Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 06, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Strong demand to short Rex Energy and OvaSciences as cost to borrow remains high

- Shorts indicate little faith in Lonmin's upcoming $400m company saving rights issue

- Hyundai Merchant Marine joins other shorts in the shipping industry as global trade slows

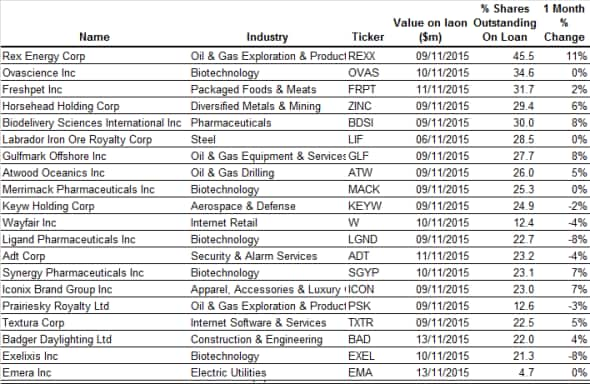

North America

Most shorted ahead of earnings in North America is Rex Energy with 45% of shares outstanding on loan. The oil and natural gas producer is down over 50% year to date and 67% over the last 12 months. Despite the stock losing more than half its value, sustained lower WTI crude prices under $50 a barrel sees the demand to short remaining high above 10%.

Also witnessing a high cost to borrow (above 10%) due to strong demand is second most shorted ahead of earnings, OvaScience. The fertility treatment firm currently has 34% of shares outstanding on loan with short sellers consistently increasing their positions over the last year.

Third most shorted is newly listed pet food maker Freshpet. Short sellers have bulked up on positions in the stock, reaching a third of shares outstanding on loan. The stock meanwhile has dived 45% in the last three months and is down 65% from highs reached in April.

Europe

Most shorted ahead of earnings in Europe is Kuka, a German based engineering firm that supplies robotics to the industry, with 15.4% of shares outstanding on loan.

Shares in the company have been on a tear in recent years, with the stock up 44% in the last 12 months alone. This has attracted short sellers in recent months. However, some covering was seen in recent weeks as the stock staged a rally.

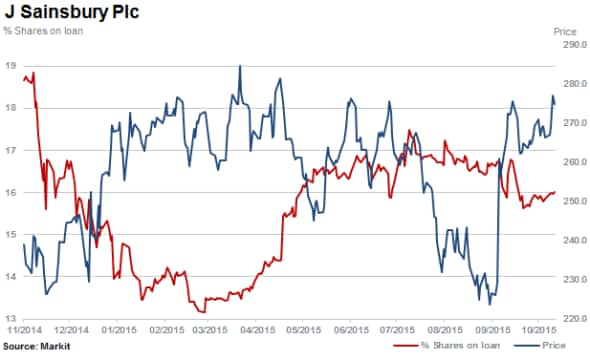

Second most shorted in Europe is UK retailer Sainsbury's with 15.5% of shares outstanding on loan. Shares in the retailer surged at the end of September as management guided for a better than expected trading year. Since August, short sellers have trimmed positions in the retailer.

Third most shorted ahead of earnings is embattled platinum producer Lonmin with 16.5% of shares outstanding on loan currently. Short interest is rapidly approaching levels not seen since the Marikana tragedy in 2012

Lonmin is preparing for a $400m rights issue (twice its market cap), and ahead of this, demand to borrow the stock has increased, nearing 10%.

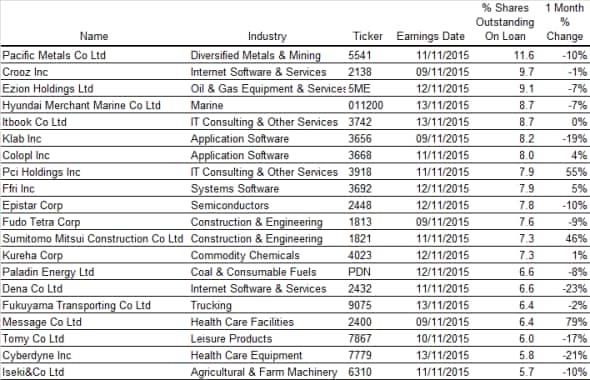

Apac

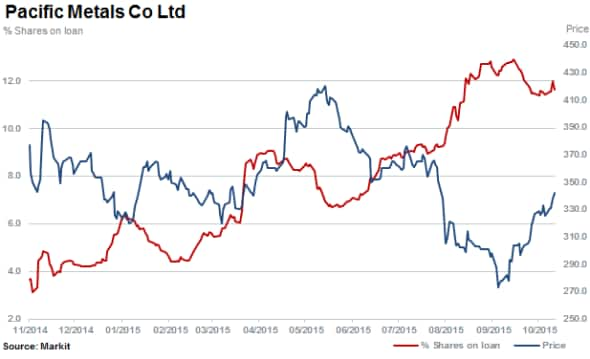

Most shorted ahead of earnings in Apac is Pacific Metals with 11.6% of shares outstanding on loan. The Japan based nickel and stainless steel producer has posted losses since 2013 and has attracted shorted sellers throughout 2015.

Third most shorted in Apac is Ezion, a Singapore based provider of marine logistics and support services to the oil and gas industries. Shares out on loan currently stand at 9.1%, and the stock is down 50% over the last 12 months.

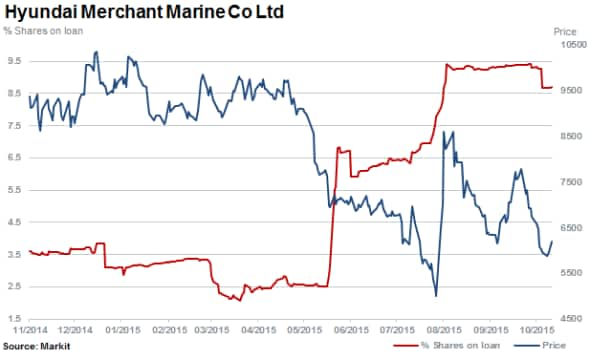

Korean based Hyundai Merchant Marine has 8.7% of shares outstanding on loan and saw a marked increase in short interest post the emerging market selloff in August. The logistics, container and bulk shipping company has come under pressure, similar to that of Korean shipbuilders, as reduced commodity prices and a glut in global supply puts pressure on the industry and shipping rates.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}