Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 02, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Shorts surged in Canadian lender Home Capital Group ahead of recent plunge

- Fingerprint Card short seller took profits after the firm pulls its guidance

- Chemical firm OCI highest conviction Asian firm announcing earnings

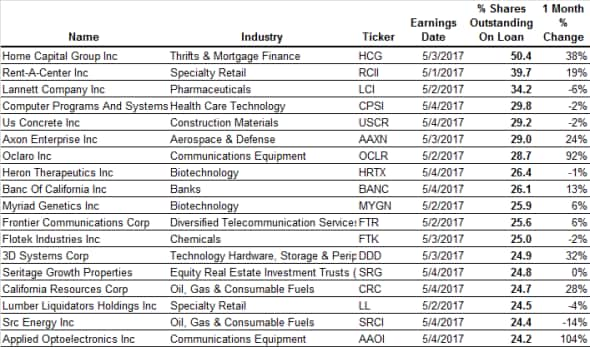

North America

The post election bull market has made it tough going for short sellers over the last few months. Yet despite the tough macro environment for contrarian investors, shorts have still managed to correctly call several of this year's worst stock collapses as evidenced last week in Canadian mortgage lender Home Capital Group. The company's stock fell by over 60% last week after the firm announced that it was seeking emergency liquidity to plug a gap in its balance sheet left by a recent depositor withdrawals. This was only the latest in a string of bad news however as the Canadian market regulator had previously accused the company of misleading investors in its disclosures which sent its shares down sharply. Short sellers, who were already very active in Home Capital Group's shares, increased their bets in the wake of the recent allegations which meant that over 50% of the lender's shares were out on loan just before last week's collapse. These events will no doubt make this week's earnings announcement a bit of a non-event for short sellers given that Home Capital Group shares have already lost three quarter of their value year to date.

The large amount of capital committed by Home Capital short sellers in recent weeks is far from a one off event as the majority of the most shorted firms ahead of earnings have seen large increases in the demand to borrow their shares in the month leading up to earnings which indicates that short sellers are still very much active in the current market.

Communications equipment firms Applied Optoelectonics and Oclaro are two firms which have felt the worst deterioration in investor sentiment ahead of earnings as demand to borrow both firms' shares has doubled over the last month. The firms now have 29% and 24% of their shares out on loan respectively.

Telecommunication short sellers have also been actively targeting mobile operators as Frontier Communications has over a quarter of its shares out on loan. This consistently high short interest comes despite the fact that Frontier shares have lost over 75% of their value from their peak in 2015. This skepticism is mirrored by sell side analysts who aren't the company to turn a quarterly profit until at least Q4 2018.

3D printing firm 3D Systems, which has rallied strongly from its lows set in Q1 2016, is another firm to come under short seller's scrutiny heading into Q1 earnings season as demand to borrow its shares has climbed by over a third in the last month to 25% of shares outstanding.

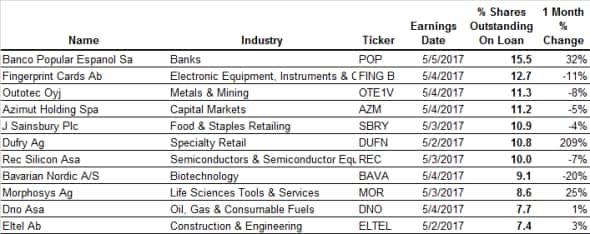

Europe

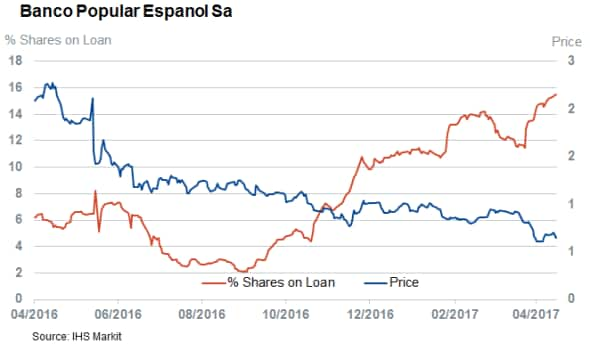

European short sellers have singled our Spanish bank Banco Popular as their highest conviction short among the region's firm announcing earnings this week. While Banco Popular has been a short target for some time now, demand to borrow the firm's shares has reached fever pitch over the last month after its debt was downgraded by ratings agency Moody's owing to its deteriorating capital position. This report prompted short sellers to increase their bets by a third to an all-time high 15.5% of shares outstanding.

Fingerprint Cards, sees itself as the second most shorted European company ahead of earnings as it has 12.7% of its shares out on loan ahead of its first quarter earnings announcement on Thursday. Short sellers have already profited from the company's first quarter as Fingerprint Cards pulled its profit and margin guidance back in March citing weak demand from OEM customers. The days following the announcement saw Fingerprint Card shares lose over a third of their value and short sellers, which had borrowed an all-time high 23% of the company's shares prior to the profits warning, have started to take profits off the table from their Fingerprint short as demand to borrow has since fallen by 40%.

Supermarket firm Sainsbury's is the only UK traded firm to feature among the 10 most shorted firms announcing earnings in Europe this week. Although fairly negative owing to its large short interest, Sainsbury's investor sentiment has brightened somewhat in recent weeks as demand to borrow its shares has recently hit the lowest in over two and a half years.

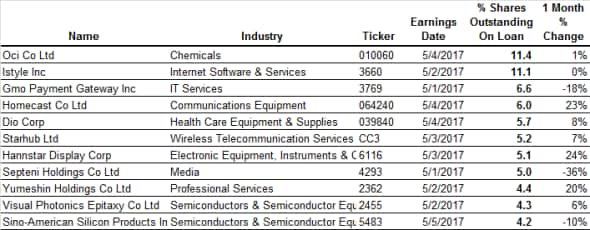

Asia

The high conviction short in Asia this week is South Korean chemical manufacturer OCI which has 11.4% of its shares out on loan. OCI has a large exposure to the solar industry as it supplies polysilicon, a fundamental building block of solar panels, and the slowing demand from the world's largest solar panel installer, China, threatens to compound the industry's ongoing glut of manufacturing capacity. Despite these potential operational headwinds, OCI short sellers have trimmed their positions somewhat as demand to borrow its shares has fallen by nearly a third from the highs set in Q3 last year.

Tech firms make up the vast majority of the 10 remaining short targets announcing earnings next week with Japanese web marketer iStyle the most shorted of the lot as it has 11.4% of its shares outstanding on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}