Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 13, 2016

Consumer focused firms dominate ratings mismatch list

Despite a recent surge, credit risk globally is still way off the previous yearly highs, but 26 investment grade companies are continuing to feel the lingering effects of this year's volatility with CDS traders demanding deep high yield levels of spreads in order to insure their bonds against default.

- Consumer firms lead the list of IG issuers with a liquid CDS implying a rating of B or lower

- Casino and Gap both have CDS trading with a CCC implied credit rating

- Only three IG energy firms have an implied CDS rating two notches below investment grade

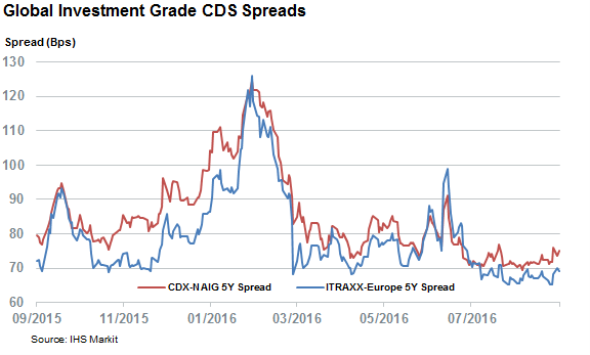

Credit risk has awakened from its summer slumber over the last couple of days with the CDX IG and iTraxx main now trading 8 and 11% higher than their close on Thursday. While it's still too early to see whether this latest surge is a passing event or a longer lasting trend both indices are still below their 12 month averages and now trade roughly 40% off the highs set earlier in the year.

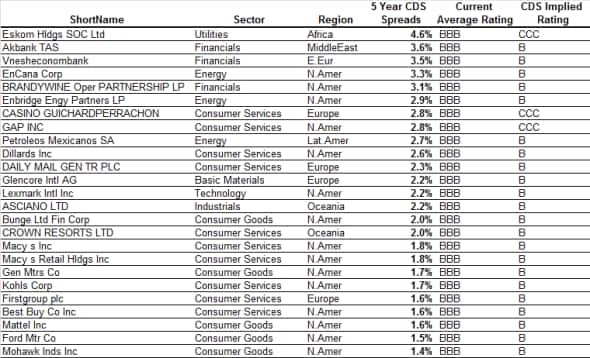

This recovery has not lifted all investment grade issuers however, as Markit CDS pricing data indicates that 26 global investment grade bond issuers have liquid CDS contracts referencing their debts with spread levels more in line with junk issuers than their current investment grade status. This analysis is based on all CDS contracts with at least five market makers that reference issuers with a credit rating of BBB or above and that currently trade at least two notches below investment grade based on the Markit's CDS sector curves.

Consumer firms top the list

In a stark departure from what that list would have been at the height of the credit market volatility earlier in the year, the list of investment grade issuers whose CDS spread implies otherwise is replete with consumer focused firms. Ten consumer services and five consumer goods names have made the list.

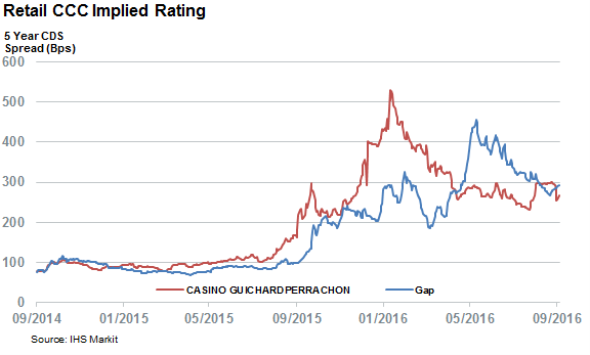

Retailers, which roll up to the consumer services sector are the biggest contributor they also include two of three of the names which trade most deeply in junk territory with a CCC implied rating. This includes US clothing conglomerate Gap whose CDS spread is north of 270bps and European retailer Casino which trades even wider at 280bps.

Although both firms have seen their CDS spreads tighten from the highs set earlier in the year, the improvement in sentiment hasn't been enough to take them back to single B territory.

The other CCC investment grade candidate is South African utility Eskom Hldgs SOC Ltd which trades north of 400bps.

Names to watch in the consumer goods sector includes US carmakers GM and Ford and toymaker Mattel.

Despite a slew of downgrades and improving investor sentiment, commodities firms are still represented in the screen of companies trading with a mismatch between their current credit rating and CDS spread. The current mismatch screen includes three energy and one basic material constituent. The most prominent energy name in the screen is Mexican national energy firm PEMEX whose CDS implies a B rating, two notches below its current BBB rating.

The sole member of the basic materials space is commodities trading house Glencore which has a single B implied rating. Although it's CDS spread has fallen by over 80% from the highs in January, CDS market makers are still requiring over two and a half times the spread than the 88bps commanded by its BBB rated basic material peers.

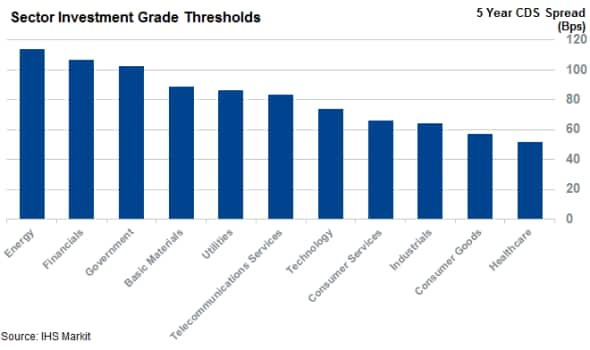

Energy firms still have the highest investment grade threshold as the BBB barrier for energy firms is with BBB names carrying a spreads of over 110bps. Healthcare comes in on the other side of the scale with an investment grade threshold that is less than half that of energy with 52bps.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092016-credit-consumer-focused-firms-dominate-ratings-mismatch-list.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092016-credit-consumer-focused-firms-dominate-ratings-mismatch-list.html&text=Consumer+focused+firms+dominate+ratings+mismatch+list","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092016-credit-consumer-focused-firms-dominate-ratings-mismatch-list.html","enabled":true},{"name":"email","url":"?subject=Consumer focused firms dominate ratings mismatch list&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092016-credit-consumer-focused-firms-dominate-ratings-mismatch-list.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Consumer+focused+firms+dominate+ratings+mismatch+list http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092016-credit-consumer-focused-firms-dominate-ratings-mismatch-list.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}