Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 06, 2016

US gun shorts retreat as sales surge

The prospect of increased gun control in the US has not fazed equity investors, with shares in the two listed gun makers hovering near recent highs while short sellers duck for cover.

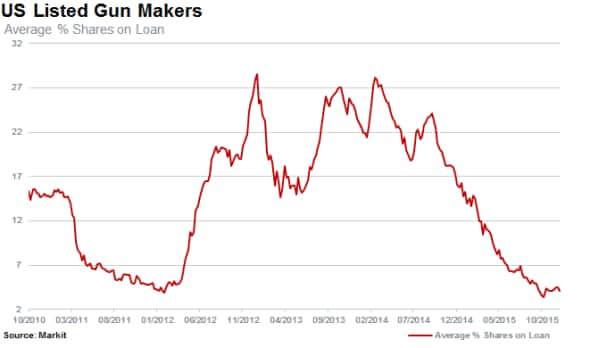

- Short interest in gun makers now at three year low of below 5%

- Smith & Wesson shares reach all-time high as short interest touches decade low

- Sturm Ruger short interest at just one third of the levels seen in 2015

US listed gun makers ended 2015 on a high after a record number of Americans had their backgrounds checked by the National Instant Criminal Background Check System in December. This surge in activity in the closing month of the year, which provides a proxy for overall gun sales, pushed 2015 to a new record high for the industry as total background checks overtook the previous record seen in 2013. 2015 also marked a profitable year for gun maker shareholders as Smith & Wesson and Sturm & Ruger shares both outperformed their peers in in the wider aerospace and defence sector over the last 12 months.

The strong momentum in these two stocks has continued into the new year as fresh proposals and executive actions by US president Obama to tighten gun control in the country has propelled them 10% in 2016 so far. While Obama's proposed legislation has the potential to curb gun sales, the Republican-controlled congress' lack of enthusiasm on the topic means that any action is unlikely to fully come into law. Furthermore, previous proposed curbs have had the adverse effect on sales as customers rushed to get ahead of any legislation which could restrict their ability to own guns.

The current trend looks set to see of repeat of the stock movements seen in January 2013; the last time president Obama proposed to restrict gun sales.

Shorts cover

Unlike 2013 however, short sellers have shown little appetite to play the sector as both listed firms now see a recent low demand to borrow their shares at less than 5% of shares outstanding. Current demand to borrow the gun makers, stands at a fifth of the levels seen the last time gun control stood on the legislative agenda.

Smith & Wesson shares embody this perverse logic both on the long and short side. The stock hit an all-time after Obama's actions came to light.

Short sellers have shown little appetite to stand on the opposing side given that demand to borrow the firm's shares stands at 2.8% of shares outstanding; lower than the S&P 500 average.

Strum Ruger shares see relatively higher levels of short interest with 5.5% currently out on loan. But it's worth noting that demand to borrow is 85% lower than at the start of 2013. Most of the covering occurred in the last 12 months, over which short interest in the firm has fallen by over 60%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Equities-US-gun-shorts-retreat-as-sales-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Equities-US-gun-shorts-retreat-as-sales-surge.html&text=US+gun+shorts+retreat+as+sales+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Equities-US-gun-shorts-retreat-as-sales-surge.html","enabled":true},{"name":"email","url":"?subject=US gun shorts retreat as sales surge&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Equities-US-gun-shorts-retreat-as-sales-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+gun+shorts+retreat+as+sales+surge http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Equities-US-gun-shorts-retreat-as-sales-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}