Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 30, 2019

Weekly Pricing Pulse: The January recovery continues

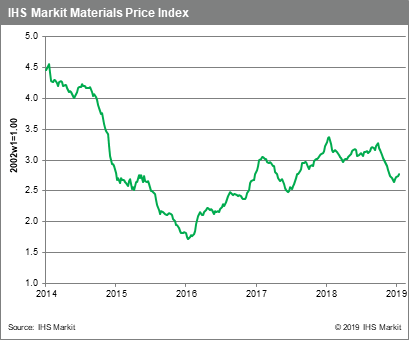

Despite warnings of slowing growth from central banks and concern about the lack of progress in the US-China trade talks, commodities as measured by our Materials Price Index (MPI) rose 0.8% last week. Markets were helped by a weaker dollar and some optimism that stimuli recently deployed by Chinese authorities would be enough to support demand.

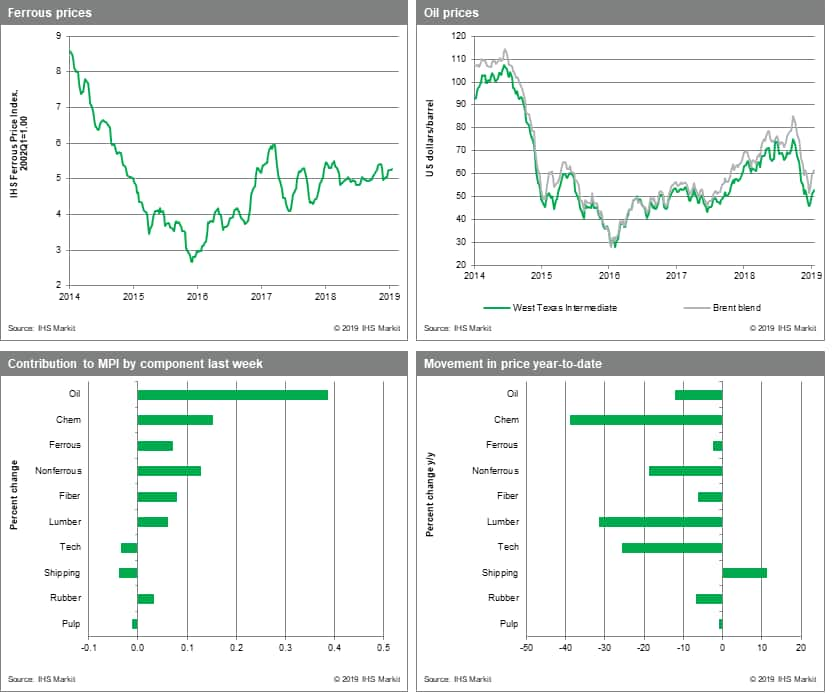

Oil prices increased 2.3% w/w even though the market was buffeted by cross currents. Fears of weaker global demand growth were offset by projected production cuts by the Vienna Alliance, though the wildcard of US production growth continues to hang over the market and was enough to temper crude price gains last week. Non-ferrous prices performed well rising 1.9% w/w - of big base metals, only copper failed to register a price increase for the week. Lumber prices were up, 2.9% w/w, supported by shutdowns at key sawmills in British Colombia, the result of persisting supply, cost and tariff pressures in the lumber market. The ferrous metal sub-index rose a small 0.3% last week, but has upside potential. Although iron ore prices are relatively high, the accident at Vale's Córrego do Feijão mine in Brazil opens the possibility that the company's wider operations could be affected by government, as seems likely, conduct broader environmental reviews.

While commodities have enjoyed a small bounce in January, there is also a lack of conviction in the market's recent recovery. Incoming data continues to show a waning expansion in global manufacturing while trade tensions continue to mount. The next six weeks will renew focus on Brexit and US-China trade negotiations, the outcomes of which will set the tone in markets for the rest of 2019. For now, markets appear to be approaching both with guarded optimism, though what seems unthinkable now - a hard Brexit and full-blown US-China trade war - are still possible.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-january-recovery-continues.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-january-recovery-continues.html&text=Weekly+Pricing+Pulse%3a+The+January+recovery+continues+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-january-recovery-continues.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: The January recovery continues | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-january-recovery-continues.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+The+January+recovery+continues+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-the-january-recovery-continues.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}