Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 08, 2016

Investors flock to emerging market bonds

After a subdued May, fixed income investors are returning to emerging markets amid stronger commodity prices and a weaker US dollar.

- EM bond returns have rallied with sovereigns returning 1.5% so far this month

- Fixed income investors have been increasing their emerging market holdings for the past three weeks

- iShares J.P. Morgan USD Emerging Markets Bond ETF has seen its AUM increase by 74% since February

After a subdued May, fixed income investors are returning to emerging markets (EM) amid stronger commodity prices and a weaker US dollar.

Positive sentiment after January's market volatility saw EM bonds rally in relief, but enthusiasm faded as the Fed stepped up talks of a summer interest rate hike. However, this was undone last week after a weak jobs number in the US prompted caution from the Fed. The subsequent weaker US dollar, coupled with the continued rise of crude oil and commodity prices has meant returns have been strong so far this month, and investors are looking to cash in.

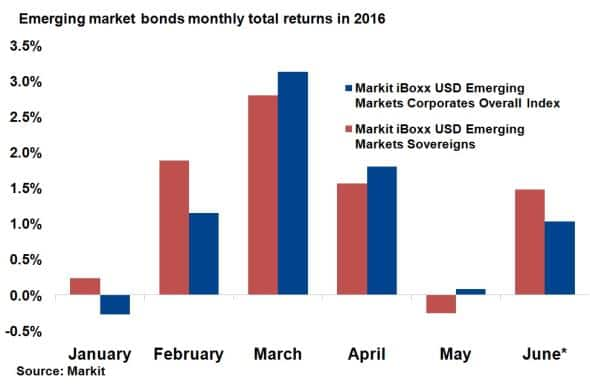

EM returns

The EM bond rally was broad across sovereign and corporate bonds and peaked in March. EM corporate bonds, as represented by the Markit iBoxx USD Emerging Markets Corporates Overall Index, returned 6.1% between February and March, while sovereign bonds as represented by the Markit iBoxx USD Emerging Markets Sovereigns, saw a 6.2% total return over the same period. Running out of steam and dealing with renewed optimism in global markets (which led to hawkish tones coming from prominent Fed members) EM returns in May subsequently suffered. Corporates returned 0.1% in May while sovereign bonds posted a negative return.

But it seems May was only a blip, given the returns posted by EM bonds so far this month. Crude oil prices have powered past $50 per barrel, the probability of an interest rate hike next week has vanished and political risk in countries such as Brazil have dissipated. EM corporates and sovereigns have returned 1.0% and 1.5% so far this month, respectively.

Investor load up

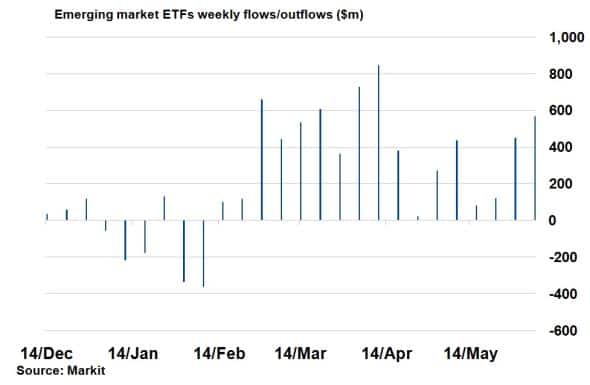

June's rally has coincided with more positive investor sentiment, with fixed income investors increasing their emerging market holdings for the past three weeks.

According to Markit's ETP analytics, ETFs tracking emerging market bonds saw $567m of inflows last week, the largest since the start of May, as the asset class gathers momentum.

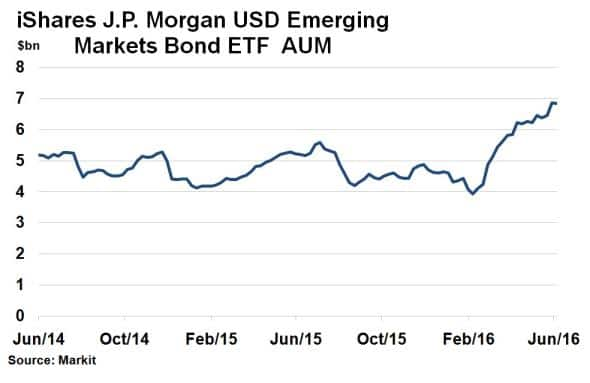

The rise in the fixed income ETF as a way to gain emerging market debt exposure is best exemplified by the iShares J.P. Morgan USD Emerging Markets Bond ETF, which has seen its AUM increase by 74% since February 8th.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-credit-investors-flock-to-emerging-market-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-credit-investors-flock-to-emerging-market-bonds.html&text=Investors+flock+to+emerging+market+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-credit-investors-flock-to-emerging-market-bonds.html","enabled":true},{"name":"email","url":"?subject=Investors flock to emerging market bonds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-credit-investors-flock-to-emerging-market-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+flock+to+emerging+market+bonds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-credit-investors-flock-to-emerging-market-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}