Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 11, 2020

Weekly Pricing Pulse: Commodities finally yield after weeks of downside pressure

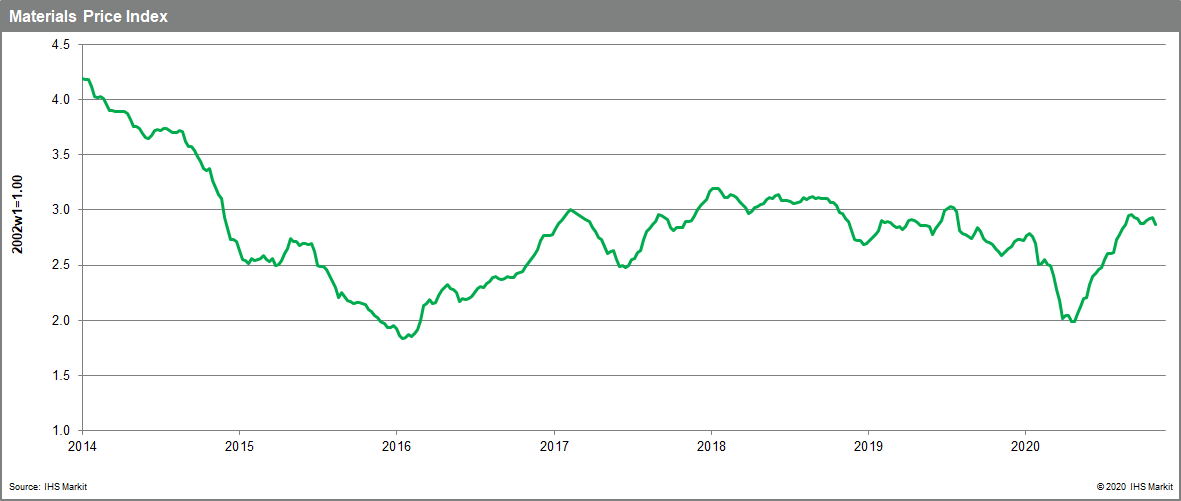

Commodity prices, as measured by our Materials Price Index (MPI), dropped 2.3% last week in a broad-based retreat that saw eight of the index's components fall. The MPI's decline ran counter to equity markets, which had their best post-election week since 1932, on optimism that at least one unknown has been removed from the outlook with the possibility that some sort of second stimulus package will be forthcoming before year-end.

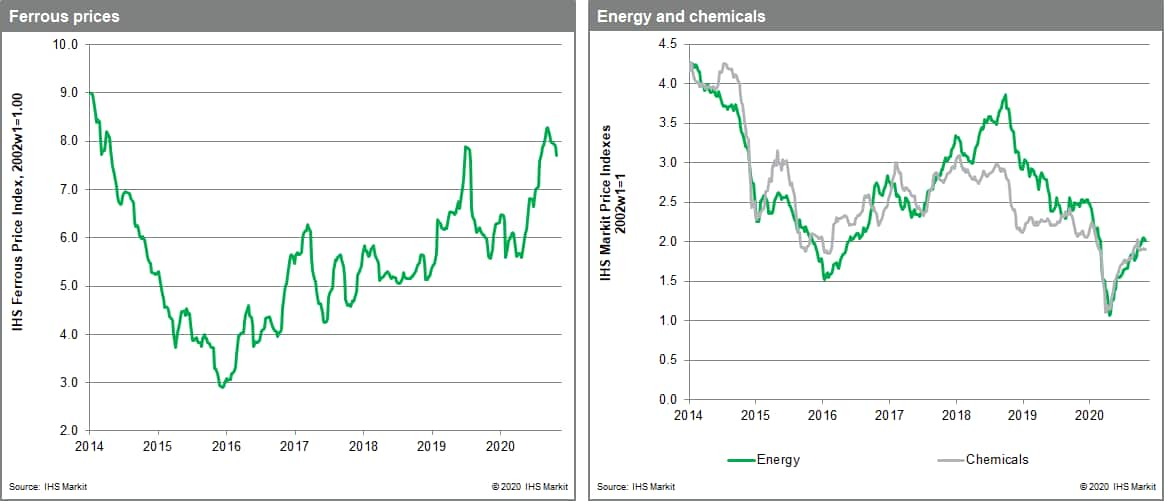

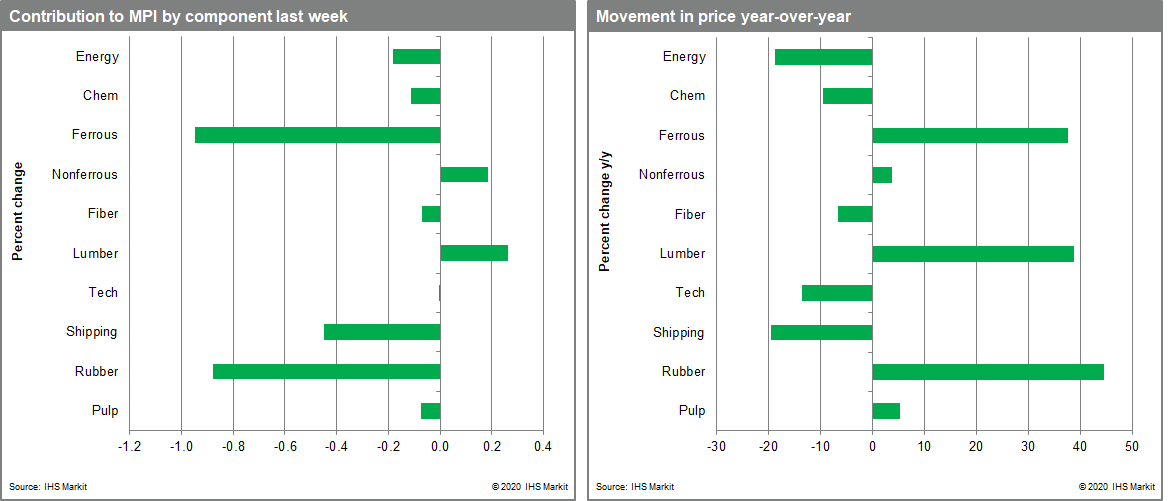

Rubber dominated moves in the MPI, reversing also all of the previous week's 18.0% gain by falling 17.5% as traders took profits. Tight underlying fundamentals should keep rubber prices supported in the short-term, however. Bulk freight rates fell 11.5% on the better availability of Capesize vessels and sharply slower exports from Brazil last week. Steel raw materials also fell 2.3% on slower Chinese imports as well as higher iron ore port stocks in mainland China, which reached 128 MMt, up from a 2020 low of 107 MMt. Energy fell 1.6% as natural gas dropped 6.0% following its recent surge. Oil also dipped 0.6% due to OPEC prices falling on concerns that a Biden presidency might ease sanctions on Iranian crude exports. Counterintuitively, Brent and WTI both rose on improving risk asset demand following the Biden win. Lumber prices appear to have found a floor, rising 8.5% last week after falling 45% from a record-high in early September. Non-ferrous metals prices rallied 2.0%, chiefly on aluminium price increases, which rose by more than 3.0% last week. Aluminium has felt a pull from China, where good consumption growth is drawing metal from the rest of the world.

The US presidential election dominated markets last week. Stock prices rose as the week progressed and it became clearer that the Democrat, Joe Biden, would be elected president. Incomplete down-ballot election results, however, suggest Republicans might retain a narrow majority in the US Senate, implying a divided government. While this clouds the outlook for additional fiscal support in the next two years, Senate majority leader McConnell (Republican) expressed interest in working on a narrow fiscal package during the lame-duck session of Congress. A definitive result in the presential election with the prospect for some sort of fiscal stimulus was enough for equity markets (and commodity markets at the very end of the week) to take a glass half full view of the near future. The question is whether rapidly rising COVID-19 case counts in Europe and North America will now blunt this optimism.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-yield-after-downside-pressure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-yield-after-downside-pressure.html&text=Weekly+Pricing+Pulse%3a+Commodities+finally+yield+after+weeks+of+downside+pressure+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-yield-after-downside-pressure.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities finally yield after weeks of downside pressure | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-yield-after-downside-pressure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+finally+yield+after+weeks+of+downside+pressure+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-yield-after-downside-pressure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}