Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 25, 2024

Week Ahead Economic Preview: Week of 28 October 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Payrolls, PMIs and price updates to guide US and eurozone policy

The coming week is crowded with economic data that will add to a market already jugging the earnings season and speculation around the US Presidential Election. Specifically, we'll see some key data inputs to monetary policy settings in both the United States and eurozone, including inflation updates, non-farm payrolls and third quarter GDP estimates. Manufacturing PMI data will also help guide our understanding of the latest global production, trade and industrial price trends.

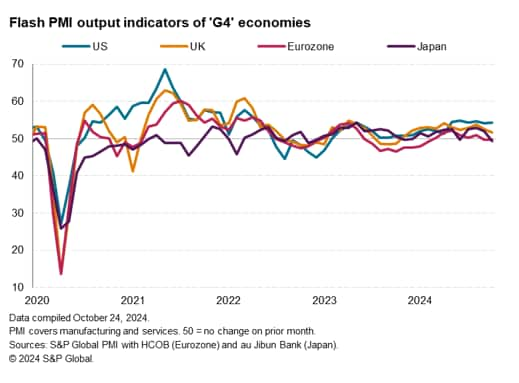

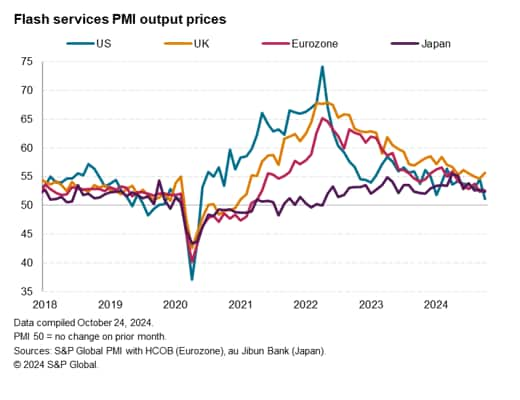

Recent PMI survey data, including October's flash numbers, have clearly highlighted how economic growth is being subdued by heightened geopolitical uncertainty. October saw business activity contract for a second successive month in the eurozone and also slip into decline in Japan. The United Kingdom meanwhile saw growth weaken sharply as uncertainty ahead of the imminent government spending review in the autumn Budget exacerbated broader geopolitical risk worries. One area showing notable resilience is the US services economy where, despite a further drop in manufacturing production in October, the sector continues to drive robust economic growth. However, even in the US, the PMI surveys showed the labor market softening further in October as companies cited a reluctance to hire amid the cloudy economic outlook.

Markets will therefore be eager to assess the non-farm payroll report on Friday for new clues as to the US labor market's health but will equally be focusing on Thursday's inflation data in the form of the PCE index, the core reading of which is the FOMC's favored inflation gauge.

In the eurozone, speculation is rife that the ECB could 'go large' with a 50 basis point cut in December amid signs of the economy struggling, but this would need the inflation data due out in the coming week to come in on the soft side, and for the third quarter advance GDP estimate to confirm the weak economic growth picture being portrayed by the PMI surveys.

An eye also needs to be kept on the worldwide manufacturing PMI which are updated during the week, and in particular the numbers for mainland China following recent government stimulus announcements.

Key diary events

Monday 28 Oct

New Zealand Market Holiday

Hong Kong SAR Trade (Sep)

Mexico Balance of Trade (Sep)

United States Dallas Fed Manufacturing Index (Oct)

Tuesday 29 Oct

Japan Unemployment Rate (Sep)

Germany GfK Consumer Confidence (Nov)

Sweden GDP (Q3, flash)

United Kingdom Mortgage Lending and Approvals (Sep)

United States Goods Trade Balance (Sep)

United States Wholesale Inventories (Sep)

United States S&P/Case-Shiller Home Price (Aug)

United States JOLTs Job Openings (Sep)

Wednesday 30 Oct

Australia Monthly CPI Indicator (Sep)

Australia Inflation (Q3)

Japan Consumer Confidence (Oct)

Eurozone GDP (Q3, flash)

Eurozone Economic Sentiment (Oct)

Mexico GDP (Q3, prelim)

United Staes ADP Employment Change (Oct)

United States GDP (Q3, adv)

Germany Inflation (Oct, prelim)

United States Pending Home Sales (Sep)

Thursday 31 Oct

Singapore, Malaysia Market Holiday

South Korea Industrial Production (Sep)

Japan Industrial Production (Sep, prelim)

Australia Retail Sales (Sep)

China (Mainland) NBS PMI (Oct)

Japan BOJ Interest Rate Decision

Germany Retail Sales (Sep)

France Inflation (Oct, prelim)

Taiwan GDP (Q3, adv)

Hong Kong SAR GDP (Q3, adv)

Eurozone Inflation (Oct, flash)

Eurozone Unemployment (Sep)

Italy Inflation (Oct, prelim)

Canada GDP (Aug)

United States Core PCE Price Index (Sep)

United States Personal Income and Spending (Sep)

Friday 1 Nov

India, Philippines, Sweden Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (1-4 Nov)

Australia Building Permits (Sep, prelim)

Indonesia Inflation (Oct)

United Kingdom Nationwide Housing Prices (Oct)

Switzerland Inflation (Oct)

Brazil Industrial Production (Sep)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly

Earnings (Oct)

United States ISM Manufacturing PMI (Oct)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing PMI releases

Global manufacturing PMI figures will be released across 1st to 4th November. Insights into the goods producing sector will be sought following early indications from flash PMI data across major developed economies, with close attention to be paid to demand and output performance after September data revealed a further deterioration of business conditions for manufacturers.

Americas: US Q3 GDP, labour market report, ISM manufacturing PMI, core PCE, JOLTs job openings, personal income and spending data

Key data releases in the fresh week include an advance reading of Q3 US GDP, non-farm payrolls and manufacturing PMI figures. According to the consensus, a stronger third quarter GDP reading is expected with the US having been a recent outperformer among developed economies according to PMI data. Meanwhile, job additions are expected to slow to reflect the cooling job market trend, but also capturing the effect from natural disasters in the US. This comes after the latest S&P Global Flash US PMI revealed that employment fell for a third straight month in October. Final manufacturing PMI readings will also be updated alongside the ISM Manufacturing reading on Friday. Additionally, the Fed's preferred inflation gauge, the core PCE reading will be released for September.

EMEA: Eurozone GDP, inflation, Germany GfK Consumer Confidence, UK mortgage lending, nationwide housing prices

The eurozone issues flash third quarter GDP data on Wednesday with subdued conditions having been alluded to by the latest PMI data. The most up-to-date October HCOB Flash Eurozone PMI further showed that the eurozone has remained stalled at the start of the fourth quarter, thereby outlining the risk for a GDP contraction into the end of the year. Meanwhile, flash PMI data revealed that eurozone prices rose at the slowest pace since early 2021 and continue to point to below-target inflation rates in the months to come. Preliminary eurozone October CPI figures will be watched to confirm the trend on Thursday.

APAC: BOJ meeting, China PMI, Australia CPI, Japan unemployment, industrial production, consumer confidence, Taiwan, Hong Kong SAR GDP

In APAC, the Bank of Japan (BOJ) convenes for their October meeting but with another rate hike only expected early next year. Falling business activity and rising selling price inflation in Japan adds to the dilemma, however.

Key data releases in the region meanwhile include China PMI, via both the Caixin and National Bureau of Statistics (NBS) readings, and also CPI data out of Australia.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-october-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-october-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+28+October+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-october-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 28 October 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-october-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+28+October+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-october-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}