Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 01, 2024

Week Ahead Economic Preview: Week of 4 November 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US election week, global PMIs, plus US and UK monetary policy meets

Markets in the coming week will be dominated by Tuesday's US Presidential Election, though there are plenty of other economic events to note. These include worldwide PMI survey data and a slew of monetary policy meetings, notably in the US and the UK.

Polling for the US Presidential Election closes on Tuesday 5 November, but the tightness of the race suggests that we may have to wait some time until a winner emerges. It took four days for the 2020 election to be declared. With the two candidates offering markedly different policy programs, notably in relation to trade and protectionism, the markets could see some considerable volatility amid speculation on the outcome as the result is awaited.

Meanwhile, Thursday sees monetary policy announcements from both the Federal Open Market Committee in the US and the Bank of England's Monetary Policy Committee in the UK. Markets are pricing in 25 basis point cuts from both.

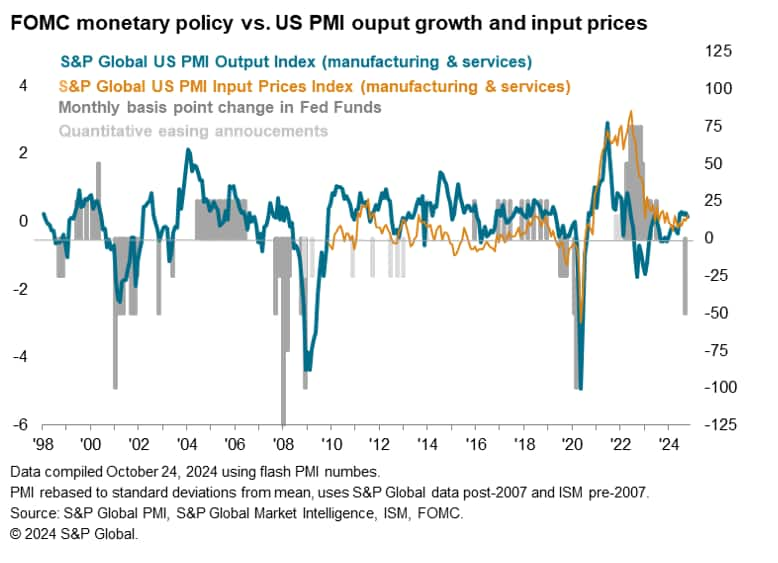

The FOMC cut, almost fully priced in by the markets, would take the fed funds rate to a range of 4.50-4.75%, adding to the policy loosening which commenced with September's 50 basis point cut. A further 25 basis point cut is also likely in December with further cuts through 2025 as inflation pressures continue to recede, albeit caveated by any possible changes to the Fed's outlook following the election.

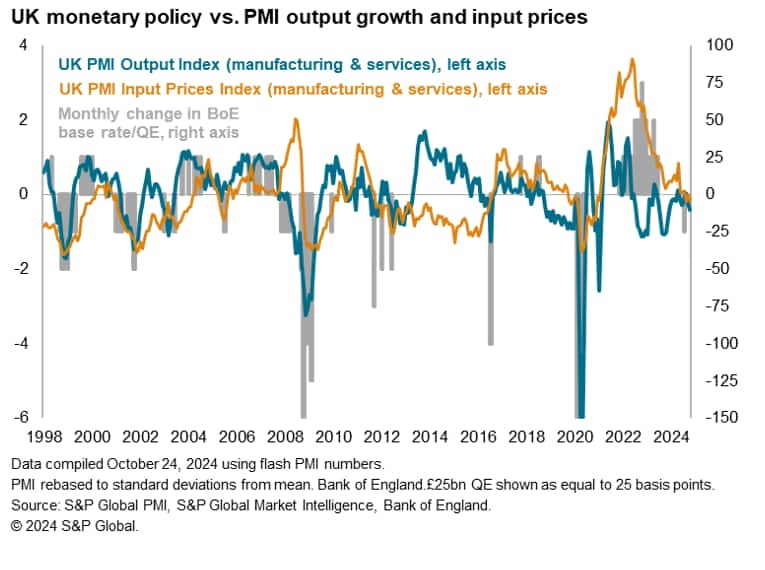

A widely anticipated quarter point cut by the Bank of England will take UK Bank Rate to 4.75% following a similar sized initial policy loosening back in August. However, markets have started to further pare back the UK central bank's scope to cut rates further over the coming year relative to other major economies following the new government policies announced in the Autumn Budget. The government's independent forecaster now sees inflation averaging 2.6% in 2025, up from a pre-Budget forecast of 1.5%.

From an economic data perspective, S&P Global's worldwide PMI surveys and the ISM's US polls will provide updated insights into manufacturing and service sector business conditions. Read our overview of September's PMI data here and a wrap-up of the early October flash PMIs here.

Key diary events

Monday 4 Nov

Japan Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (1-4 Nov)

Turkey Inflation (Oct)

United States Factory Orders (Sep)

Tuesday 5 Nov

United States Presidential Election

Worldwide Services, Composite PMIs and Detailed Sector PMI inc.

global PMI* (5-6 Nov)

South Korea Inflation (Oct)

Australia RBA Interest Rate Decision

Indonesia GDP (Q3)

Thailand Inflation (Oct)

Switzerland Unemployment Rate (Oct)

France Industrial Production (Sep)

Spain Unemployment Change (Oct)

Canada Trade (Sep)

United States Trade (Sep)

United States ISM Services PMI (Oct)

Wednesday 6 Nov

New Zealand Unemployment (Q3)

Japan BoJ Meeting Minutes (Sep)

Germany Factory Orders (Sep)

Malaysia BNM Interest Rate Decision

Taiwan Inflation (Oct)

United Kingdom Construction PMI* (Oct)

Brazil Trade (Oct)

Canada BoC Summary of Deliberations (Oct)

Brazil Banxico Interest Rate Decision

Thursday 7 Nov

Australia Trade (Sep)

China (Mainland) Trade (Oct)

Germany Trade (Sep)

Germany Industrial Production (Sep)

United Kingdom Halifax House Price Index* (Oct)

Eurozone Construction PMI* (Oct)

Sweden Riksbank Rate Decision

Norway Norges Bank Interest Rate Decision

Eurozone Retail Sales (Sep)

Mexico Inflation (Oct)

United Kingdom BOE Interest Rate Decision

United States FOMC Interest Rate Decision

Friday 8 Nov

France Trade (Sep)

Taiwan Trade (Oct)

China (Mainland) Current Account (Q3, prelim)

Italy Industrial Production, Retail Sales (Sep)

Brazil Inflation (Oct)

Canada Unemployment (Oct)

United States UoM Sentiment (Nov, prelim)

Saturday 9 Nov

China (Mainland) Inflation (Oct)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide services, composite and detailed sector PMI

The release of Global Manufacturing PMI numbers on Monday will be followed by worldwide services and composite PMI numbers across November 5-6. Services performances will eagerly awaited after flash PMI showed growth for the world's major developed economies, the 'G4' economies, softening on the back of deteriorating manufacturing sector conditions, though holding up well for the US. Detailed sector data will also be released in the week for insights into the key areas of growth and weakness.

Americas: US election, FOMC meeting, ISM services PMI, Canada trade and employment data

The US Presidential Election will dominate the week in light of the economic implications attached to the outcome, especially pertaining to the outlook for fiscal and trade policies. We also have the November Federal Open Market Committee (FOMC) meeting unfolding in the week and a 25-basis point rate cut widely expected, though that has been fully priced in by the market ahead of the meeting according to the CME FedWatch tool. The rhetoric on the future rate path remains a key area of focus, albeit likely to be overshadowed by the election.

Additionally, ISM services PMI will be due on Tuesday ahead of the preliminary University of Michigan consumer sentiment reading on Friday.

EMEA: BOE meeting, Eurozone Construction PMI, retail sales, Germany trade, UK House Price Index, Turkey inflation

The Bank of England (BOE) convenes for their November meeting and is widely expected to resume lowering interest rates after keeping the Bank Rate unchanged at 5% earlier in September. <span/>The latest October Flash UK PMI showed the cooling of input cost inflation, providing further room for the BOE to further lower interest rates, with the following rate cut likely in January 2025 according to the markets.

On the data front, besides PMI data releases, eurozone retail sales and Germany trade data will be in focus.

APAC: RBA, BNM meetings, mainland China trade and inflation data, Australia trade, South Korea, Philippines, Thailand inflation figures

Central bank meetings in Australia and Malaysia take place in the week but no changes in monetary policy settings are expected according to consensus. Meanwhile key data releases include trade and inflation figures due out of mainland China. Australia's trade numbers will also be updated in addition to a series of CPI data from the region.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-november-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-november-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+4+November+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-november-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 4 November 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-november-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+4+November+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-4-november-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}