Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 07, 2016

Middle Eastern credit risk surges

The rising tension between Saudi Arabia and Iran and has exasperated an already tricky situation for the region's bondholders.

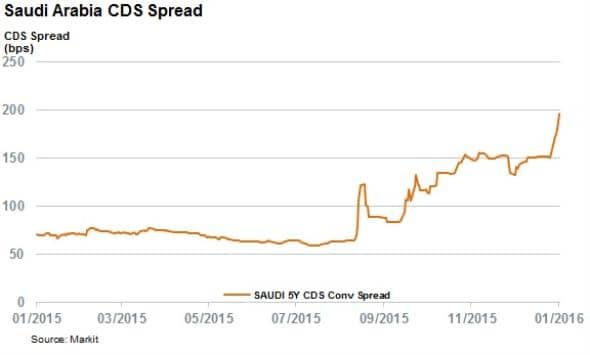

- Saudi Arabian CDS spreads widened to an all-time high of 195bps

- Saudi corporate bonds down more than 60bps so far this year

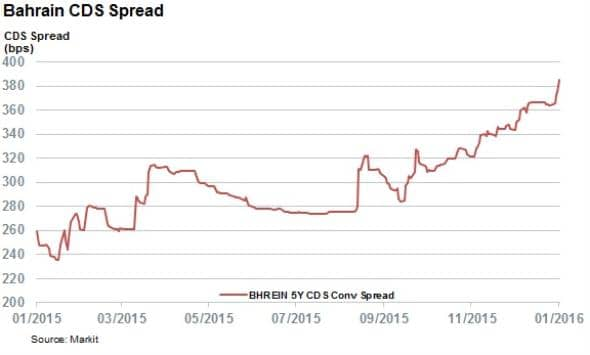

- Bahrain's CDS spread has jumped to levels not seen since 2011 pro-democracy movement

Saudi Arabia's decision to execute a prominent Shiite cleric last week reignited tension with its regional rival Iran. Unlike previous periods of conflict in the region, the ongoing escalation of hostilities between the two arch rivals, both diplomatically and through long standing proxy conflicts, has sent the price of oil lower as the market discounts the possibility of an OPEC production cut. It's worth noting that the two countries make up two of the oil cartel's three largest producers.

These tensions are also starting to spill over in bond markets as credit risk in Saudi bonds and its allies has hit new recent highs following the escalation in hostilities and slide in oil price.

Saudi CDS spreads widen

Saudi Arabia has borne the brunt of the recent widening as its CDS spread has surged to 195bps as of the latest count, the highest on record for the country. This recent spike marks a stunning reversal given that these contracts were trading at 40bps prior to the recent oil price collapse.

While the country still has a relatively large sovereign wealth fund, the recent spike in CDS spreads indicate that the market is increasingly demanding more in order to insure the growing pile of Saudi bonds against default. This trend will no doubt continue given the country's current precarious fiscal situation which shows no signs of reverting given oil's decade low levels.

Corporate bonds also hit

This surging credit risk is also spilling over onto the credit market as Dollar denominated bonds issued by Saudi corporations have sunk by over 60bps since the start of the year according to the Markit iBoxx USD Corporates Saudi Arabia Index which tracks the asset class.

Contagion in regional peer

Saudi Arabia's woes and the growing risk of continued Sunni/Shiite strife is also stoking credit risk in the rest of the region.

Bahrain, whose Sunni ruling family overseas a Shiite majority has also seen its CDS spread jump to 385bps, 20bps higher than at the start of January. These levels were last seen four years ago when the largely Shia majority demanded greater democracy from the ruling family.

Egypt, which is relatively isolated from the recent spike in tensions both ethnically and geographically but relies on Saudi hand-outs to kick-start its economy, has also seen its CDS spreads hit new recent highs. Its spread is now trading at 476bps, 200 more bps than 12 months ago.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Credit-Middle-Eastern-credit-risk-surges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Credit-Middle-Eastern-credit-risk-surges.html&text=Middle+Eastern+credit+risk+surges","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Credit-Middle-Eastern-credit-risk-surges.html","enabled":true},{"name":"email","url":"?subject=Middle Eastern credit risk surges&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Credit-Middle-Eastern-credit-risk-surges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Middle+Eastern+credit+risk+surges http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07012016-Credit-Middle-Eastern-credit-risk-surges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}