Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 06, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Lgi Homes is the most shorted company announcing earnings next week

- UK firms make up over half of the heavily shorted European firms

- Gumi sees short sellers cover after its shares nearly double

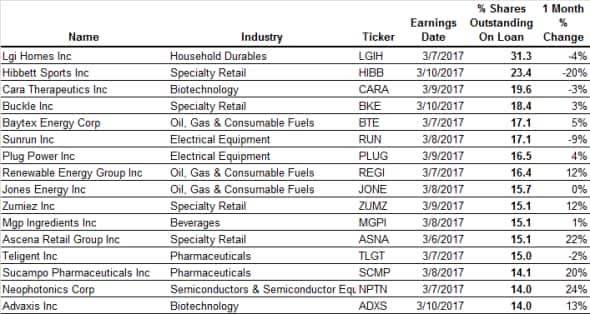

North America

The highest conviction short play announcing earnings next week is US homebuilder LGI Homes which has just over 31% of its shares out on loan. While the company relies on convertible bonds as part of its capital structure, which could be driving demand to borrow its shares higher, the current short interest is much higher than what would be expected from investors delta hedging their corporate bond exposure. This indicates that a portion of the short base is directionally driven.

Retailers also feature heavily among next week's list of heavily shorted stocks with specialty bricks and mortar and stores which are coming off a tough holiday shopping period which has seen many of their peers post disappointing results.

This week's favorite retail short is sportswear retailer Hibbett Sports which has 23% of its shares out on loan to short sellers. Hibbett enjoyed a revival in its share price last year after several of its competitors went bankrupt. Short sellers never really believed in the rally as Hibbett's short interest continued to climb while its shares rallied. This skepticism has since been vindicated as the company's shares have gone on to lose over a quarter of their value from the recent highs registered in December. This retreat in Hibbett's share price has picked up pace in recent weeks since the firm's management released some downbeat preliminary earnings.

The other high conviction retail shorts announcing earnings next week are Buckle, Zumiez and Ascena Retail which all have at least 15% of their shares on loan.

Another firm to watch out for is Neophotonics which has seen its short interest surge by a quarter in the last month to an all-time high 14% of its shares outstanding.

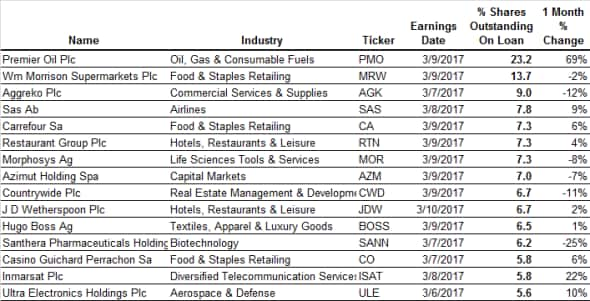

Europe

UK firms make up over half of the next week's most heavily shorted companies announcing earnings.

Premier Oil leads the pack as it has over 23% of its shares out on loan. Ironically the high demand to borrow Premier shares may be a positive sign for the company as the large increase seen in the last few weeks coincided with news that the company is looking to restructure its debt. The subsequent 69% increase in Premier's short interest could actually indicate that investors are hedging themselves ahead of a debt for equity swap.

The other high conviction short play announcing earnings this week is supermarket firm WM Morrison which has just under 14% of its shares shorted. While still high, the demand to borrow Morrison shares has fallen drastically in recent weeks after the firm posted better than expected results.

Supermarket short sellers aren't limited to the British isle as French supermarket firms Carrefour and Casino have 7.3 and 5.8% of their shares out on loan respectively.

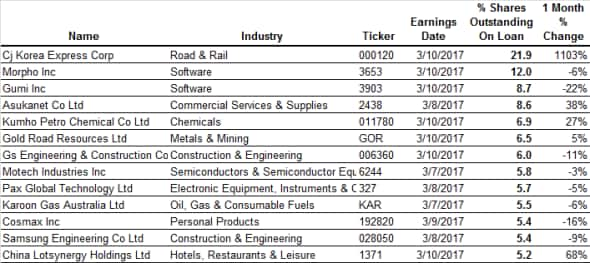

Asia

Japanese software firms have been the high conviction play in Asia and this week is no exception as Morpho and Gumi top the list of heavily shorted firms announcing earnings in the region. The latter of the two has seen a sharp decrease in short interest after its shares nearly doubled over the last three months.

Australian small caps, which were a key focus among the firms announcing earnings last week, also feature on this week's list of high conviction short as gold miner Gold Road Resources has over 6% of its shares out on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}