Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 02, 2015

Biotech gives shorts healthy boost in August

A sharp retreat from the US Biotech sector since mid-July 2015 has rewarded short sellers actively playing the sector despite six months of losses.

- US biotech average short interest rises to 7.3%, remains second only to energy

- Infertility drug maker Ovascience shares fall by 38% as short sellers continue campaign

- Short sellers show conviction in Myriad Genetics, the most shorted name in biotech

Dizzying heights

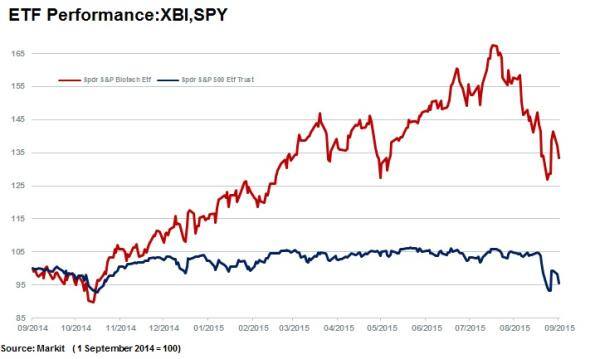

The US biotech sector has dropped 20% from an impressive peak reached in mid-July 2015. Despite the selloff, measuring the sector's performance using the S&P Biotech ETF, the sector is up 15%, this year, outpacing the market. Additionally, the sector is up by 33% over the last 12 months.

Short seller's patience rewarded

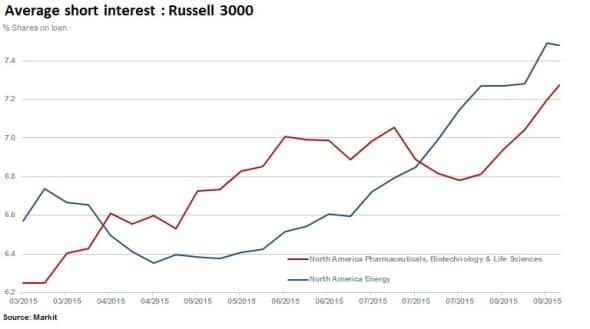

According to Markit Securities Finance data, short sellers have keenly followed the biotech sector in 2015, increasing positions recently with average short interest rising to 7.3% in the last few months. This makes the sector the second most shorted behind the energy sector.

Although 88% of the Russell 3000 biotech names fell in the past month, those that fell by a greater margin than their peers were 46% more short sold than the sector average short interest. This indicates that short sellers were largely successful in targeting the falling names of sector over the recent sell off.

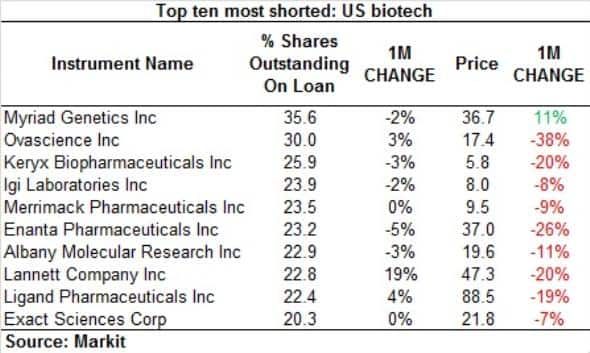

On the most shorted end of the spectrum, nine out of the 10 most shorted names have seen their price retreat in the last month; Myriad Genetics being the only holdout.

One of the most short sold names currently is Ovacience with 30% of shares outstanding on loan. The stock has fallen by a dramatic 38% in the past month, with short sellers adding 3% to positions. The company is developing new in vitro fertilisation techniques to improve fertility rates but testing data has failed to impress investors thus far.

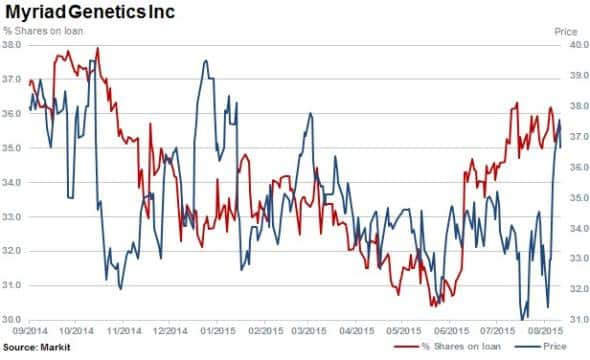

With 36% of shares outstanding on loan, perennial biotech short, Myriad Genetics, remains the most shorted name in the sector.

The stock rallied in August by 11% but short sellers were undeterred and continue to hold their positions. Demand to short Myriad is also strong and has sent the benchmark fee above 10%, one of the highest in the sector.

Short sellers have increased positions in Lannett by 19%, the most over the past month. Shares outstanding on loan currently stand at 22.8%, increasing through the stock's recent fall.

Big four sell off

The "big four' of biotech were also hit hard by the recent biotech selloff; declining on average by 13% in August. These larger firms measured in market value attract less than 0.5% in short interest. Nevertheless, there is still $880m of short value on loan across the big four alone.

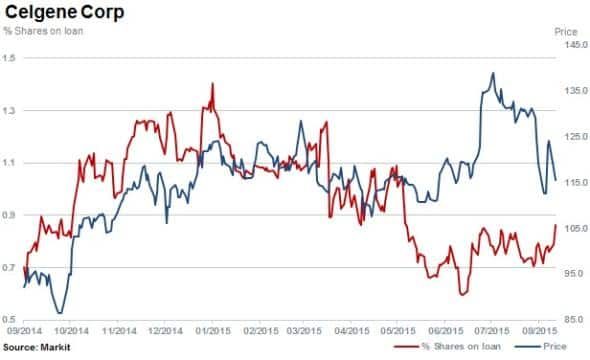

In context the sectors most short sold name, Myriad Genetics, currently has $670m of value currently on loan. Celgen makes up the bulk of the total big four value on loan with nearly $500m held by short sellers.

Celgene shares are currently up 25% over the past 12 months but down 12% since the beginning of August.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-equities-biotech-gives-shorts-healthy-boost-in-august.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-equities-biotech-gives-shorts-healthy-boost-in-august.html&text=Biotech+gives+shorts+healthy+boost+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-equities-biotech-gives-shorts-healthy-boost-in-august.html","enabled":true},{"name":"email","url":"?subject=Biotech gives shorts healthy boost in August&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-equities-biotech-gives-shorts-healthy-boost-in-august.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Biotech+gives+shorts+healthy+boost+in+August http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092015-equities-biotech-gives-shorts-healthy-boost-in-august.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}