Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 10, 2015

High yield selling off despite outperformance

Global bond volatility has seen investors flee the most volatile part of the bond market, despite the fact that high yield bonds have outperformed in the past couple of months.

- Accommodative interest rate policy has boosted high yield bond issuance

- But bond ETF investors have sold over $2bn of high yield exposure since April

- Markit iBoxx $ High Yield index has outperformed its investment grade peer by 4% YTD

Last week, ECB president Mario Draghi said 'get used to' bond volatility and. the Fed appears on the cusp of increasing interest rates, albeit tentatively. Recent surges in bunds and treasury yields since mid-April has driven fixed income ETF investors to the relative shelter of the short end of the curve and to adopt interest rate hedged products.

ZIRP distortion

Immediately after the financial crisis the Fed cut short term interest rates to near zero in response to the deteriorating economic conditions at the time. Six years on, and three rounds of QE later, rates remain close to zero and the corporate bond landscape is totally different.

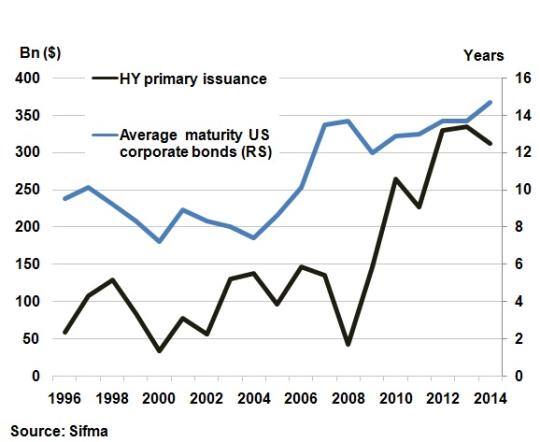

The high yield market has seen primary issuance increase during the past seven years of accommodative monetary policy. This has been driven by the incentive for borrowers to issue bonds at historically low yields and for income seeking investors happy to oblige. From 2009-2014 the average US corporations issued an average of $269bn of high yield bonds annually, over twice the pace of the preceding five years which saw $130bn of issuance per year. The looks set to continue as 2015 is already ahead of last year's pace as companies look to enjoy the last rays of the easy credit shine.

Falling bond yields have also led investors seeking returns to buy up longer dated bonds offering higher yields. Companies have been eager to respond to this trend as seen by the fact that the bonds listed in 2014 had an average maturity of 14 years, compared with eight years for 2008 vintage bonds.

Risks

The new environment created by zero interest rate policy will have an impact on the corporate bond market when yields eventually rise. We have already seen issuance stagger over the past few months amid Treasury bond volatility in recent weeks.

Higher average maturities and lower yields have led to bonds being issued with higher durations and therefore higher price sensitivity to changes in underlying interest rates. When rates do normalise, the increase in long term yields could make high yield a potentially painful part of the bond market.

Investors seem to be heeding these warning signs as high yield bond ETFs have seen over $2bn of outflows in May and the opening week of June.

Issuers also potentially impacted

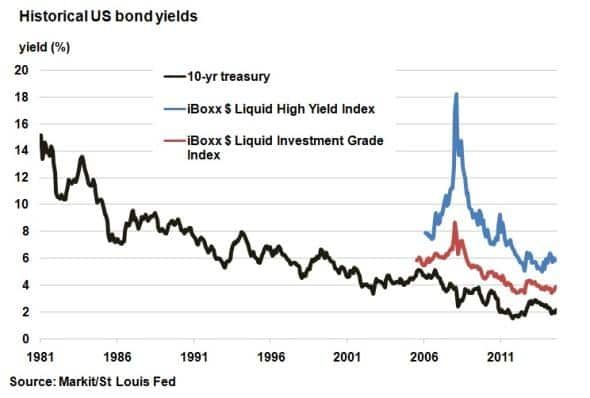

Corporate bond issuers also are presented with risks. Excluding periods of severe liquidity crunches, as in 2008, corporate bond yields have been in steady decline in tandem with treasury yields.

10-yr treasury yields have gone from 14% in 1981 to 2% in 2015. A reverse in this trend would pose a risk when corporations look to roll over maturing debt at higher prevailing rates. It would be the first time in a generation corporations would be faced with such a trend.

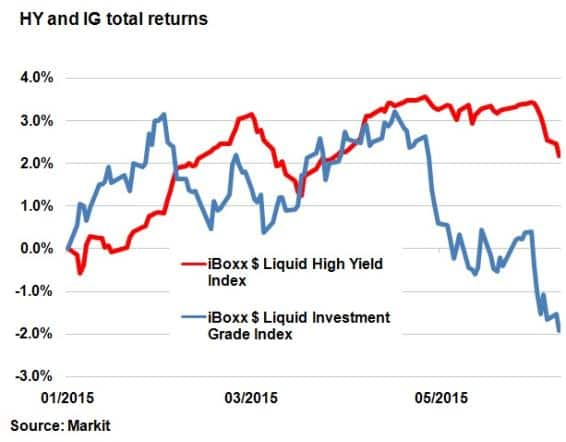

High yield bonds have managed to avoid most of the recent bond market volatility as the Markit iBoxx $ High Yield index has actually continued to provide investors with positive total returns over the recent bout of volatility. The index is now up by over 2% year to date largely iBoxx $ Liquid Investment Grade index whose year to date total return now stands at -2%.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Credit-High-yield-selling-off-despite-outperformance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Credit-High-yield-selling-off-despite-outperformance.html&text=High+yield+selling+off+despite+outperformance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Credit-High-yield-selling-off-despite-outperformance.html","enabled":true},{"name":"email","url":"?subject=High yield selling off despite outperformance&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Credit-High-yield-selling-off-despite-outperformance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+yield+selling+off+despite+outperformance http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Credit-High-yield-selling-off-despite-outperformance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}