Continued focus on shareholder returns means there will be no upstream activity recovery in 2020

In 2019, operators struggled to manage the dual pressures of maintaining production to ensure consistent revenues and ensuring that shareholders felt they were receiving adequate returns for their investments. How any given operator coped is up for discussion, but objectively speaking, overall production did grow (despite the new paradigm and increasing attention paid to the upcoming " energy transition"), but the upstream environment was difficult - especially for service companies - and everyone wondered when the next upturn would come. IHS Markit has just released its Q1 WellIQ report, and in summary unfortunately we do not expect any significant upturn until the beginning of 2022.

In the short term, Q1 2020 will be the starting point of the new "maturity" era in the North American shale industry, with continued attention directed towards minimizing any remaining inefficiencies, reducing operational costs, maintaining favorable credit ratings, returning cash to investors, and developing corporate strategies to weather the storm of increased volatility and stifled oil prices.

While Drilled Uncompleted wells (DUC) have fallen out of favor as the industry's most talked about topic, they still have a role to play. Indeed, per IHS Markit's Plays & Basins team "The number of "excess" DUCs remains overestimated in the mainstream press, but even with a relatively modest contribution of 10-20% of new wells onstreamed, DUC conversion constitutes an important element of 2020 growth".

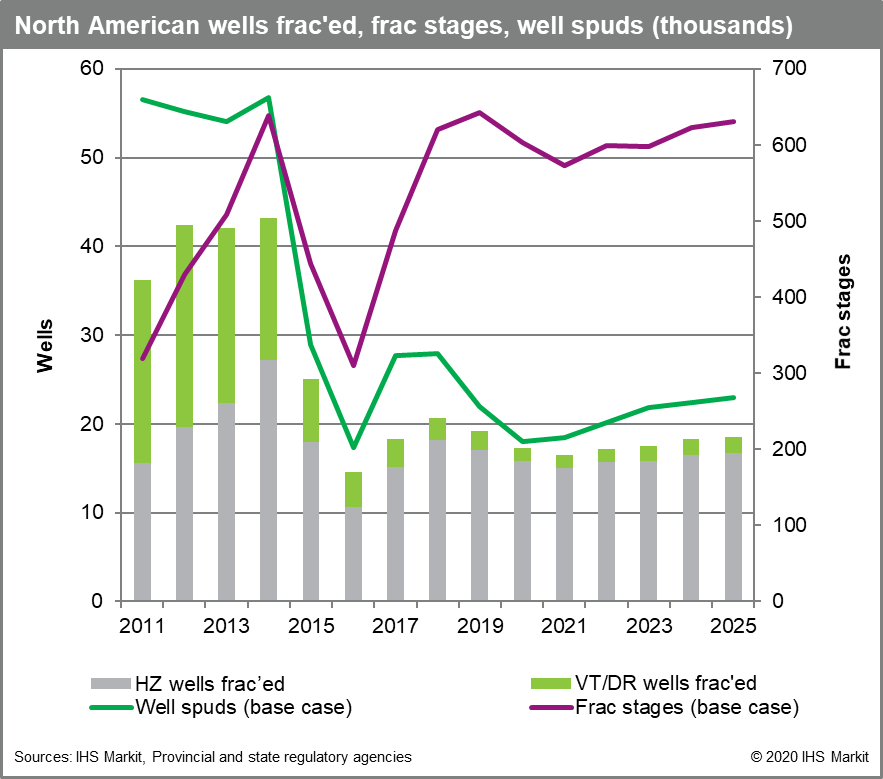

Figure 1: IHS Markit projections for North American upstream

activity

In the medium term, the next two years will be revealing for the industry, as only those companies which have truly adapted to these lean times will continue to exist. The downward transition that we expect over the next two years will see a roughly 11% drop in North American frac stages from the yearly peak in 2019 to the projected bottom in 2021.

Turning briefly to Canada, we do not currently see any new developments that would cause a drastic upturn in unconventionals activity. These types of development are relatively de-localized and are currently not the most material money-makers for Canada (that title goes to large oil sands developments which are now quite profitable). Regardless, IHS Markit expects DUCs to be brought online in 2021 due to the end of the Alberta government's oil production curtailment, which is set to expire in mid-2020.

We provide full details regarding North American upstream activity in our WellIQ report, which is open to subscribers of IHS Markit's Onshore Services & Materials offering. Learn more about our WellIQ service.

Jesus Ozuna is a Principal Research Analyst at IHS Markit.

Posted 13 February 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.