appropriateness of higher interest rates.

Key diary events

Monday 18 Nov

Japan Machinery Orders (Sep)

Singapore Non-oil Domestic Exports (Oct)

Thailand GDP (Q3)

Switzerland Industrial Production (Q3)

Spain Balance of Trade (Sep)

Eurozone Balance of Trade (Sep)

Canada Housing Starts (Oct)

Global G20 Meeting (Nov 18-19)

Tuesday 19 Nov

Australia RBA Meeting Minutes (Nov)

Eurozone Inflation (Oct, final)

Canada Inflation (Oct)

United States Building Permits (Oct, prelim)

United States Housing Starts (Oct)

Wednesday 20 Nov

Brazil Holiday

Japan Trade (Oct)

China (Mainland) Loan Prime Rate (Nov)

Germany PPI (Oct)

United Kingdom Inflation (Oct)

Indonesia BI Interest Rate Decision

South Africa Inflation (Oct)

Taiwan Export Orders (Oct)

South Africa Business Confidence (Q4)

Thursday 21 Nov

Norway GDP (Q3)

France Business Confidence (Nov)

Hong Kong SAR Inflation (Oct)

Turkey TCMB Interest Rate Decision

South Africa SARB Interest Rate Decision

Canada New Housing Price Index (Oct)

Eurozone Consumer Confidence (Nov, flash)

United States Initial Jobless Claims

United States Existing Home Sales (Oct)

Friday 22 Nov

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan Inflation (Oct)

Malaysia Inflation (Oct)

Singapore Inflation (Oct)

Germany GDP (Q3, final)

United Kingdom Retail Sales (Oct)

Taiwan Unemployment Rate (Oct)

Mexico GDP (Q3, final)

Canada Retail Sales (Sep)

United States UoM Sentiment (Nov, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

November flash PMI

Flash PMI data for November will be released for major economies - including the US, UK, Eurozone, Japan, Australia and India - on Friday, November 22. The latest October PMI data indicated that global growth accelerated amidst further easing of price inflation, though employment fell during the month. Whether the inflation trends remain conducive for monetary policy easing, and whether business confidence further improved - especially post the latest US election results, will be awaited with the Friday release.

Americas: Canada inflation, US building permits, housing starts and existing home sales data

In the US, a series of housing market data will be in focus alongside the flash PMI and consumer sentiment on Friday, while Canada's October inflation data will be due Tuesday for insights into the official price trends. This comes after the latest S&P Global Canada PMI data showed that selling prices rose at a rate that was modest and the slowest in four months despite input cost inflation being at a one-year high.

EMEA: UK inflation, retail sales data, Eurozone inflation, trade, Germany, Norway GDP

Besides flash PMI data, key releases in the week for Europe include October inflation and retail sales data from the UK. While UK core inflation may continue to hover above the 3.0% level in October, a further easing of price pressure is expected in the coming months according to PMI price indications which preludes the trend for core CPI. UK retail sales data will meanwhile be due on Friday and the latest S&P Global UK Services PMI hinted at a weaker growth trend for retail demand heading into the final quarter of 2024.

Other data to watch include the final October inflation reading out of the Eurozone while GDP data from Germany and Norway will also be updated.

APAC: BI meeting, RBA minutes, China Loan Prime Rate, Japan inflation and trade data, Thailand GDP, Singapore, Malaysia, Hong Kong SAR CPI

The Reserve Bank of Australia's (RBA) minutes from their November meeting will be due next week. This is while Bank Indonesia convenes with a rate cut on the table following the latest US Fed move.

On the data front, Japan's October inflation data will be released on Friday with the au Jibun Bank Japan PMI data previously showing output prices rising at a quicker pace during the month. Latest S&P Global Business Outlook data further revealed that cost pressures are expected to heighten in the year ahead while Japanese firms' willingness to raise their output charges in the year ahead remained elevated.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-november-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-november-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+18+November+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-november-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 18 November 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-november-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+18+November+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-november-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}