Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 27, 2022

Weekly Pricing Pulse: Commodity prices rebound

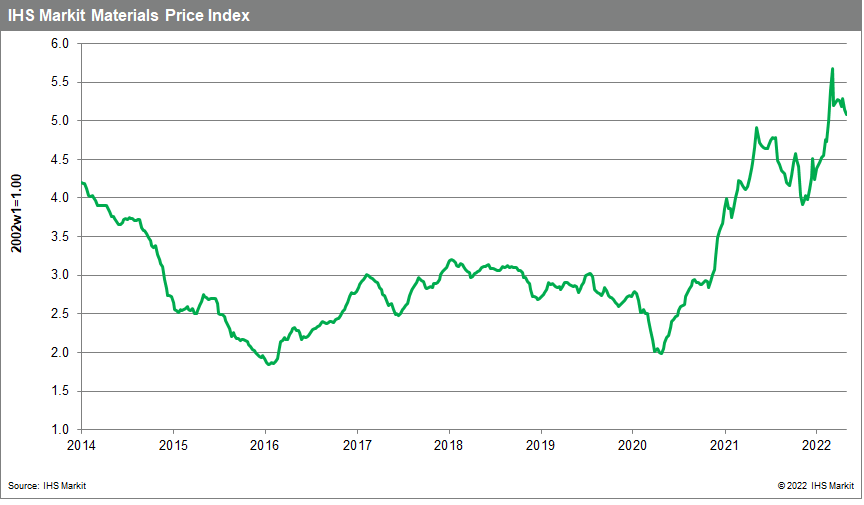

Our Materials Price Index (MPI) rose 2.0% last week, with six of the index's ten sub-components increasing. This was only the second weekly increase since the start of April and followed three successive weekly declines. This recovery in prices is at odds with the general pessimism running through markets as interest rates rise and global growth prospects recede. Even though the MPI has pushed higher in the last two weeks, it is still 12.7% lower than the all-time high established in early March.

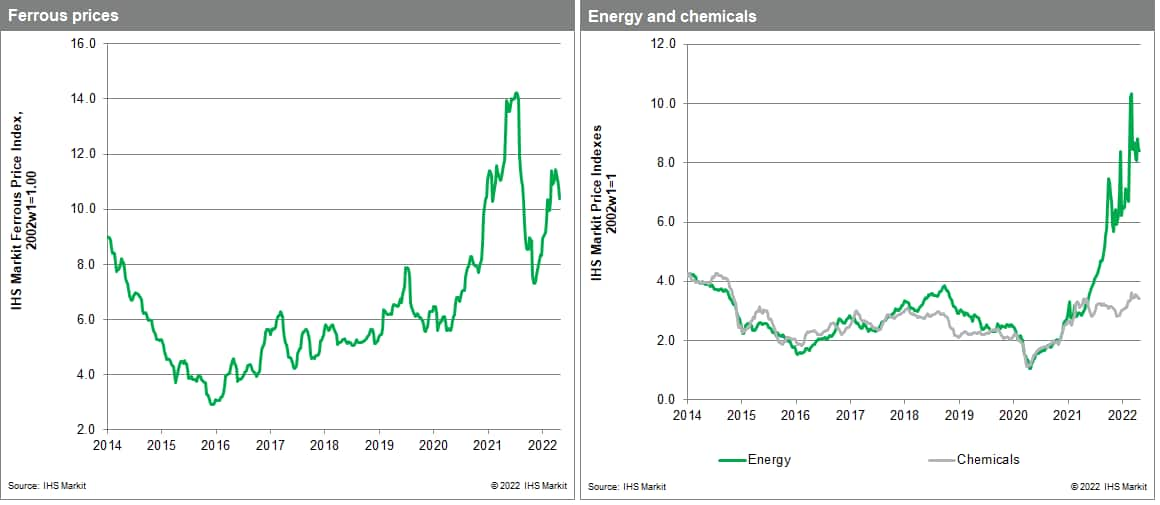

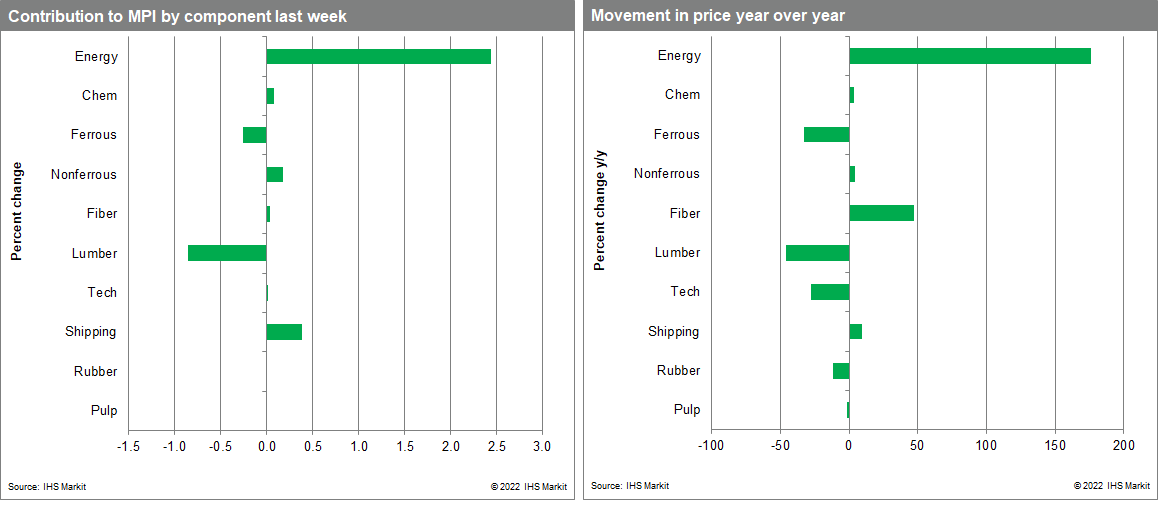

A broad rise in energy prices pushed the overall MPI higher last week. Non-energy prices were in fact down by 0.6% last week. However, coal, oil and natural gas all increased, with the energy sub-index climbing 9.8%, its biggest weekly increase since late February in the immediate aftermath of Russia invading Ukraine. Global coal prices remain at record highs with logistical issues in Europe stemming from low water levels in the Rhine the latest problem to impact the industry. This coincided with India scrapping import duties on coking coal to help domestic industry, which provided further support for prices. Oil prices also showed strength last week with Brent Crude, the international benchmark, reaching $114 per barrel up from $102 the week before. Prices jumped on news that mainland China plans to fully re-open the city of Shanghai on the 1st of June following several weeks of strict lockdowns. This optimistic tone did not extend to lumber markets, as US lumber prices recorded the second largest weekly decline in history, falling 23.7%. Prices fell to $734 per thousand board feet, the lowest in six months, as house sales slowed due to higher mortgage rates and soaring prices.

Equity markets briefly entered bear market territory last week with selloffs on a similar scale to the immediate aftermath of global COVID-19 lockdowns. This benefited commodity prices as investors sought to limit losses on stocks. Lower COVID-19 case numbers in mainland China also boosted sentiment among traders. However, fundamentals do not support a sustained increase in commodity prices at this point. Global growth is showing signs of slowing. Coupled with tighter financial markets and an eventual easing of supply bottlenecks, commodity prices should retreat, not increase over the next year. The caution in this optimistic view of commodity markets is that unwinding the cost pressures built up over the past two years in supply chains will take some time. Inflation is peaking now, though its decline may prove painfully slow.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rebound-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rebound-may.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rebound+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rebound-may.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rebound | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rebound-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rebound+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rebound-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}