Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2023

Week Ahead Economic Preview: Week of 6 March 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy week ahead culminates with the US labour market report. Prior to which, key data releases include China's inflation and trade figures and GDP readings from the UK, eurozone, South Korea and Japan. Further colour on worldwide economic trends will also be sought via the S&P Global Sector PMI. Central bank meetings will meanwhile take place across Canada, Australia, Japan and Malaysia.

The US equity market embodied cautious risk sentiment across February, seeing major US indices concluding the month lower than where they started. This was congruent with advance indications from our S&P Global Investment Manager Index (IMI). To a large extent, the worries - especially over the macroeconomic environment and central bank policy - had already been visible from the IMI survey and only further intensified with the better-than-expected US PMI releases. The surveys left investors mulling the resilient growth and still-elevated inflation indications, and consequent upward revisions to central bank peak rates.

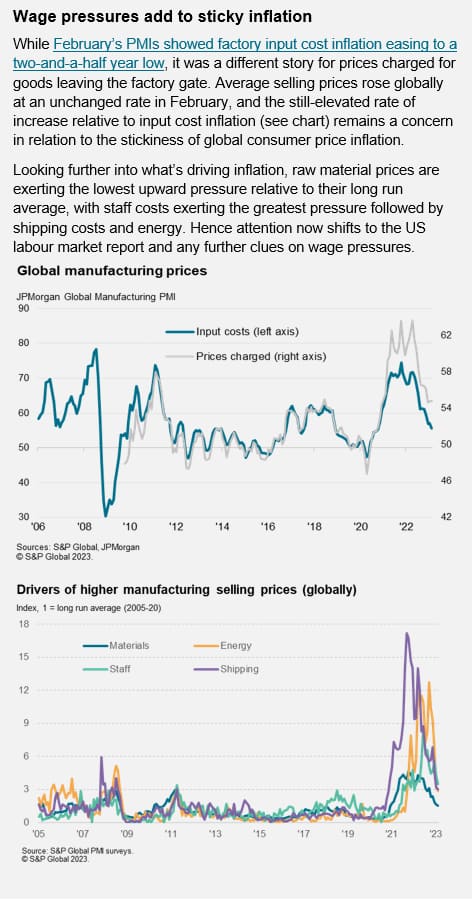

Amid the ongoing scrutiny of growth and inflation developments, the key focus next week will be on February's US labour market report. Another surge in non-farm payrolls, such as the 517k reading in January, or an acceleration in earnings growth, may further dampen market sentiment in the current "good news is bad news" environment.

In Europe, watch out for Germany's industrial production data, eurozone GDP for the fourth quarter and the first official GDP data on the UK economy so far this year.

Meanwhile in Asia Pacific, central banks in Australia, Japan and Malaysia join the Bank of Canada in updating monetary policy in the coming week. The Reserve Bank of Australia (RBA) will be watched especially closely for the possibility for another increase of its cash rate. This comes after PMI figures indicated that the Australia economy continue to hold up in early 2023 and with regional activity showing improvements into February, such as in mainland China's manufacturing sector. China's CPI, PPI and trade figures will also be due for the first time of 2023, showing January and February conditions. These numbers will offer the first official indications of mainland China's reopening effect following the rebound seen in PMI numbers.

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-march-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-march-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+6+March+2023+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-march-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 6 March 2023 | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-march-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+6+March+2023+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-march-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}