Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2023

Week Ahead Economic Preview: Week of 6 March 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US labour market report and China data in focus

A busy week ahead culminates with the US labour market report. Prior to which, key data releases include China's inflation and trade figures and GDP readings from the UK, eurozone, South Korea and Japan. Further colour on worldwide economic trends will also be sought via the S&P Global Sector PMI. Central bank meetings will meanwhile take place across Canada, Australia, Japan and Malaysia.

The US equity market embodied cautious risk sentiment across February, seeing major US indices concluding the month lower than where they started. This was congruent with advance indications from our S&P Global Investment Manager Index (IMI). To a large extent, the worries - especially over the macroeconomic environment and central bank policy - had already been visible from the IMI survey and only further intensified with the better-than-expected US PMI releases. The surveys left investors mulling the resilient growth and still-elevated inflation indications, and consequent upward revisions to central bank peak rates.

Amid the ongoing scrutiny of growth and inflation developments, the key focus next week will be on February's US labour market report. Another surge in non-farm payrolls, such as the 517k reading in January, or an acceleration in earnings growth, may further dampen market sentiment in the current "good news is bad news" environment.

In Europe, watch out for Germany's industrial production data, eurozone GDP for the fourth quarter and the first official GDP data on the UK economy so far this year.

Meanwhile in Asia Pacific, central banks in Australia, Japan and Malaysia join the Bank of Canada in updating monetary policy in the coming week. The Reserve Bank of Australia (RBA) will be watched especially closely for the possibility for another increase of its cash rate. This comes after PMI figures indicated that the Australia economy continue to hold up in early 2023 and with regional activity showing improvements into February, such as in mainland China's manufacturing sector. China's CPI, PPI and trade figures will also be due for the first time of 2023, showing January and February conditions. These numbers will offer the first official indications of mainland China's reopening effect following the rebound seen in PMI numbers.

Wage pressures add to sticky inflation

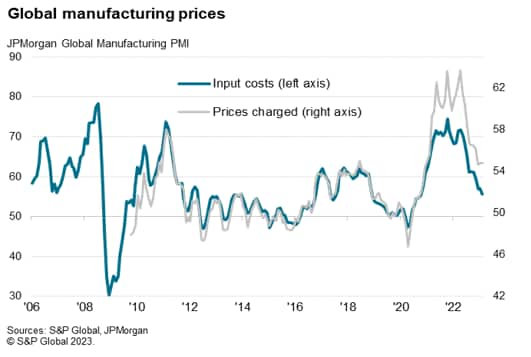

While February's PMIs showed factory input cost inflation easing to a two-and-a-half year low, it was a different story for prices charged for goods leaving the factory gate. Average selling prices rose globally at an unchanged rate in February, and the still-elevated rate of increase relative to input cost inflation (see chart) remains a concern in relation to the stickiness of global consumer price inflation.

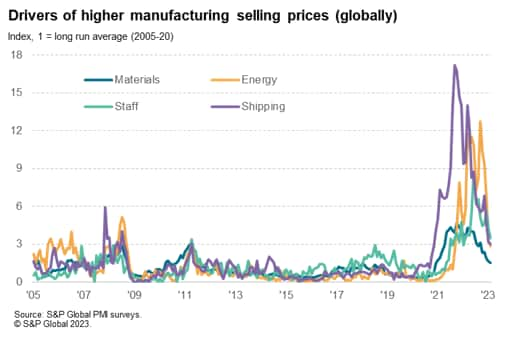

Looking further into what's driving inflation, raw material prices are exerting the lowest upward pressure relative to their long run average, with staff costs exerting the greatest pressure followed by shipping costs and energy. Hence attention now shifts to the US labour market report and any further clues on wage pressures.

Key diary events

Monday 6 March

Thailand Market Holiday

South Korea CPI (Feb)

Switzerland CPI (Feb)

Eurozone S&P Global Construction PMI* (Feb)

Germany S&P Global Construction PMI* (Feb)

United Kingdom S&P Global/CIPS Construction PMI* (Feb)

Eurozone Retail Sales (Jan)

United States Factory Orders (Jan)

S&P Global Sector PMI* (Feb)

Tuesday 7 March

India Market Holiday

South Korea GDP (Q4, revised)

Australia Trade Balance (Jan)

Philippines CPI (Feb)

China (Mainland) Trade (Feb)

Australia RBA Cash Rate (Mar)

Thailand CPI (Feb)

United Kingdom Halifax House Prices* (Feb)

Norway Manufacturing Output (Jan)

Germany Industrial Orders (Jan)

Taiwan CPI and Trade (Feb)

United States Wholesale Inventories (Jan)

S&P Global Metals and Electronics PMI* (Feb)

Wednesday 8 March

Japan Current Account (Jan)

Germany Industrial Production and Retail Sales (Jan)

Eurozone GDP (Q4, revised)

United Kingdom KPMG / REC UK Report on Jobs* (Feb)

United States ADP National Employment (Feb)

United States International Trade (Jan)

Canada Trade Balance (Jan)

United States JOLTS Job Openings (Jan)

Canada BoC Rate Decision (8 Mar)

Thursday 9 March

Japan GDP (Q4, revised)

United Kingdom RICS Housing Survey (Feb)

China (Mainland) CPI, PPI (Feb)

Malaysia Overnight Policy Rate

United States Initial Jobless Claims

Friday 10 March

Germany CPI (Feb, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Jan)

United Kingdom Goods Trade Balance (Jan)

Norway CPI (Feb)

India Industrial Output (Jan)

United States Non-Farm Payrolls, Unemployment, Average earnings

(Feb)

Canada Unemployment Rate (Feb)

Japan BOJ Rate Decision (10 Mar)

China (Mainland) M2, New Yuan Loans, Loan Growth (Feb)

GEP Global Supply China Volatility Index* (Feb)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Global Sector, Metals and Electronics PMI data

Following the global manufacturing and services PMI releases, detailed global sector PMI - including US, Europe and Asia splits - will be updated to provide another lens for viewing the latest economic developments. Data from the previous sector PMI release in January presented a mixed picture for global growth at the start of 2023, with consumer activity supported by good weather and mainland China's reopening, while financial services activity was weighed by higher rates, notably in the US.

Americas: US labour market report, BoC meeting

February's US labour market report will be the key data release next week. After January's blockbuster 517k gain, the consensus is looking for a gain of around 200k. Any unexpected strength will naturally pile more pressure on the Fed to keep hiking. There seems to be a lot of noise in the series, however, meaning stand ready for potential upside or downside surprises and possible revisions to back data.

Separately, the Bank of Canada convenes on Wednesday when it is widely expected to keep rates on hold after the economy stalled in the Fourth quarter.

Europe: Eurozone GDP, UK output figures

In Europe, a revised eurozone Q4 GDP estimate will be released on Wednesday after the earlier estimate suggested the region avoided recession with a 0.1% gain. That said, the attention will likely be with the UK monthly GDP and sector output numbers for January, due Friday. Market reactions towards the February flash UK PMI, which indicated growth for the first time in seven months, underscored market concerns of higher interest rates, meaning the official output figures will also be watched closely for evidence of the economy's resilience.

Asia-Pacific: RBA, BoJ, BNM meetings, China CPI, PPI, trade data, South Korea, Japan GDP figures

Central bank meetings will unfold in APAC economies including Australia, Japan and Malaysia. While the consensus indicates no change in Japan and Malaysia, the Reserve Bank of Australia (RBA) may hike rates. China's inflation figures, loans and trade data will also be closely watched as the first official releases of the year and assessed for any impact of the reopening of the economy.

Special reports

Global Factory Output Returns to Growth Amid China's Reopening and Supply Chain Improvements - Chris Williamson

India's Economic Growth Moderates in Last Quarter of 2022 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-march-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-march-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+6+March+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-march-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 6 March 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-march-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+6+March+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-march-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}