Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 10, 2015

Investors rotate into Europe

Despite strong fund flows into European ETFs over the past six months investors have favoured certain sectors such as consumer discretionary goods, revealing insights into sector rotation strategies.

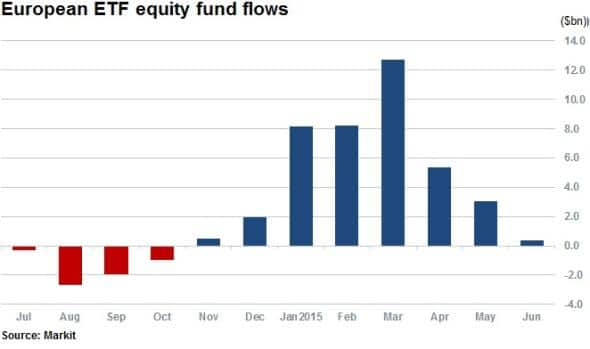

- $38bn of flows into European ETFs ytd but fund flows have slowed in recent months

- The energy sector has seen some of the largest outflows in months

- Our Sector Rotation Model identifies possible trading strategies using sector ETFs

European ETFs

European ETFs have witnessed $38bn of inflows ytd. Investors have increased their European asset allocations just as the ECB began measures in carrying out Europe's own quantitative easing programme.

The recent slowdown of flows into the region may be due to uncertainty created by the continued unresolved possibility of grexit.

Bond markets however have continued to sell off, with the 10 year German bund yield back above 1% as concerns ease over the implications of Greece leaving the euro. This is confirmed with fixed income ETFs seeing $1bn of outflows in May 2015.

Sectors in focus

Globalization has blurred the delineation of country and sector and possible diversification benefits. Hidden sector exposures and fully integrated markets imply that sector effects are of greater importance as companies in the same sectors are highly correlated. The prices of these stocks usually move based on similar fundamental and economic drivers.

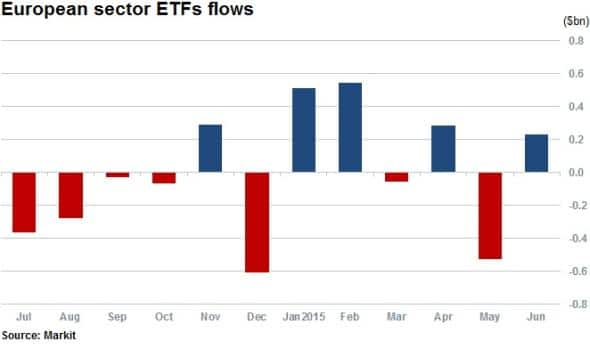

Sector focused ETFs in Europe have grown in the past two years from under $10bn to nearly $14bn in AUM. Over the past year sector fund flows have been fickle, with average monthly flows representing a relatively large portion of total AUM - indicating the ETFs increased use by investors, as efficient sector exposure tools.

Sectors favoured

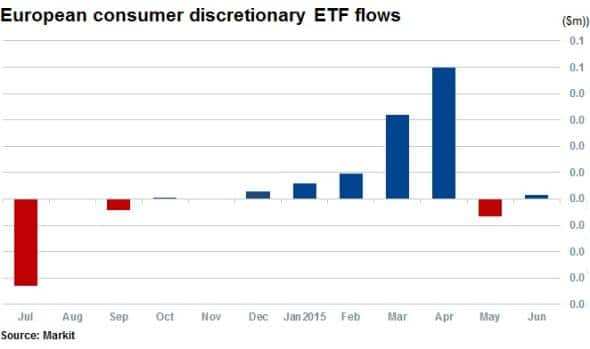

ETFs categorised as consumer discretionary have benefited from the recent European inflows. This sector has seen AUM more than double over the past year, reaching $160m in AUM.

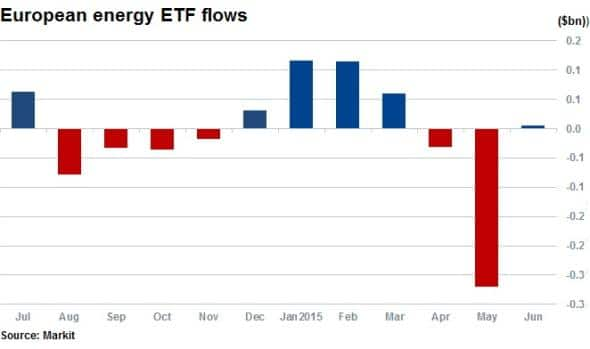

The large increase in inflows and AUM (albeit off a small base) has occurred while flows into energy ETFs stalled as investors pulled out over $300m between April and May 2015. A much larger category in terms of total AUM, energy ETFs in Europe peaked in February 2015 at $1.02bn, declining to $776m currently.

The Sector Rotation Model

Markit's Sector Rotation Model (SRM) has been constructed for developed European markets with US and Apac models to be released in the near future.

The model's strategy pairs sector Purchasing Managers' Index (PMI) survey data with traditional value, momentum and sentiment data to systematically score the relative attractiveness of 10 sector groups.

Cyclical goods & services (which are comparable to consumer discretionary goods) is currently ranked unfavourably (as of the May 31st 2015) according to the latest update to the SRM.

The latest SRM ranks are as follows;

- Favourable: Healthcare, non-cyclical goods & services, utilities.

- Unfavourable: Basic Materials, cyclical goods & services and industrials.

- Neutral: energy, financials, technology, telecom Services.

Mapping the SRM to specific sector ETFs creates a practical test scenario to develop real world trading portfolios. This development has been supported by the increase in AUM of sector focused ETFs to about $350bn, just less that 10% of global ETF AUM.

Using test period data from March 2007 to April 2015 and the SPDR MSCI Europe UCITS ETF as a proxy for the market - the following strategies delivered the following return statistics:;

- A simple strategy holding favourable sector ETFs identified by the model returned an average of 0.31% in excess monthly returns over the market with a 65% hit rate (positive outcomes during the test period). Extending to a 12-month horizon, returns averaged 4.70% higher than the market with an even higher hit rate of 78%.

- A strategy of going long the favourable sector ETFs and shorting the unfavourable ETFs delivered a monthly spread of 0.43% on average in 62% of months.

More information

To obtain further detail on model performance, ranking methodology and current sector ranks please contact us at press@markit.com.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Equities-Investors-rotate-into-Europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Equities-Investors-rotate-into-Europe.html&text=Investors+rotate+into+Europe","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Equities-Investors-rotate-into-Europe.html","enabled":true},{"name":"email","url":"?subject=Investors rotate into Europe&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Equities-Investors-rotate-into-Europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+rotate+into+Europe http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062015-Equities-Investors-rotate-into-Europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}